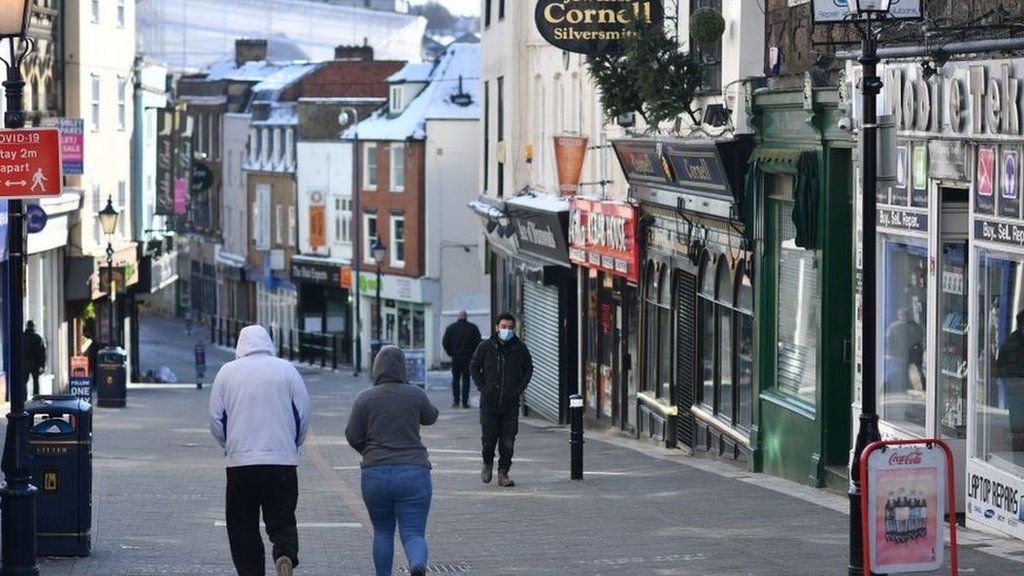

Budget 2021: £5bn fund to help High Street recover from Covid

A new £5bn cash grant scheme for High Street businesses aims to "get the tills ringing again", Rishi Sunak says.

Ahead of Wednesday's Budget, the chancellor said the grants, worth up to £18,000 per firm, will help shops and pubs reopen as England eases lockdown.

The one-off payment has been broadly welcomed by businesses, but some groups have said it does not go far enough.

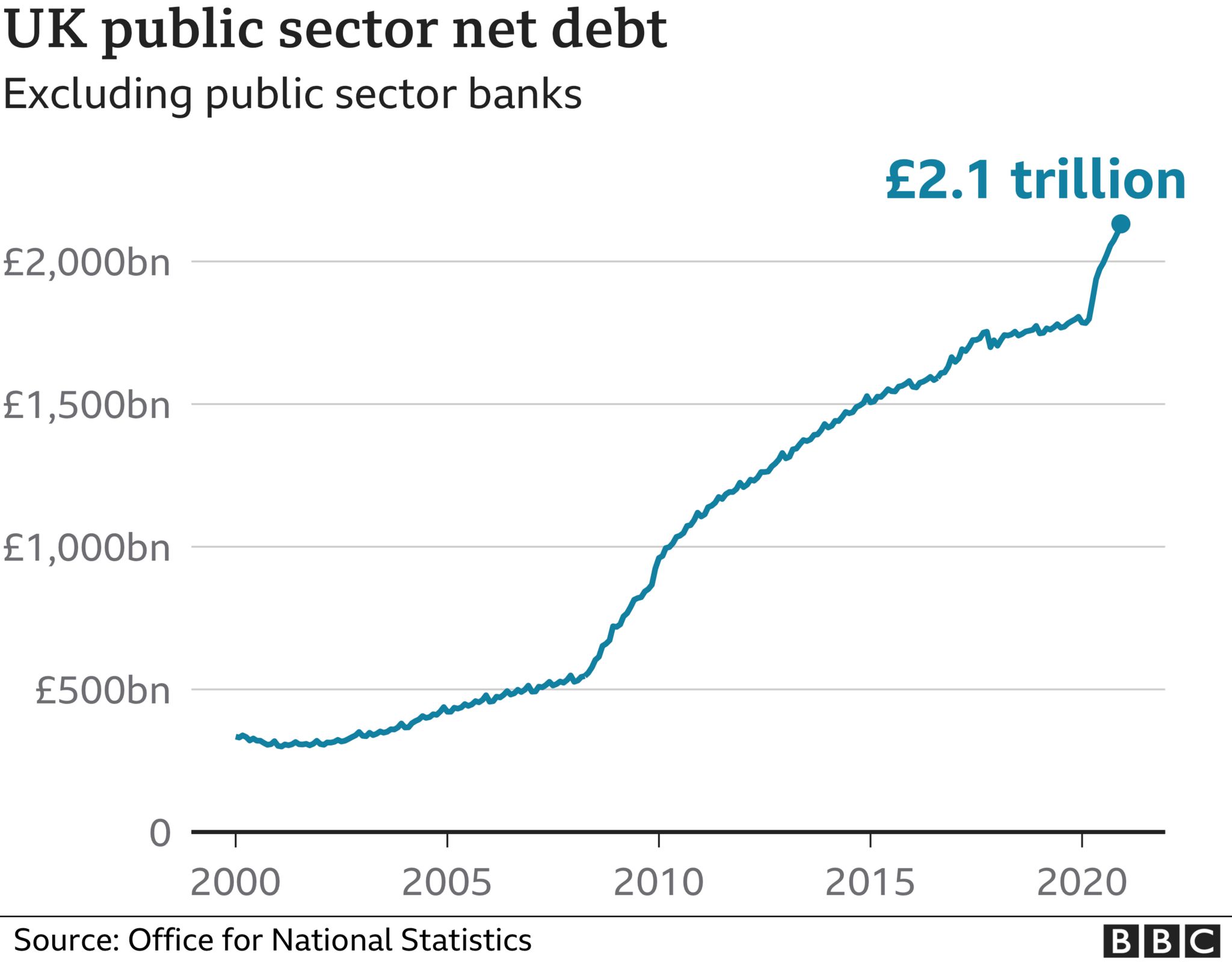

Mr Sunak has warned public finances face a challenge due to the pandemic amid "enormous strains".

The chancellor said earlier this weekend he wanted to "level with people about the challenge", but added: "I will do whatever it takes to protect the British people through this crisis and I remain committed to that."

The government has so far borrowed £271bn this financial year - up £222bn on 2019-20. This has pushed the national debt to £2.13 trillion.

'Restart grants'

Nearly 700,000 shops, restaurants, hotels, hair salons, gyms and other businesses in England, will be eligible for the so-called "restart grants", to be distributed directly to firms by local authorities from April. It will replace the current monthly grant system.

The funding takes the total spent on direct grants to businesses during the pandemic to £25bn, the Treasury said. The devolved nations will receive equivalent extra funding.

Mr Sunak told the Mail on Sunday it had been an "incredibly difficult year for our High Streets" and that the new money would provide businesses "the support they need to get them through, get them back on their feet and get the tills ringing once again".

Non-essential shops in England, along with outdoor hospitality, will be allowed to reopen from 12 April at the earliest.

Details of the grant scheme came as part of a series of announcements ahead of Mr Sunak's annual economic speech on Wednesday, including:

- a new government-backed mortgage guarantee scheme for home buyers with small deposits

- an "elite" visa to encourage high-skilled workers including researchers, engineers and scientists to come to the UK

- £126m for traineeships and a "flexi-job" apprenticeship in England

- and a "world-first" green savings bond for retail investors to help boost the UK's transition to net zero emissions

Mike Cherry, national chair of the Federation of Small Businesses, welcomed the "much-needed lifeline" provided to businesses by the grants, but called for the chancellor to set out more funding "for those that have been excluded from income support throughout this crisis".

UK Hospitality chief executive Kate Nicholls said businesses were "crying out for the cash" and urged the grants to be paid as soon as possible.

And Helen Dickinson, of the British Retail Consortium, which represents chain stores, said the latest money was a "vital injection of funding" but warned it would "only provide temporary relief" if the business rate holiday did not continue.

Other groups called for the extension of the furlough scheme and the temporary reduction in value added tax (VAT) on hospitality sales.

Last year was the worst for the High Street in more than 25 years as the pandemic accelerated the move towards online shopping, with more than 180,000 jobs lost in retail alone, according to the Centre for Retail Research.

As part of the plan to recoup costs incurred by the pandemic, the Sunday Times reported that Mr Sunak could freeze some income tax thresholds for three years.

It would mean that the chancellor would not break a 2019 election pledge that guaranteed the Conservatives would not raise the "rate" of income tax.

Corporation tax - the levy paid by businesses on profits - might also rise.

However, Mr Sunak is facing pressure on taxes and spending from backbench Tories and Labour.

Some Conservative MPs, such as former Brexit secretary David Davis, have also spoken out against attempts to increase taxes.

Tory rebels have been told that they risk having the whip withdrawn if they vote against the Budget.

Labour has said it opposes tax rises in the short-term and has called for a £20 uplift in universal credit to be kept.

But Conservative former chancellor Lord Ken Clarke has encouraged Mr Sunak to consider raising VAT, national insurance and income taxes in order to repair the public finances.

Meanwhile, Labour said it wanted a "jobs promise" to ensure young people do not become a "lost generation" due to the pandemic.

Under Labour's plan, all 16 to 24-year-olds out of work or education for six months would be helped into jobs or studies, the party said.

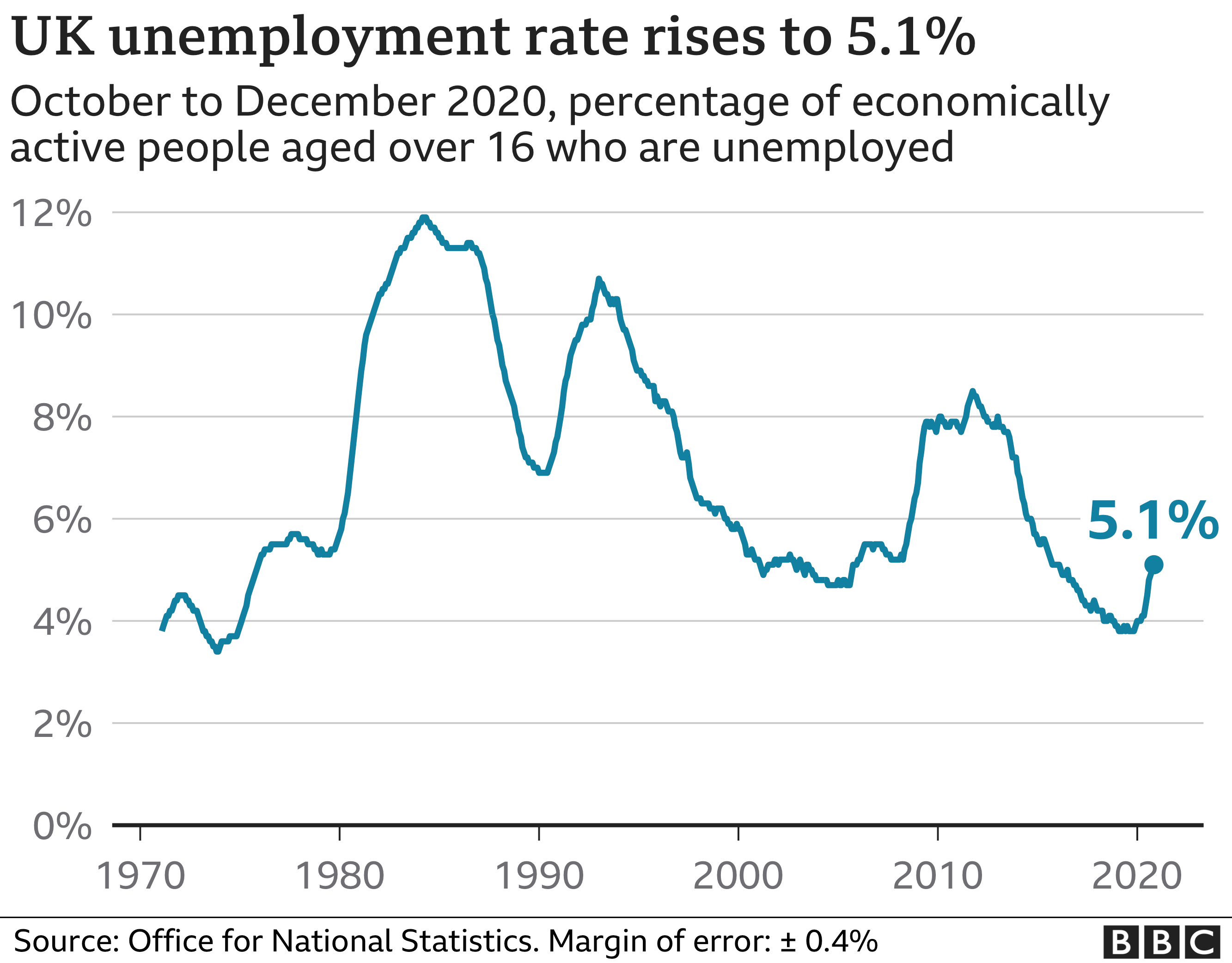

The party estimated that more than a million people will become "long-term unemployed" in 2021 and 2022, with 660,000 young people out of work or education for six months or more.

The most recent unemployment rate - for October to December - was 5.1%, according to the Office for National Statistics, equivalent to 1.74 million people.

Shadow work and pensions secretary Jonathan Reynolds said that without immediate action a "lost generation, scarred by unemployment" could be created.

- ZARA MCDERMOTT WANTS ANSWERS: Revenge porn is raging in the UK and Zara wants to know, can anyone safely share intimate images again?

- BINGE-WATCH BATES MOTEL THIS WEEKEND: The Psycho prequel exploring the dark backstory of how a teenage boy becomes a killer

February 28, 2021 at 04:14PM

https://www.bbc.co.uk/news/business-56227339

Labels: BBC News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home