Australian Dollar, APAC Markets Focus on Bond Yields to Start March

Treasury Yields, Australian Dollar, RBA– Talking Points

- US markets ended on a sour note in February as a bond market rout hit confidence

- Rising government yields may continue to threaten risk appetite throughout markets

- AUD/USD selloff leaves the pair in a fragile technical posture searching for support

Recommended by Thomas Westwater

Get Your Free Top Trading Opportunities Forecast

The risk-off move seen across markets last week, prompted by rising government bond yields, may continue as investors reallocate their portfolios. US equity indexes were among the hardest hit, lead by technology stocks, with the Nasdaq 100 index sinking nearly 5% on the week. The Dow Jones Industrial Average, S&P 500, and small-cap Russell 2000 also saw steep losses.

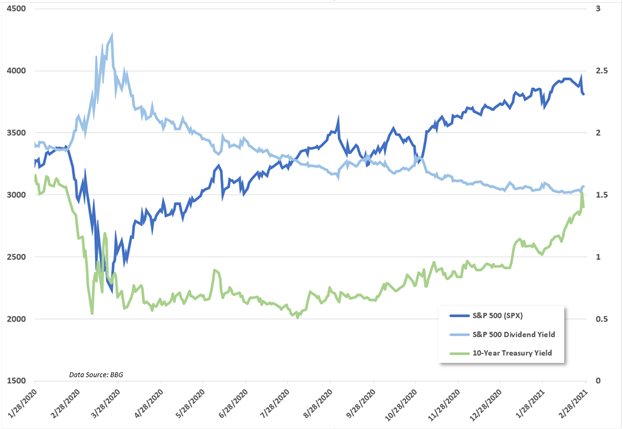

A sharp rise in Treasury yields was the main culprit for last week’s selloff, stemmed from a growing reflationary theme. The 10-year yield climbed for a fourth straight week as investors continued to ditch government debt. A likely trigger for the selloff may have likely been the 10-year rate eclipsing the S&P 500’s dividend yield.

The US session will kick March off with Manufacturing PMI figures for February from Markit Economics and the Institute for Supply Management. Later in the week, will see the highly anticipated Non-farm payrolls report cross the wires, with analysts expecting a print of 165k jobs added for February, according to the DailyFX Economic Calendar.

S&P 500 Dividend Yield vs 10-Year Treasury Rate

Monday’s Asia-Pacific Outlook

APAC equity markets will likely take direction from bond markets to kick off March. A risk-off atmosphere may continue to plague equity prices if government bond yields continue to pace higher. Alternatively, if yields moderate, equity prices may see buying pressure through the week. Hong Kong’s Hang Seng Index (HSI) dropped 3.64% on Friday and mainland China’s Composite closed 2.12% lower.

Today’s economic calendar shows Australia’s Ai Group Manufacturing Index on the docket. The week’s main event, however, will be an interest rate decision from the Reserve Bank of Australia. Analysts are expecting the RBA to hold its benchmark rate steady at 0.10%, although traders will key in on comments over the recent bond market rout. The RBA unexpectedly threw an offer into the market to purchases A$3 billion in three-year notes last week.

The move came after an intense selloff in Australian bond futures when 10-year saw the sharpest drop in years. While the move appeared to help calm markets, the RBA may have to step in again if investors continue to sell. The Australian Dollar was bruised badly, with AUD/USD ending its worst week since September 2020.

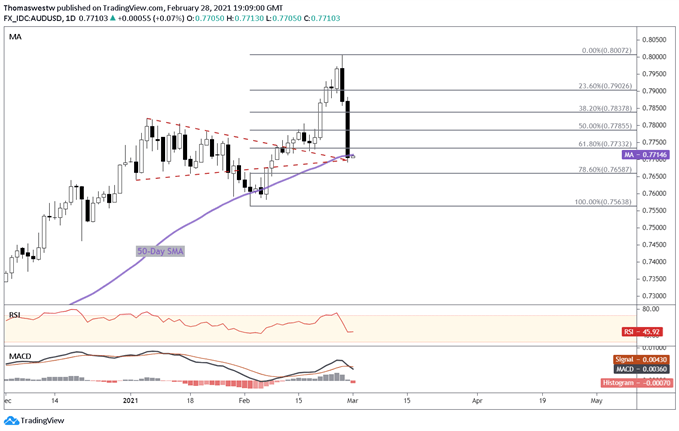

AUD/USD Technical Outlook

The Australian Dollar dropped over 2% against the US Dollar on Friday and broke below its 50-day Simple Moving Average in the process. A Triangle chart pattern came back into play on the downswing, with the apex of the pattern appearing to provide a level of support. The move’s velocity caught many traders off-guard as prices dropped nearly 4% in under 48 hours.

AUD/USD’s technical posture is now rather fragile compared to just last week. To the downside, the 78.6% Fibonacci retracement level may offer support and a potential reversal point. Conversely, moving back above the 50-day SMA could restore some confidence and allow the cross to begin tracking higher. The MACD oscillator suggests more pain could be in store for the Aussie-Dollar, however.

AUD/USD Daily Price Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

March 01, 2021 at 12:00PM

Thomas Westwater

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/asia_am_briefing/2021/03/01/Australian-Dollar-APAC-Markets-Focus-on-Bond-Yields-to-Start-March.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home