Australian Dollar Outlook: AUD/USD May Break Support on Jobs Report

Australian Dollar, AUD/USD, Jobs Report – Talking Points

- Risk aversion rises as Covid-19 forces NYC schools to close down

- Australian Dollar in focus with October’s jobs report on tap

- AUD/USD may break under 2019 high on weak employment data

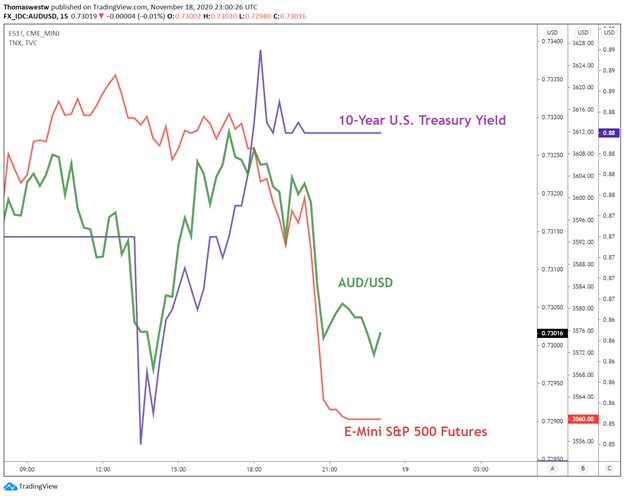

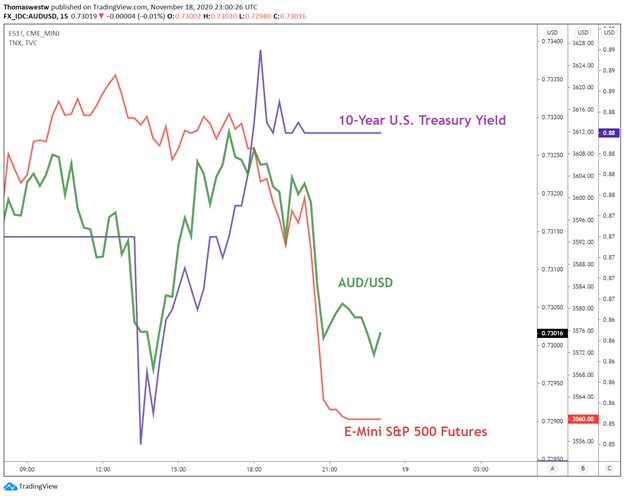

On Wall Street, Covid-related economic fears pushed stocks lower into the closing bell. The S&P 500 index fell 1.16% while the tech-heavy Nasdaq 100 index dropped 0.69%. U.S. equities accelerated to the downside after New York City announced that it will close down in-person schooling beginning tomorrow. In the Treasury market, yields across the curve pushed higher, with the 10-year yield rising from a multi-week low.

AUD/USD, E-Mini S&P 500 Futures, 10-Year Treasury CBOE Note Yield

Chart created with TradingView

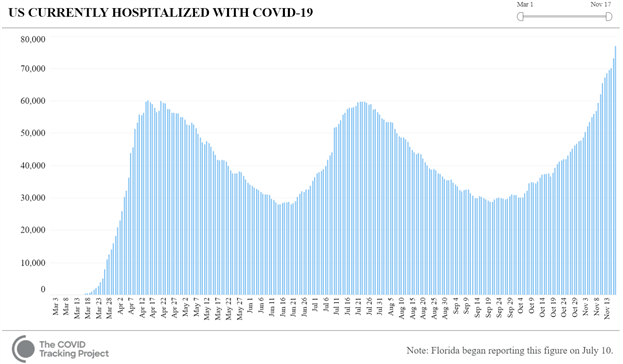

The situation across the United States continues to deteriorate with daily cases, deaths, and hospitalizations seeing a rapid rise. As of November 17, hospitals in the U.S. have 76,830 Covid patients according to the Covid Tracking Project. The figures are alarming and experts are stressing that many regions’ hospitals are at or near capacity.

U.S. Currently Hospitalized Covid Patients

Source: The Covid Tracking Project

The announcement out of NYC reversed earlier optimism after Pfizer announced that they are ready to submit their Covid vaccine under the FDA’s emergency use authorization. The news-driven sentiment echoed across the broader market, hitting the sentiment-linked Australian Dollar.

Recommended by Thomas Westwater

Improve your trading with IG Client Sentiment Data

Thursday’s Asia-Pacific Outlook:

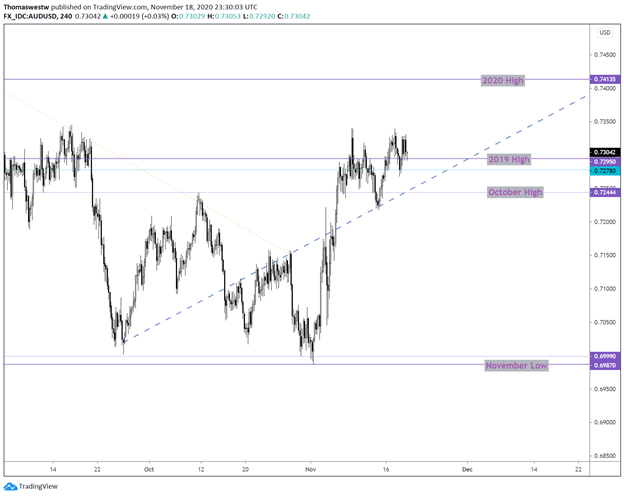

The Australian Dollar moves into focus with October’s employment report set to cross the wires at 00:30 GMT. According to the DailyFX Economic Calendar, Australia is set to report a loss of 30k jobs and a 0.3% uptick in its unemployment rate. AUD/USD has climbed nearly 4% higher since October’s close, as vaccine headlines helped bolster the Aussie-Dollar.

AUD/USD has been hovering above the 0.73 handle this week, but a disappointing jobs report would likely pressure prices to the downside. The 2019 high at 0.7295 may provide some support if we see Australia report figures in line with expectations. However, any significant miss to the downside would likely see notable selling pressure. If the jobs report does disappoint, a drop to a prior trendline from September may be in play.

AUD/USD Four-Hour Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

November 19, 2020 at 01:00PM

Thomas Westwater

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/asia_am_briefing/2020/11/19/Australian-Dollar-Outlook-AUDUSD-May-Break-Support-on-Jobs-Report.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home