Euro Price Outlook: Delayed Ratification of Recovery Fund to Weigh on EUR

EUR/USD, EUR/GBP, EU Recovery Fund, Coronavirus Restrictions, Interest Rate Differentials – Talking Points:

- Equity markets broadly gained during APAC trade on the back of the speedy distribution of vaccines in the US.

- The delayed ratification of the EU recovery fund, and increase pace of bond-purchases from the ECB, may weigh on the Euro.

- EUR/USD at risk of extended losses after slicing below sentiment-defining support.

- EUR/GBP eyeing fresh yearly lows as bears remain comfortably in control of the exchange rate.

Discover what kind of forex trader you are

Asia-Pacific Recap

Equity market broadly gained during Asia-Pacific as the speedy distribution of vaccines in the US underpinned market sentiment against a backdrop of enhanced restrictions in Europe. Japan’s Nikkei 225 climbed 0.16%, China’s CSI 300 rose 0.55%, and Hong Kong’s Hang Seng Index surged 1.12%. Meanwhile Australia’s ASX 200 dropped 0.9% as an outbreak of coronavirus infections in Queensland weighs on investor sentiment.

In FX markets, the cyclically-sensitive Australian and New Zealand Dollars largely outperformed their major counterparts, while the haven-associated Japanese Yen and Swiss Franc lost ground. Gold dipped back below $1710/oz on the back of rising Treasury yields, and crude oil dropped 0.4% as the unblocking of the Suez Canal alleviated supply concerns.

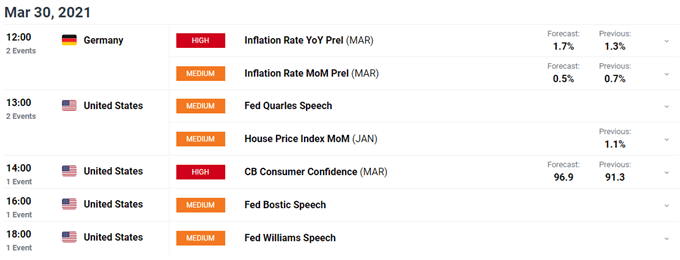

Looking ahead, German inflation figures and US consumer confidence data headlines the economic docket.

DailyFX Economic Calendar

EU Recovery Fund Delay, Rising Covid-19 Cases to Weigh on EUR

As mentioned in previous reports, a resurgence of coronavirus infections, and the resulting tightening of restrictions, in several European nations could undermine the Euro against its major counterparts in the near term.

German Chancellor Angela Merkel is threatening to utilize federal authority to enforce measures to stem the recent surge in coronavirus cases seen in the nation, after walking back plans for a five-day hard lockdown to be implemented at the start of April. A marked increase in Covid-19 cases has also forced France, Italy and the Netherlands to extend their respective restrictive measures.

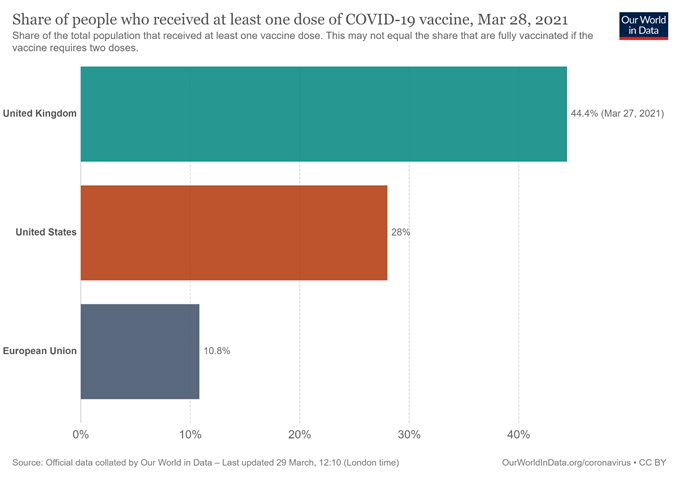

The delayed rollout of vaccines, and the resistance from residents in response to reports questioning the safety of AstraZeneca’s shot, could see these measures prolonged and in turn result in a notable reduction in second-quarter economic growth forecasts. As of March 27, only 10.8% of EU residents have received at least one dose of a coronavirus vaccine. In contrast, 28% of Americans and 44.4% of people in the UK have been inoculated with at least one shot.

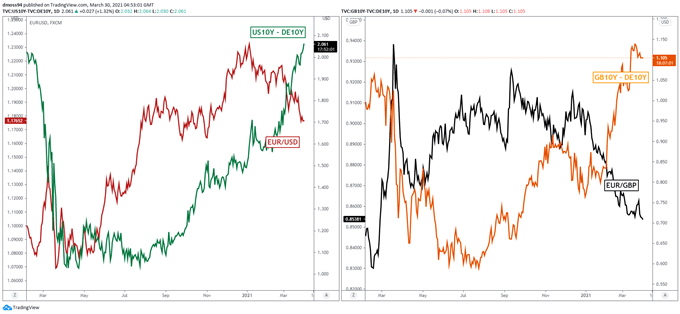

Moreover, the recent order from the German Constitutional Court preventing President Steinmeier from ratifying the European Recovery Fund, in tandem with the European Central Bank upping its pace of weekly bond purchases through the PEPP, could drive the price of haven-associated German Bunds higher.

This would see the differential between Bunds and both UK GILTS and US Treasury yields widen even further and place additional downside pressure on the Euro. As it stands, the spread between UK 10-year GILTS and German 10-year Bunds is hovering at the highest levels since late-2019, while the spread between US 10-year Treasury and 10-year Bund yields has soared above 2% for the first time in over a year.

A continuation of this trend could see the British Pound and US Dollar extend gains against the Euro in the weeks ahead.

Chart prepared by Daniel Moss, created with Tradingview

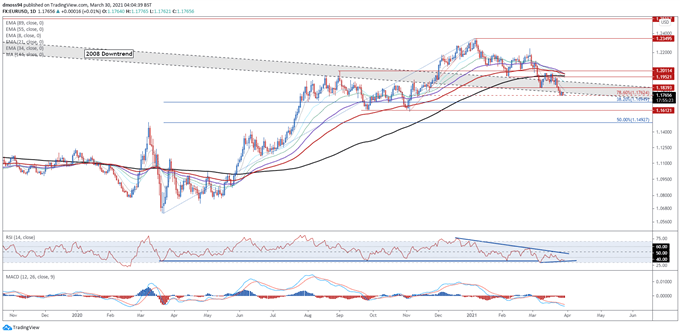

EUR/USD Daily Chart – Possible Death Cross May Foreshadow Extended Losses

From a technical perspective, EUR/USD rates seem at risk of extending recent losses as prices plunge back below psychological support at 1.1800, falling to the lowest levels since November of last year.

With the a bearish Death Cross taking shape on the moving averages, and the MACD registering its most negative readings since February 2020, the path of least resistance appears to heavily favour the downside.

A daily close below the 78.6% Fibonacci (1.1762) would probably intensify selling pressure and carve a path for price to challenge the November low (1.1602).

However, if Fibonacci support holds firm a short-term rebound to retest former support-turned-resistance at the March 9 low (1.1835).

Chart prepared by Daniel Moss, created with Tradingview

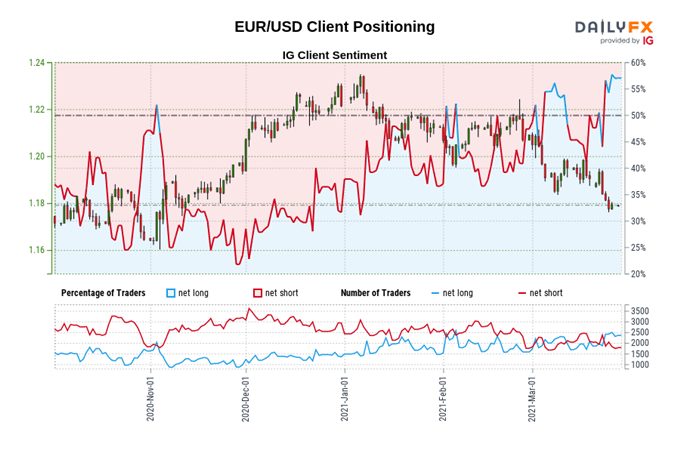

IG Client Sentiment Report

The IG Client Sentiment Report shows 54.26% of traders are net-long with the ratio of traders long to short at 1.19 to 1. The number of traders net-long is 6.30% higher than yesterday and 26.92% higher from last week, while the number of traders net-short is 18.50% higher than yesterday and 12.66% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

EUR/GBP Daily Chart – Descending Pitchfork Guiding Price Lower

EUR/GBP rates may also extend recent losses, as prices continue to track within the confines of a descending Andrews’ Pitchfork and register the lowest daily close since February 2020.

A bearish crossover on the MACD indicator, in combination with the RSI tracking below 40, suggests that bears are in control of the exchange rate.

With that in mind, gaining a firm foothold below the 78.6% Fibonacci (0.8542) on a daily close basis likely signals the resumption of the primary downtrend and opens the door for the exchange rate.

That being said, if this level should remain intact, a relief rally back towards psychological resistance at 0.8600 could eventuate.

Chart prepared by Daniel Moss, created with Tradingview

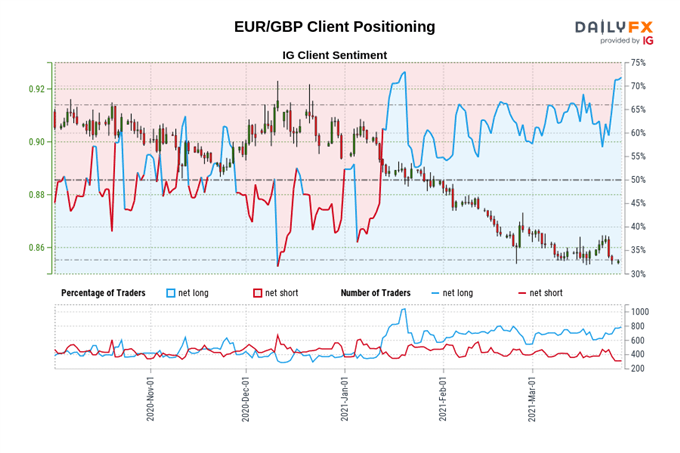

IG Client Sentiment Report

The IG Client Sentiment Report shows 62.50% of traders are net-long with the ratio of traders long to short at 1.67 to 1. The number of traders net-long is 6.66% lower than yesterday and 13.49% higher from last week, while the number of traders net-short is 38.83% higher than yesterday and 10.81% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss

Recommended by Daniel Moss

How to Trade EUR/USD

March 30, 2021 at 07:00PM

Daniel Moss

https://www.dailyfx.com/forex/fundamental/daily_briefing/session_briefing/euro_open/2021/03/30/Euro-Price-Outlook-Delayed-Ratification-of-Recovery-Fund-to-Weigh-on-EUR.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home