NZD/USD, NZD/JPY React as Soaring Treasury Yields Skew Market Risk Profile

Treasury Yields, NZD/USD, NDZ/JPY, Reflation – Talking Points

- Treasury rates soar, shifting the market’s risk profile and forcing investors to ditch equities

- APAC equity markets at risk as global reflation theme pushes sovereign yields higher

- NZD/USD, NZD/JPY selloff overnight as the risk-sensitive Kiwi reacts with weakness

Recommended by Thomas Westwater

Get Your Free Top Trading Opportunities Forecast

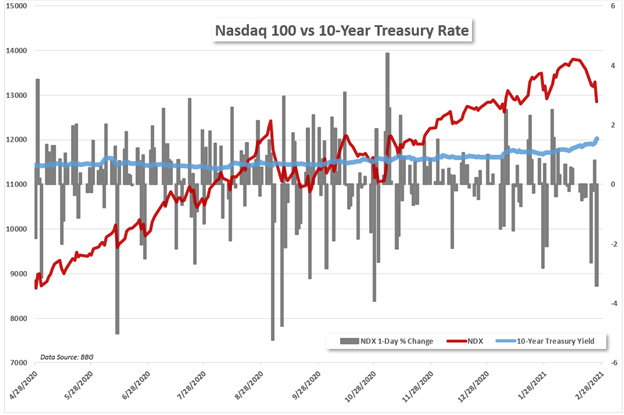

US equity prices appear to have finally waved the white flag in the face of a sharp rise in Treasury yields, with Wall Street indexes moving violently lower, led by a 3.69% decline in the small-cap Russell 2000 index. Technology stocks found no quarter from the uptick in government bond yields, the Nasdaq Composite dropped 3.52% on the day.

The US 10-year yield pushed as high as 1.563 before moving slightly lower. Still, the commonly referenced benchmark rate is at its highest level since February 2020. An influx of new government spending and improved economic prospects have spurred the move in yields, but historically speaking, rates remain relatively low.

Nasdaq 100 Index vs 10-Year Treasury Yield

Friday’s Asia-Pacific Outlook

APAC equity markets will likely face some pressure following the bloodbath seen in the New York trading session. The reflationary theme helping to push government bond yields higher is hardly contained to just Treasuries, with Australian and Japanese bonds exhibiting similar behavior as investors bet on a strong global growth rebound.

The risk aversion has spilled outside of the equity market and into the foreign exchange markets, with moves lower in the risk-sensitive New Zealand and Australian Dollars against the Greenback. The Kiwi also suffered against the safe-haven Japanese Yen. Elsewhere, gold and silver prices may see a slight rebound after an overnight selloff.

While gold prices have languished in recent months, industrial metals like copper have been surging as the metal benefits from stimulus-driven demand. Still, even the high-flying red metal was unable to avoid the broad-based market selloff, highlighting the sweeping impact from Treasury yields.

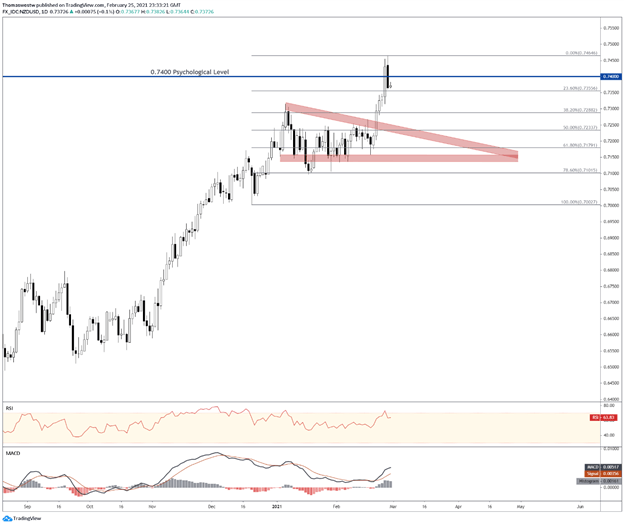

NZD/USD Technical Outlook

The New Zealand Dollar was flying high before the overnight impact from rising Treasury rates permeated throughout global markets. NZD/USD broke down below its psychologically important 0.74 handle before finding support near the 23.6% Fibonacci retracement level from the December to February move. A technical pullback was due according to the overbought Relative Strength Index and the preceding trend may continue with the MACD oscillator still bullishly positioned.

NZD/USD Daily Price Chart

Chart created with TradingView

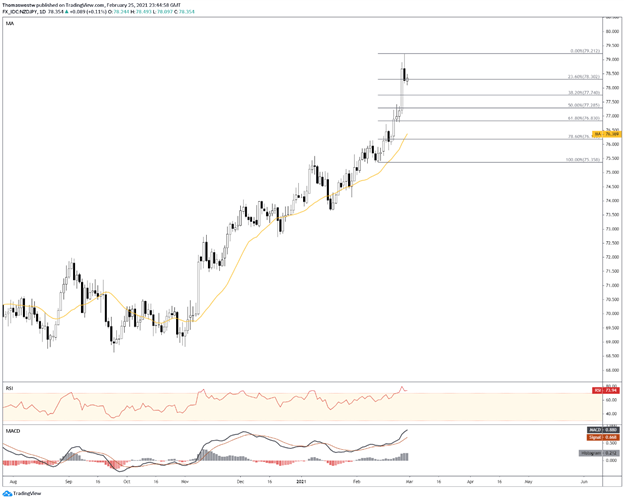

NZD/JPY Technical Outlook

The Japanese Yen – bolstered by safe-haven flows – gained 0.62% on Thursday against the New Zealand Dollar. NZD/JPY’s bullish technical stance remains intact despite the price drop, however. The pair is already starting to find some relief at the 23.6% Fib level and may quickly move to retrace the overnight selloff.

A break lower would see prices head towards the 38.2% Fib level and a more aggressive selloff could push prices down to the 20-Day Simple Moving Average, although that appears to be an unlikely scenario seeing as how strength is already recovering. RSI and MACD are also trending higher in support of price action.

NZD/JPY Daily Chart

Chart created with TradingView

NZD/USD, NZD/JPY TRADING RESOURCES

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

February 26, 2021 at 12:00PM

Thomas Westwater

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/asia_am_briefing/2021/02/26/NZDUSD-NZDJPY-React-as-Soaring-Treasury-Yields-Skew-Market-Risk-Profile.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home