Outside the Box: 5 tax-related policies Biden can push to help small businesses truly recover from COVID-19

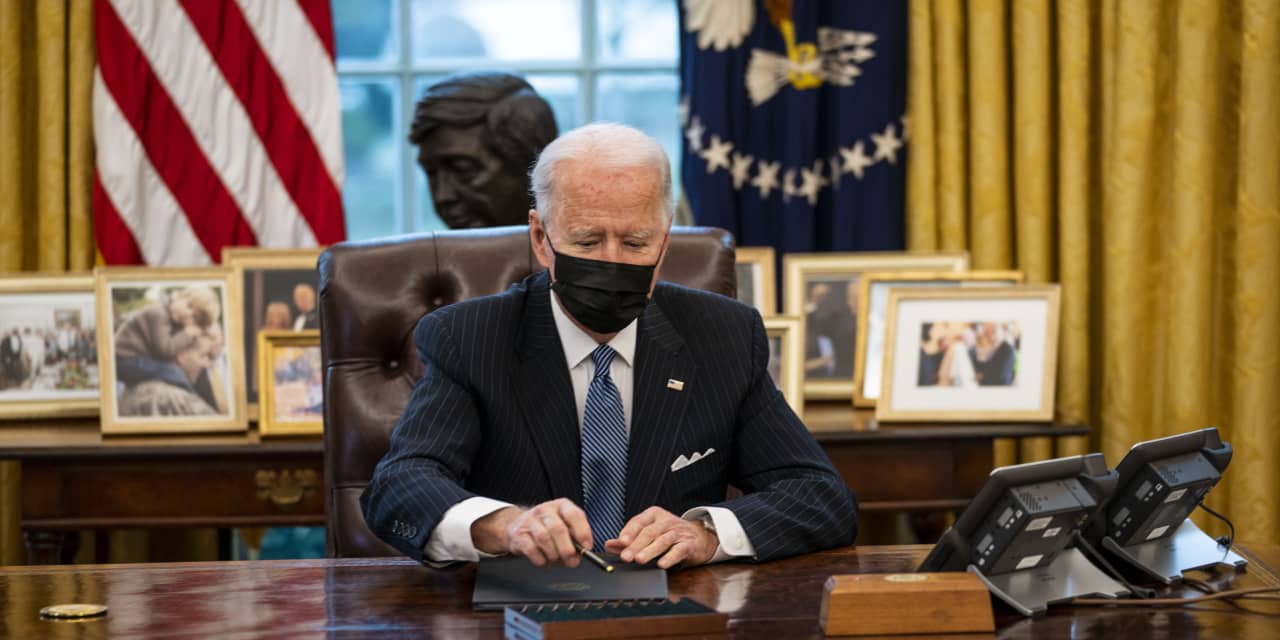

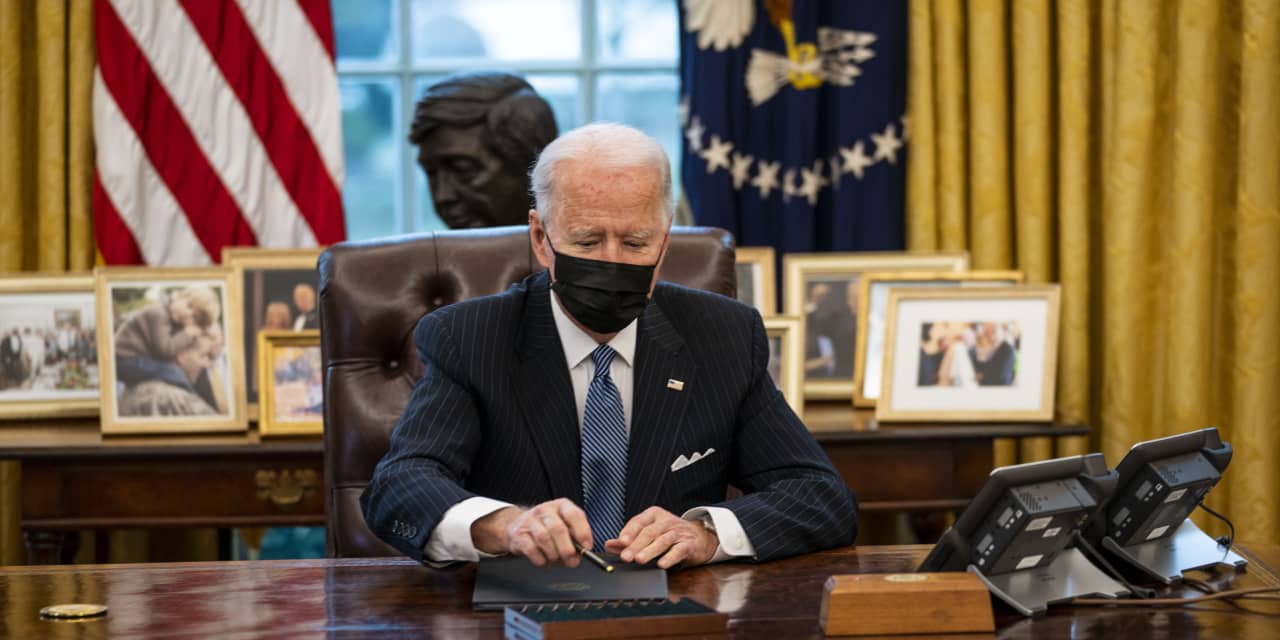

As President Joe Biden and his administration establish their plans to combat the pandemic and revive the economy, one thing cannot be understated—small businesses and entrepreneurs are in a battle for their long-term survival.

Drawing from the real-life experience of entrepreneurs, it is clear that poorly considered tax policy has an impact on the success of small firms. Likewise, well-targeted relief and reform—now more than ever—could be crucial for helping small-business owners keep their doors open.

The coronavirus pandemic has already prompted an unprecedented amount of tax and fiscal relief for entrepreneurs and small businesses, including the Paycheck Protection Program (PPP) and Employee Retention Tax Credit (ERTC), but more can and ought to be done.

Here are five tax policy options President Biden and lawmakers in Congress can pursue to ensure America’s small businesses make a fast and full recovery.

1. Repeal the tariff tax burden on American consumers and businesses

Former President Trump’s tariffs should be repealed. Tax Foundation economists estimate that these tariffs have amounted to one of the largest tax increases in recent U.S. history and have effectively clawed back as much as one-third of the economic benefits, including jobs, from the Tax Cuts and Jobs Act of 2017. Moreover, it is likely that the tariffs contributed to the downturn in manufacturing and capital spending that preceded the COVID-19 outbreak.

The Biden administration can send a strong signal to the rest of the world about its intentions to remove barriers to global trade by repealing these tariffs. As policy makers think through these complex issues, businesses should not be hampered by trade policy that was designed in the pre-pandemic era.

2. Improve the distribution of business tax relief

In 2020, the CARES Act and related economic legislation provided a wide range of tax relief to small businesses. For example, firms could receive a tax refund for net operating losses (NOLs) realized over the past three tax years. They do so by amending previous tax returns with taxable income and carrying back the loss, providing additional liquidity to struggling firms.

Data from the Treasury Department, however, suggests firms hesitated to take advantage of loss carrybacks and other tax credits like the ERTC, partially because of administrative delays and requirements to file paper-amended returns.

Moving forward, Congress and President Biden should consider the suggestions made by the National Taxpayer Advocate to improve pandemic relief with a special focus on speed and simplicity for business owners trying to understand their options.

3. Ease the tax compliance burden for gig-economy workers through a simplified expense deduction

Firms and workers participating in the gig economy have provided critical services for Americans staying closer to home during the pandemic and have the potential to provide even more support in developing the health and public safety services the economy will need as it continues to recover.

To that end, Congress should ease the tax compliance process for gig economy workers by creating a simplified expense deduction that provides an option to more simply calculate taxable income and avoid costly tax mistakes for workers seeking additional income during the pandemic.

4. Prevent ‘full expensing’ from expiring

One area to explore for potential bipartisan cooperation is ensuring entrepreneurs and small businesses can continue to fully and immediately deduct investment they make in the U.S.

Over the next several years, this tax treatment begins to phase out, which may undermine incentives to invest for smaller firms that exceed the Section 179 size limit for small business expensing, including for investments in tangible assets in industries like manufacturing.

Maintaining full expensing will be critical to ensuring a strong rebound in investment as the public health situation improves, as it provides a strong economic impact when weighed against other tax policy options.

5. Avoid harmful tax increases

President Biden’s proposed tax increases on businesses, such as raising the corporate tax rate to 28%, would reduce after-tax profits and thus harm incentives to start and grow a business, even for those businesses that have not yet made a profit but anticipate doing so in the future.

President Biden and federal policy makers should also avoid proposals that would worsen the structure of the federal tax base. For example, a minimum tax on the book income of firms, an idea for which Biden has signaled support, would increase tax complexity and undermine Biden’s other tax objectives, such as providing incentives for onshoring of critical supply chains back into the United States.

As we look forward to a stronger economic recovery from the pandemic this year, there is plenty of opportunity for policy makers to learn from and build on our economic response to the crisis. This means putting small businesses and entrepreneurs front and center when providing economic relief and ensuring our tax code does not stand in the way of an entrepreneur’s success.

Garrett Watson is a senior policy analyst at the Tax Foundation, a tax policy research organization in Washington, D.C.

January 26, 2021 at 11:00PM

http://www.marketwatch.com/news/story.asp?guid=%7B21005575-02D4-D4B5-4572-D227BBE7C099%7D&siteid=rss&rss=1

Labels: Top Stories

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home