Japanese Yen: USD/JPY May fall as Election Gives Way to Rising Covid Cases

Japanese Yen, COVID, USD/JPY - Talking Points

- US Dollar rises against the Japanese Yen as post-election trades come off

- Covid may come back into focus with U.S. election foregone amid rising cases

- USD/JPY price action faces confluent technical resistance overhead

The US Dollar continued to gain against the Japanese Yen following a powerful break higher earlier this week. USD/JPY put in a healthy 1.95% gain on Monday. Prior to this week, the Yen saw considerable inflows leading up to the U.S. 2020 election. In fact, USD/JPY moved nearly 5% lower since July, and a fifth of that move occurred in the two weeks leading up to the election.

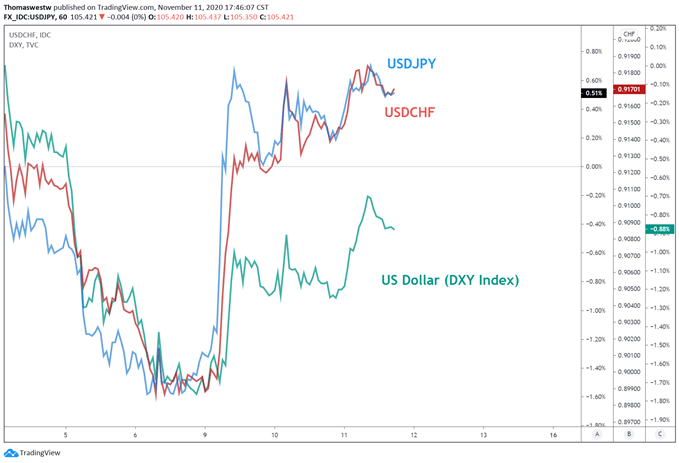

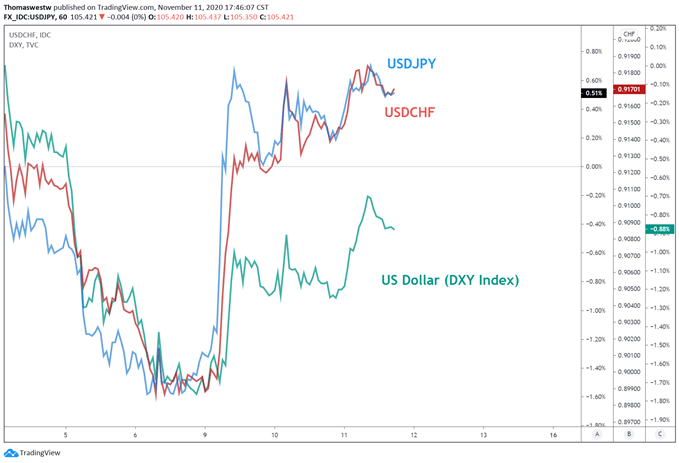

USD/JPY, USD/CHF, US Dollar (DXY) – 1 Hour Chart

Chart created with TradingView

Equity markets in the U.S. have seen a rebalancing out of tech; a rotation trade that still signals a bullish outlook from investors. This may mean a market driven by more value-based equities versus the high-growth tech sector that has led much of this year's rally. That rotation trade eased today with the Nasdaq 100 Index outperforming the S&P 500.

Thursday’s Asia Pacific Outlook

As the U.S. election impact on markets continues to fade, Covid will likely shift back into focus. Headlines surrounding the pandemic, however, seem to be affecting markets less and less recently. This could be a product of the 2020 U.S. election stealing the headlines, or traders becoming desensitized to ongoing rising virus cases. Regardless, Covid continues to plague the global economy and should be front and center to traders and investors.

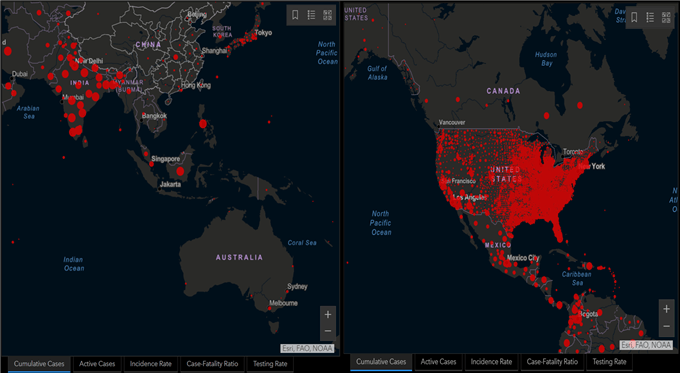

The United States death total leads the world in fatalities, with just over 240k, and daily confirmed case counts are still rising according to Johns Hopkins University. Much of Europe, particularly Spain, Italy, and France also continue to struggle in their containment efforts. While countries across Asia are faring better than western counterparts, Japan has seen a spike in cases, although less severe than before.

COVID Map United States vs Asia

Source: Johns Hopkins University

Granted, a vaccine, the key to success in fighting Covid and ending the pandemic on a global scale, appears to be making progress on several fronts. US-based Pfizer announced impressive data earlier this week that prompted a risk-on tilt across markets. Any vaccine, when approved, still faces the challenge of widespread distribution, however. That could take many months, and experts are forecasting targets ranging from April 2021 until early 2022. That said, positive vaccine headlines will likely have an outsized effect on the upside versus rising caseloads.

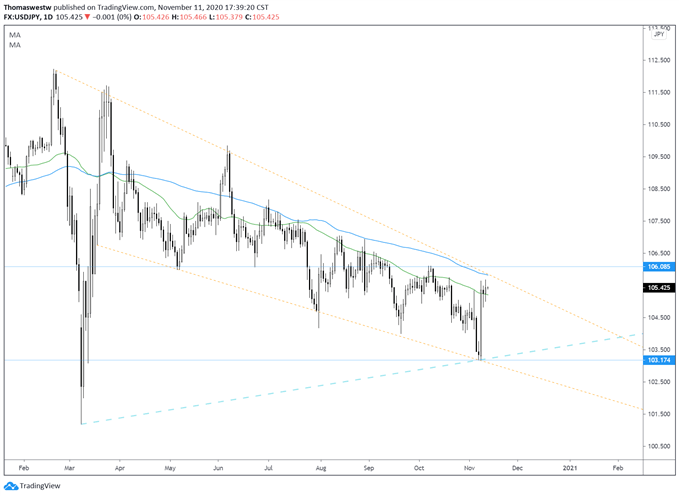

USD/JPY Technical Outlook:

Turning to the technical setup in USD/JPY, the pair now sits between the 50- and 100-day moving averages. This is after pivoting higher from a lower low within a falling wedge that formed following initial Covid-induced volatility. Should USD/JPY fail to move higher at its current price zone, a retest of the bottom range of the current channel would likely come into play.

USD/JPY Daily Chart

Chart created with TradingView

A break higher will likely see price action face a confluent area of resistance: the 100-day moving average and trendline resistance from February. That said, price action now shows the large breadth of the pre-election risk-averse trade is almost unwound. While one major headline risk removed may be bearish for the Yen, Covid remains a threat that may boost it.

Recommended by Thomas Westwater

Traits of Successful Traders

Given that, the technical picture along with Covid’s lingering effects may continue to underpin Yen strength. USD/JPY may continue to follow its longer-term trend lower until a clear timeline for a vaccine is established.

Written by Thomas Westwater, Analyst for DailyFX.com

Contact Thomas at @FxWestwater

November 12, 2020 at 01:00PM

Thomas Westwater

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/asia_am_briefing/2020/11/12/Japanese-Yen-USDJPY-May-fall-as-Election-Gives-Way-to-Rising-Covid-Cases.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home