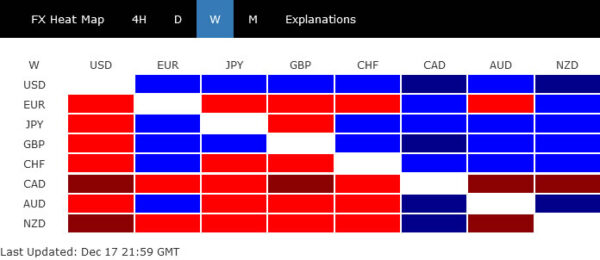

Risk sentiment continues to flip-flop in pre-holiday markets. Major European indexes and US futures are trading slightly higher. Swiss Franc, Yen and Dollar are all trading generally lower, while Kiwi and Aussie are trading higher with Sterling. Canadian Dollar appears to be getting little support from better than expected retail sales data.

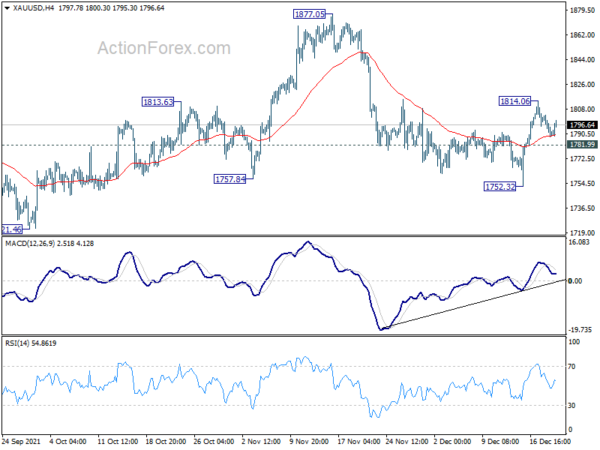

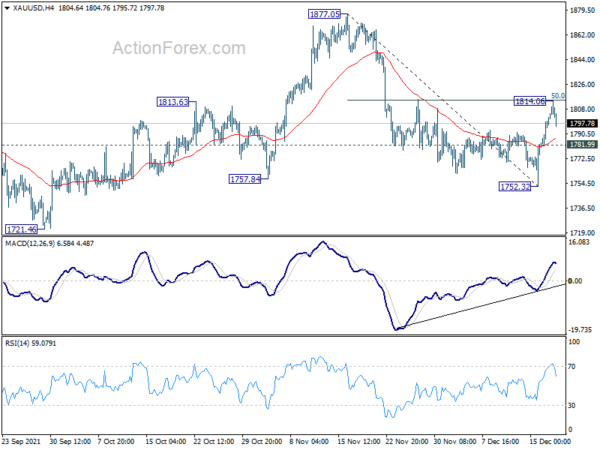

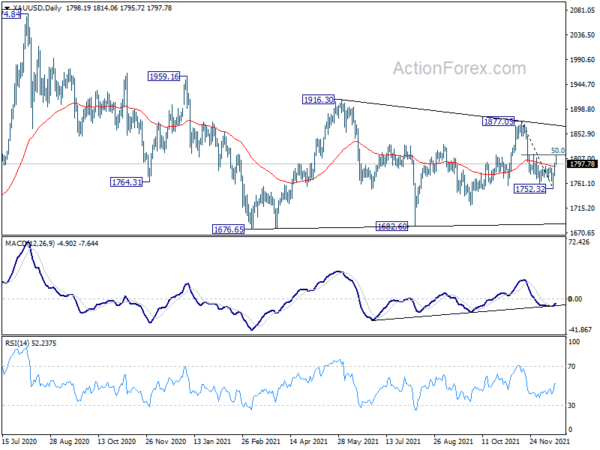

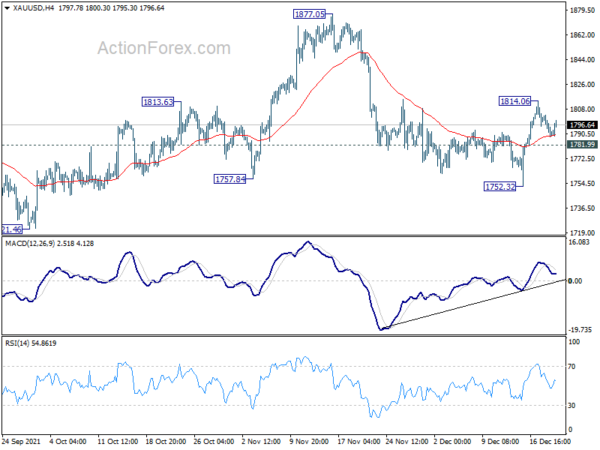

Technically, gold appears to be supported by 4 hour 55 EMA and recovers. It has yet recaptured 1800 handle yet. For now, further rise is in favor as long as 1781.99 minor support holds. Break of 1814.06 will target 1877.05 resistance. However, below 1781.99 will bring retest of 1752.32 support instead.

In Europe, at the time of writing, FTSE is up 0.99%. DAX is up 1.14%. CAC is up 1.06%. Germany 10-year yield is up 0.0462 at -0.320. Earlier in Asia, Nikkei rose 2.08%. Hong Kong HSI rose 1.0%. China Shanghai SSE rose 0.88%. Singapore Strait Times rose 0.39%. Japan 10-year JGB yield rose 0.0163 to 0.055.

Canada retail sales rose 1.6% mom in Oct, to rise further 1.2% in Nov

Canada retail sales rose 1.6% mom to CAD 57.6B in October, above expectation of 1.2% mom. Growth was led by higher sales at motor vehicle and parts dealers (+2.2%), as new car dealer sales (+2.8%) rebounded. Sales increased in 7 of 11 subsectors, representing 59.9% of retail trade. Core retail sales, excluding gasoline stations and motor vehicle and parts dealers, rose 1.5% mom.

According to advance estimate, retail sales rose 1.2% mom in November.

Germany Gfk consumer confidence dropped to -6.8, down on Omicron and prices

Germany Gfk consumer confidence for January dropped sharply from -1.8 to -6.8. In December, economic expectations dropped from 31.0 to 17.1, lowest since April. Income expectations dropped from 12.9 to 6.9. Propensity to buy dropped from 9.7 to 0.8.

Rolf Bürkl, GfK consumer expert said: “Consumer sentiment continues to be under a lot of pressure from two sides as the year draws to a close. High case numbers due to the fourth wave of the Corona pandemic with further restrictions, as well as significantly increased prices, are putting more and more pressure on consumer sentiment…. The outlook for the beginning of next year is also muted against the backdrop of the rapid spread of the Omicron variant.”

Also releaesd in Europaen session, Swiss trade surplus widened to CHF 6.16B in November, versus expectation of CHF 5.43B. UK public sector net borrowing rose to GBP 16.6B in November, versus expectation of GBP 12.0B.

Japan government: economy shows movements of picking up

In the latest Monthly Economic Report, Japan’s Cabinet Office upgraded economic assessment for the first time in 17 months. It said, “the Japanese economy shows movements of picking up recently as the severe situation due to the Novel Coronavirus is gradually easing.” Back in November, it said the economy “continues to show weakness in picking up”.

Private consumption is “picking up”, dropping “while some weakness remains”. However, business investments “appears to be pausing for picking up”. Exports are “almost flat”. Industrial production continues to appear to be “pausing for picking up”. Corporate profits are “picking up”. Employment situations shows “picking up in some components”, comparing to November’s “shows steady movement”. Consumer prices continues to “show steady movements.

RBA minutes laid three options on QE, patient on rates

In the minutes of December 21 meeting, RBA reiterated that decision about the bond purchases program will be made in February. The criteria to consider include “progress towards the Board’s goals for employment and inflation, the actions of other central banks and the functioning of the Australian bond market.” Information include December CPI, December and January labor market data, and overall impact of Omicron.

Three possible options were also discussed.

- The first option was to reduce the pace of purchases from mid February with an expectation of a likely end point in May 2022. This option is consistent with November forecasts for employment and inflation.

- The second option was to reduce the pace of purchases and review it again in May 2022. This option is stronger if progress was slower than expected.

- The third option was to cease purchases altogether in mid February. In case of better-than-expected progress, the third option would become more appropriate.

Regarding interest rate, “the Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range.” And, “this is likely to take some time and the Board is prepared to be patient.”

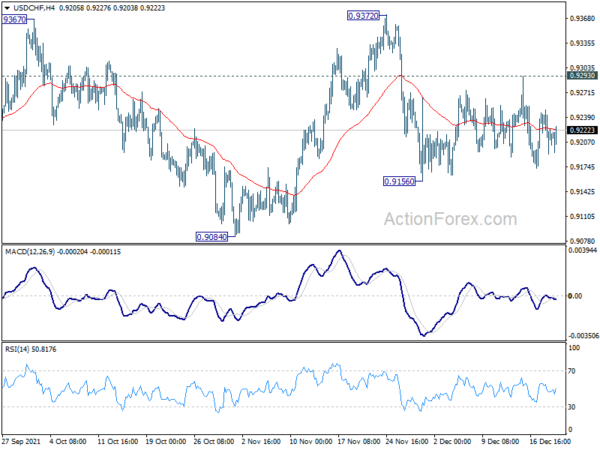

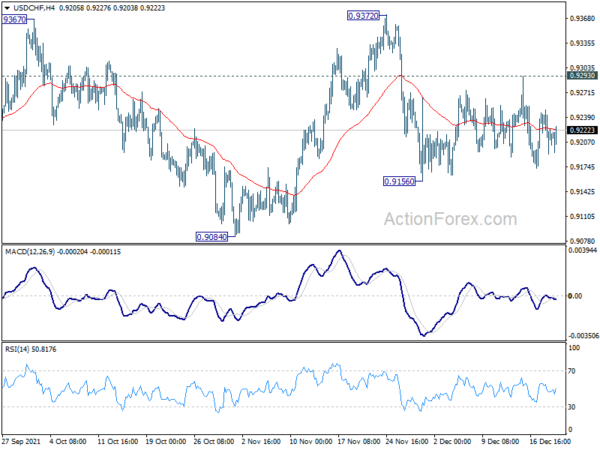

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9188; (P) 0.9220; (R1) 0.9246; More ….

USD/CHF is still bounded in range trading above 0.9156 and intraday bias remains neutral. On the downside, below 0.9156 will target 0.9084 support. Firm break there should confirm that choppy rise from 0.8925 has completed, and suggests that fall from 0.9471 is resuming. Deeper decline would be seen through 0.8925. On the upside, break of 0.9293 will suggest that the pull back from 0.9372 is finished. Intraday bias will be turned back to the upside for 0.9372.

In the bigger picture, the corrective structure of the rebound from 0.8925 argues that fall from 0.9471 is not complete yet. It could either be the second leg of pattern from 0.8756 (2021 low), or resuming larger down trend from 1.0237 (2018 high). We’d pay attention to the downside momentum and assess the odds later. But for now, medium term outlook will be neutral at best as long as 0.9471 resistance holds.

Economic Indicators Update

| GMT |

Ccy |

Events |

Actual |

Forecast |

Previous |

Revised |

| 00:30 |

AUD |

RBA Minutes |

| 07:00 |

EUR |

Germany Gfk Consumer Confidence Jan |

-6.8 |

-2.5 |

-1.6 |

-1.8 |

| 07:00 |

CHF |

Trade Balance (CHF) Nov |

6.16B |

5.43B |

5.65B |

| 07:00 |

GBP |

Public Sector Net Borrowing (GBP) Nov |

16.6B |

12.0B |

18.0B |

11.6B |

| 13:30 |

USD |

Current Account (USD) Q3 |

-215B |

-204B |

-190B |

| 13:30 |

CAD |

Retail Sales M/M Oct |

1.60% |

1.20% |

-0.60% |

| 13:30 |

CAD |

Retail Sales ex Autos M/M Oct |

1.30% |

0.80% |

-0.20% |

| 15:00 |

EUR |

Eurozone Consumer Confidence Dec P |

-8 |

-7 |