US Dollar and Yen Down as Stocks Rise, Crude Oil Down on OPEC+

STOCKS, COVID VACCINE, US DOLLAR, YEN, OPEC+, CRUDE OIL - TALKING POINTS:

- S&P 500 futures gapped higher, setting a risk-on tone that hurt USD and JPY

- Crude oil prices down after OPEC+ failed to agree to prolong production caps

- Chinese PMI data headlines the economic data docket in Asia-Pacific trade

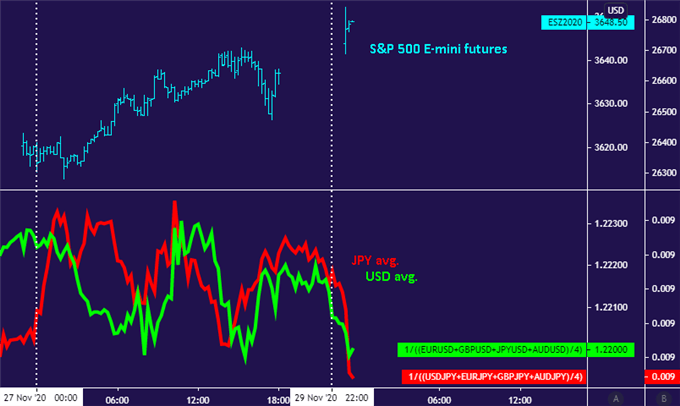

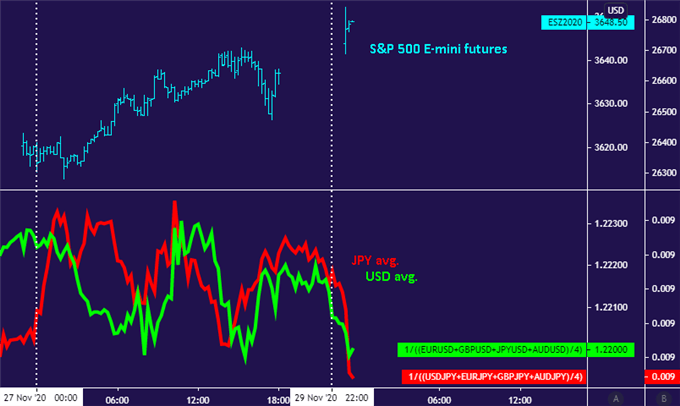

A risk-on bias is prevailing at the start of the trading week. Bellwether S&P 500 futures gapped higher at the open, signaling a broadly upbeat lead as liquidity rebuilds following last week’s drain courtesy of the Thanksgiving holiday that shuttered US markets.

The anti-risk US Dollar and Japanese Yen are performing true to form given investors’ chipper mood: both currencies are on the defensive against their major G10 FX counterparts. At the opposite end of the sentiment spectrum, the cyclically-minded Australian and New Zealand Dollars are narrowly outperforming.

Chart created with TradingView

A constellation of now-familiar narratives appears to be driving optimism. Donald Trump has begrudgingly agreed to begin the formal transition to the incoming Biden administration, former Fed Chair Janet Yellen was named as the incoming Treasury secretary, and Covid vaccine news seems encouraging.

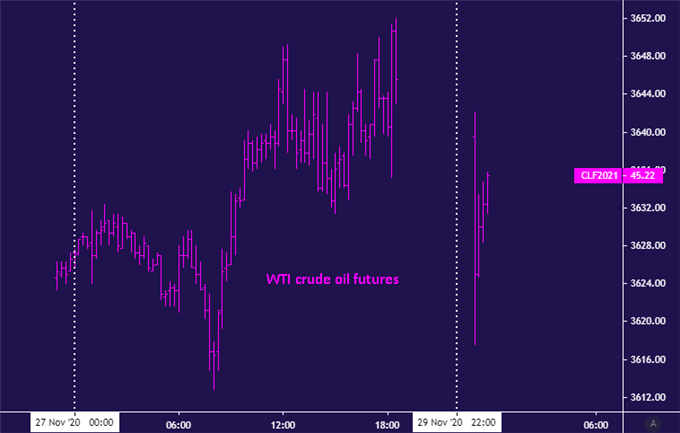

Crude oil prices are notable exception from the otherwise cheery backdrop. The WTI benchmark gapped lower at the open. That is after OPEC+ officials failed to reach agreement on delaying a planned output hike in January, when a scheme capping production starts to be unwound.

Chart created with TradingView

A full meeting of energy ministers from OPEC member states along with like-minded top producers – notably, Russia – is due to begin on Monday. The gathering will run through December 1. If the terms of an accord are not ironed out, output may rise by 1.9 million barrels per day as the calendar turns to 2021.

Elsewhere on the docket, November’s official Chinese PMI data is due to cross the wires. The pace of activity growth in the manufacturing sector is expected to tick higher while services side slows a bit. An upside surprise echoing recent outperformance relative to forecasts may buoy risk appetite further.

Recommended by Ilya Spivak

Improve your trading with IG Client Sentiment Data

FX TRADING RESOURCES

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

November 30, 2020 at 01:00PM

Ilya Spivak

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/asia_am_briefing/2020/11/30/US-Dollar-and-Yen-Down-as-Stocks-Rise-Crude-Oil-Down-on-OPEC.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home