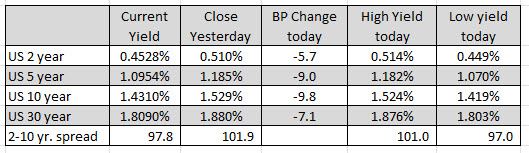

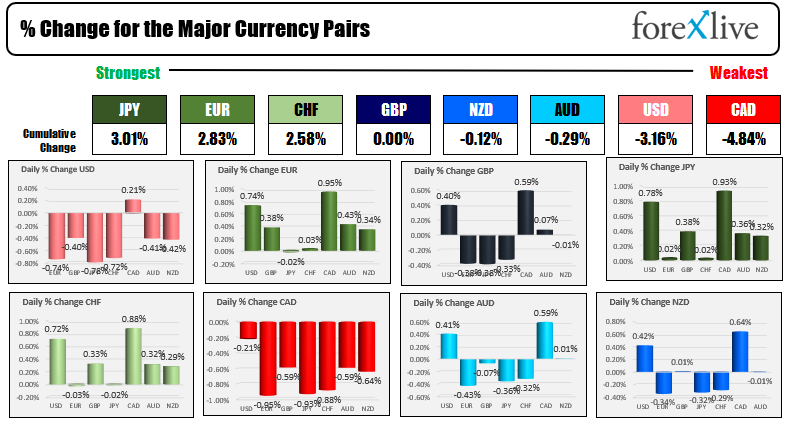

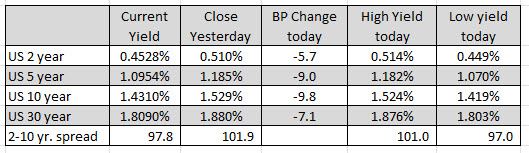

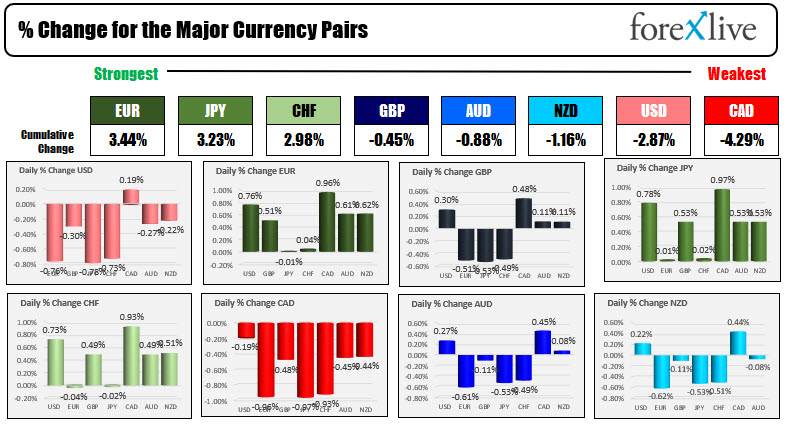

Selloff in stock markets resume today, after Moderna Chief Executive Stéphane Bancel foresaw “material drop” in effectiveness of current vaccines on Omicron. Benchmark treasury yields also tumble sharply on safe haven flows. In the currency markets, Canadian Dollar lead commodity currencies lower, as oil price tumble. Dollar is dragged down by steep falling in treasury yield. At the same time, Yen, Swiss Franc and Euro are the strongest.

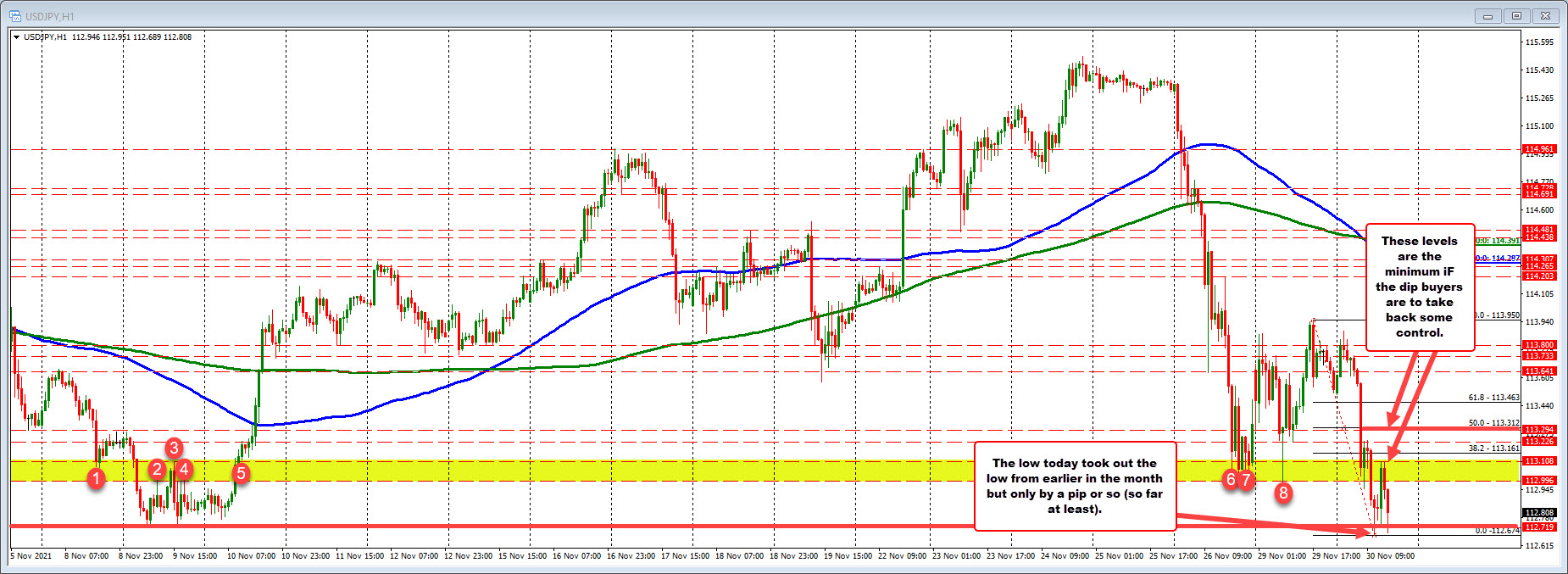

Technically, EUR/USD is finally making some concrete progress, pressing 1.1373 minor resistance. Firm break there will confirm short term bottoming at 1.1185 and bring stronger rise back to 55 day EMA (now at 1.1518). At the same time, USD/JPY is also pressing 112.71 structural support. Sustained break there will bring larger scale correction.

In Europe, at the time of writing, FTSE is down -0.85%. DAX is down -1.07%. CAC is down -1.03%. Germany 10-year yield is down -0.039 at -0.355. Earlier in Asian, Nikkei dropped -1.63%. Hong Kong HSI dropped -1.58%. China Shanghai SSE rose 0.03%. Singapore Strait Times dropped -2.54%. Japan 10-yaer JGB yield dropped -0.0157 to 0.059.

Canada GDP grew 0.1% mom in Sep, to grow further 0.8% in Oct

Canada GDP grew 0.1% mom in September, matched expectations. Overall 12 of 20 industrial sectors were up. Growth in services-producing industrials (+0.4%) more than offsetting a decline in goods-producing industries (-0.6%).

Preliminary information indicates that real GDP rebounded in October, up 0.8% with increases in most sectors.

Eurozone CPI surged to record 4.9% yoy in Nov, core CPI rose to 2.6% yoy

Eurozone CPI accelerated to 4.9% yoy in November, up from 4.1% yoy, well above expectation of 4.4% yoy. That’s the highest level on record in the 25 years of the series’s history. CPI core accelerated to 2.6% yoy, up from 2.0% yoy, above expectation of 2.3% yoy.

Looking at the main components of inflation, energy is expected to have the highest annual rate (27.4%, compared with 23.7% in October), followed by services (2.7%, compared with 2.1% in October), non-energy industrial goods (2.4%, compared with 2.0% in October) and food, alcohol & tobacco (2.2%, compared with 1.9% in October).

France CPI surged to 2.8% yoy, household consumption dropped -0.4% mom

France CPI surged to 2.8% yoy in November, following 2.6% yoy in October. HICP inflation also jumped to 3.4% yoy, up from 3.2% yoy. That’s also the highest level since 2008.

“This inflation for us today is temporary, it is linked to strong demand, itself linked to a recovery that is much stronger than we anticipated,” Finance Minister Bruno Le Maire said.

Household consumption expenditure on goods in volume dropped -0.4% mom in October, versus expectation of 0.3% mom rise. Consumption remained below 01.8% below its pre-crisis level in Q4 2019. The contraction was mainly due to a sharp drop in consumption of manufactured goods (-1.8%). It is partially offset by the recovery in consumption of food (+0.7%) and energy (+1.0%).

Also released, GDP was finalized at 3.0% qoq in Q3, unrevised.

Germany unemployment dropped -34k in November versus expectation of -20k. Unemployment rate dropped to 5.3%, down from 5.4%.

Swiss KOF dropped to 108.5, a step further back to long term average

Swiss KOF economic barometer dropped to 108.5 in November, down from 110.2, below expectation of 109.0.

KOF said: “The KOF economic barometer moves one step further towards its long-term average shortly before the end of the year. The high-flying of the barometer, which was observed in the middle of the year, is being cushioned by a further corrective movement. However, the barometer remains above its long-term average. The prospects for the Swiss economy remain positive, given that economic activity is not impaired by a recurring spread of the virus.”

Japan industrial production rose 1.1% mom in Oct, more growth expected in Nov and Dec

Japan industrial production rose 1.1% mom in October, below expectation of 1.8% mom. That’s nonetheless the first rise in four months.

The seasonally adjusted index of production at factories and mines stood at 90.5 against the 2015 base of 100. The index of industrial shipments increased 2.0% to 88.3 while that of inventories was up 0.8% at 98.9.

The Ministry of Economy, Trade and Industry expects industrial production to grow 9.0% mom in November and then 2.1% mom in December.

Unemployment rate dropped from 2.8% to 2.7% in October, better than expectation of 2.8%.

Housing starts rose 10.4% yoy in October, versus expectation of 5.2% yoy.

China PMI manufacturing rose to 50.1, non-manufacturing dropped to 52.3

China official PMI Manufacturing rose from 49.2 to 50.1 in November, above expectation of 49.6. PMI Non-Manufacturing dropped from 52.4 to 52.3, below expectation of 53.0. PMI Composite rose from 50.8 to 52.2.

“A series of policy measures to ensure energy supply and stabilize market prices have borne some fruits. The tight supply of electricity eased while prices of some raw materials dropped significantly in November,” said Zhao Qinghe, a senior NBS statistician.

New Zealand ANZ business confidence finalized at -16.4 in Nov

New Zealand ANZ business confidence was finalized at -16.4 in November, down from October’s -13.4. Own activity outlook dropped from 21.7 to 15.0. Looking at some more details, export intentions rose from 8.6 to 9.5. Investment intentions rose from1 3.8 to 16.3. Employment intentions rose from 10.9 to 15.8. Cost expectations rose from 87.2 to 88.7. Pricing intentions rose from 65.5 to 66.5. Inflation expectations rose from 3.45% to 4.24%.

From Australia, private sector credit rose 0.5% mom in October, versus expectation of 0.6% mom. Building permits dropped -12.9% mom, versus expectation of -2.0% mom. Current account surplus rose to AUD 23.9B in Q3, below expectation of AUD 27.8B.

Looking ahead

France GDP, Germany unemployment, Eurozone CPI flash and Swiss KOF will be released in European session. Later in the day, Canada will also released GDP. US will release house price index, Chicago PMI and consumer confidence.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 113.03; (P) 113.50; (R1) 114.00; More…

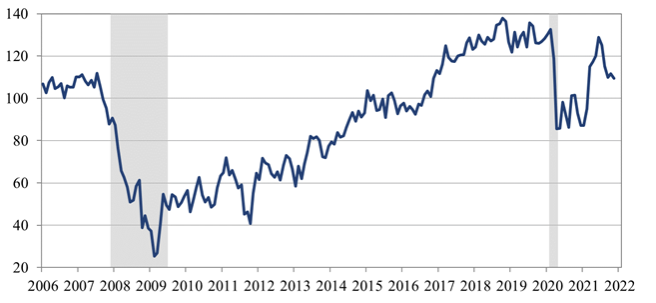

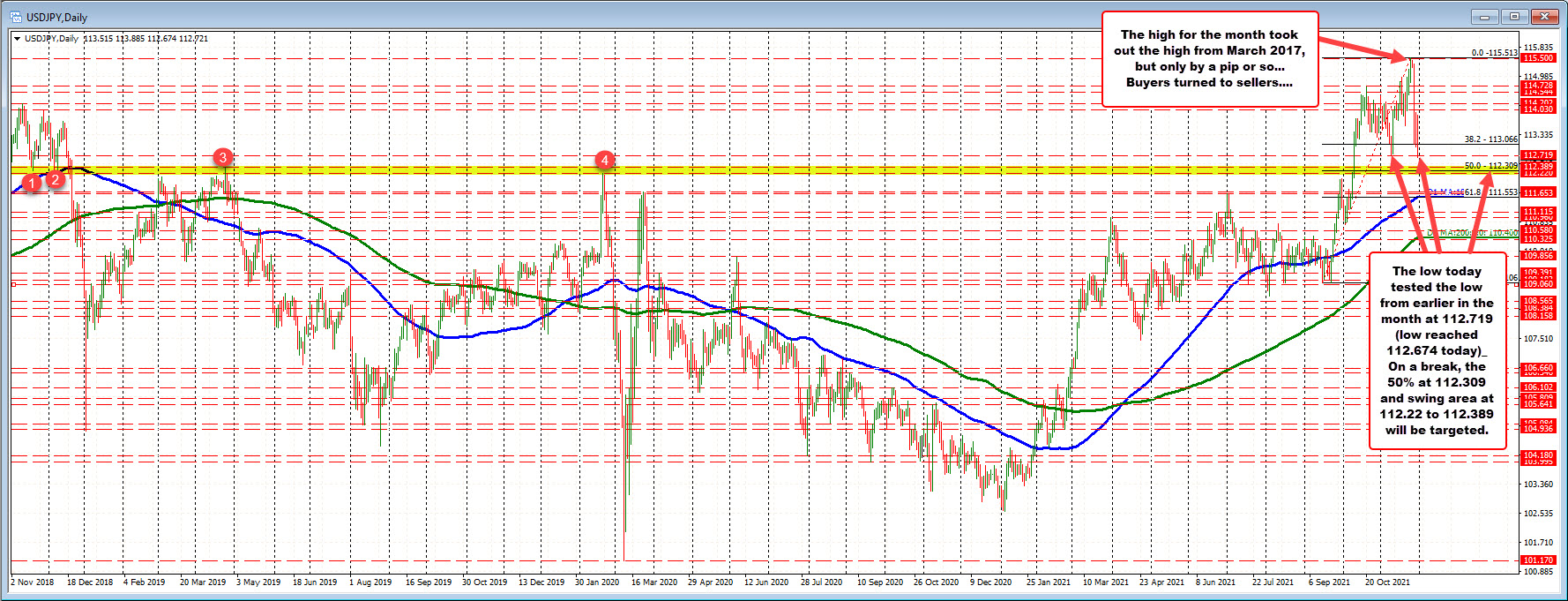

Intraday bias in USD/JPY remains on the downside with focus on 112.71 support. Sustained break there will argue that fall from 115.51 is already correcting whole rise from 102.58. Deeper decline would then be seen to 38.2% retracement of 102.58 to 115.51 at 110.57. On the upside, above 113.94 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 115.51 resistance holds, in case of recovery.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high) on resumption. However, firm break of 109.11 structural support will argue that the trend might have reversed and bring deeper fall to 107.47 support and possibly below.

Economic Indicators Update

| GMT |

Ccy |

Events |

Actual |

Forecast |

Previous |

Revised |

| 23:30 |

JPY |

Unemployment Rate Oct |

2.70% |

2.80% |

2.80% |

| 23:50 |

JPY |

Industrial Production M/M Oct P |

1.10% |

1.80% |

-5.40% |

| 00:00 |

NZD |

ANZ Business Confidence Nov F |

-16.4 |

-18.1 |

| 00:30 |

AUD |

Current Account Balance (AUD) Q3 |

23.9B |

27.8B |

20.5B |

22.9B |

| 00:30 |

AUD |

Private Sector Credit M/M Oct |

0.50% |

0.60% |

0.60% |

| 00:30 |

AUD |

Building Permits M/M Oct |

-12.90% |

-2.00% |

-4.30% |

-3.90% |

| 01:00 |

CNY |

Manufacturing PMI Nov |

50.1 |

49.6 |

49.2 |

| 01:00 |

CNY |

Non-Manufacturing PMI Nov |

52.3 |

53 |

52.4 |

| 05:00 |

JPY |

Housing Starts Y/Y Oct |

10.40% |

5.20% |

4.30% |

| 07:45 |

EUR |

France Consumer Spending M/M Oct |

-0.40% |

0.30% |

-0.20% |

0.20% |

| 07:45 |

EUR |

France GDP Q/Q Q3 |

3.00% |

3.00% |

3.00% |

| 08:00 |

CHF |

KOF Leading Indicator Nov |

108.5 |

109 |

110.7 |

| 08:55 |

EUR |

Germany Unemployment Change Nov |

-34K |

-20K |

-39K |

| 08:55 |

EUR |

Germany Unemployment Rate Nov |

5.30% |

5.30% |

5.40% |

| 10:00 |

EUR |

Eurozone CPI Y/Y Nov P |

4.90% |

4.40% |

4.10% |

| 10:00 |

EUR |

Eurozone CPI Core Y/Y Nov P |

2.60% |

2.30% |

2.00% |

| 13:30 |

CAD |

GDP M/M Sep |

0.10% |

0.10% |

0.40% |

| 14:00 |

USD |

S&P/CS Composite-20 HPI Y/Y Sep |

20.00% |

19.70% |

| 14:00 |

USD |

Housing Price Index M/M Sep |

1.20% |

1.00% |

| 14:45 |

USD |

Chicago PMI Nov |

67.2 |

68.4 |

| 15:00 |

USD |

Consumer Confidence Nov |

110.8 |

113.8 |