Euro Price Forecast: EUR/USD, EUR/JPY May Slide Ahead of Sentiment Print

Euro, EUR/USD, EUR/JPY, Easing Restrictions, Consumer Confidence – Talking Points:

- Equity markets gained ground during APAC trade as the FOMC retained its dovish stance.

- The Euro may slide lower against the Japanese Yen and US Dollar in the near term, after bursting higher in recent days.

Asia-Pacific Recap

Equity markets gained ground during Asia-Pacific trade, on the back of the FOMC retaining its dovish monetary policy stance and the prospect of additional fiscal stimulus. Australia’s ASX 200 (+0.26%), Japan’s Nikkei 225 (+0.21%), Hong Kong’s Hang Seng Index (+0.63%) and China’s CSI 300 (+0.58%) all pushed higher.

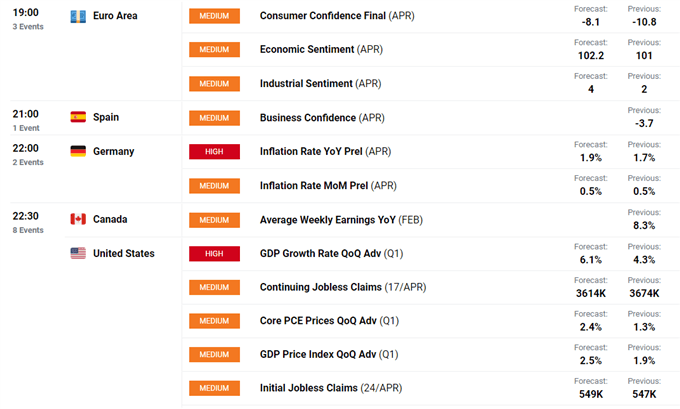

In FX markets, the British Pound outperformed its major counterparts, while the haven-associated US Dollar and Japanese Yen slipped lower. Gold prices held relatively steady, while silver jumped 0.75%, despite yields on US 10-year Treasuries climbing 2 basis points. Looking ahead, US Q1 GDP figures headline the economic docket alongside Germ inflation figures for April.

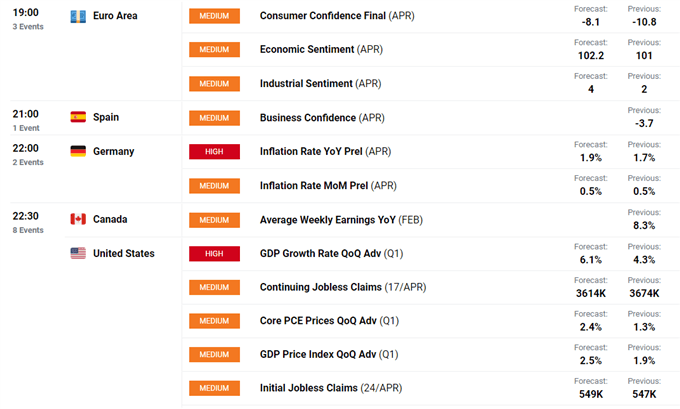

DailyFX Economic Calendar

Consumer Confidence, Economic Sentiment Data in Focus

As expected, the easing of restrictions in several European nations paved the way for the Euro to gain ground against its haven-associated counterparts in the near term. Italy rolled back curbs earlier this week, while Greece is expecting to follow suit at the beginning of next month.

Germany is also contemplating introducing privileges for vaccinated individuals, while France is planning to lift its ban on domestic travel on May 3. These promising developments, alongside the ECB keeping its monetary policy steady for the time being, paint a rather bullish backdrop for the Euro ahead.

However, there is the possibility that much of this has been fully priced into the market, and therefore an underwhelming data release could ignite some short-term weakness.

With that in mind, upcoming consumer confidence and economic sentiment data could prove noteworthy, with a meaningful undershoot possibly leading market participants to discount the Euro against the Japanese Yen and US Dollar.

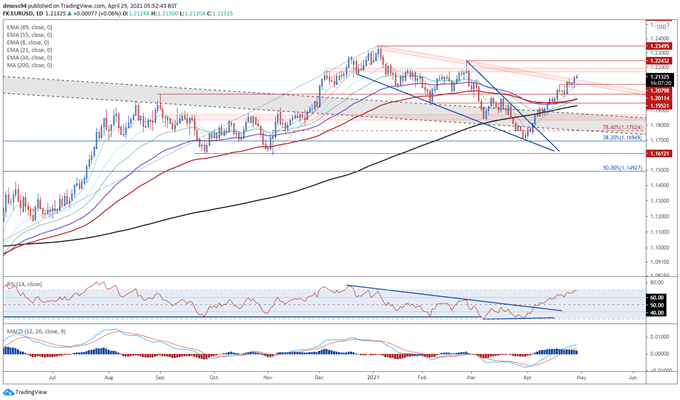

EUR/USD Daily Chart – Shooting Star Candle Could Ignite Reversal

Chart prepared by Daniel Moss, created with Tradingview

From a technical perspective, the outlook for EUR/USD rates appears relatively mixed, as price struggles to penetrate range resistance at 1.2170 – 1.2190.

The premature formation of a Shooting Star candle could inspire sellers in the near term and generate a pullback to key support at 1.2080, with a break below probably garnering follow-through and bringing the 1.2000 handle into the cross hairs.

However, if 1.2100 holds firm, a challenge of the February high (1.2243) is hardly out of the question.

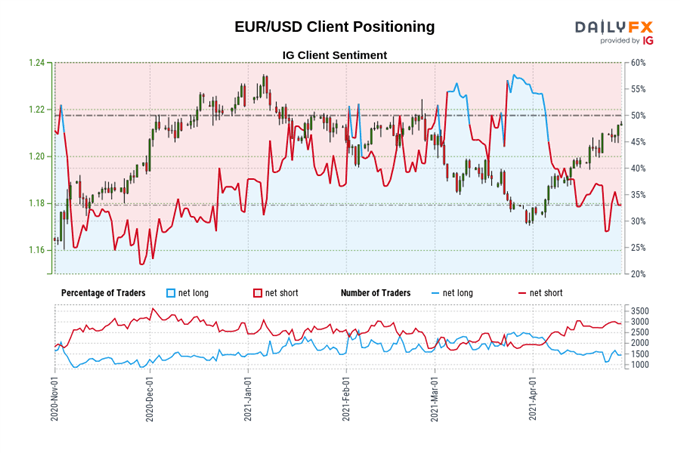

The IG Client Sentiment Report shows 32.76% of traders are net-long with the ratio of traders short to long at 2.05 to 1. The number of traders net-long is 16.69% lower than yesterday and 16.14% lower from last week, while the number of traders net-short is 3.82% lower than yesterday and 7.98% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

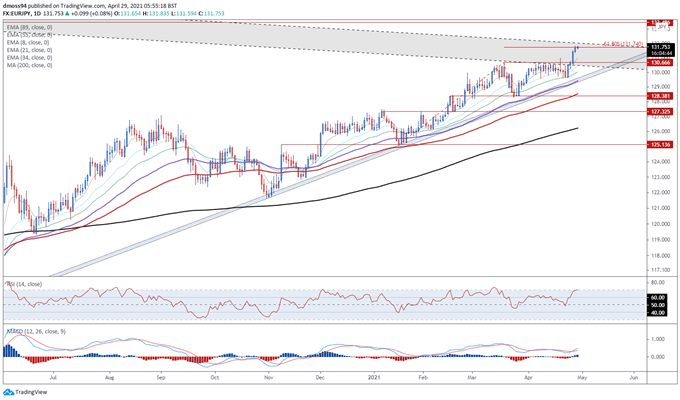

EUR/JPY Daily Chart – 61.8% Fibonacci Resistance in Focus

Chart prepared by Daniel Moss, created with Tradingview

EUR/JPY rates could reverse lower in the coming days, as a Shooting Star candle forms at the 61.8% Fibonacci (131.74).

Bearish RSI divergence indicates that the climb to fresh yearly highs may be running out of steam, leaving the exchange rate vulnerable to a pullback in the near term.

Failing to gain a firm foothold above psychological resistance at 132.00 on a daily close basis could encourage would-be sellers and generate a downside push back to former resistance-turned-support at the March high (130.67).

Conversely, clearing 132.00 convincingly probably signals the resumption of the primary uptrend and brings the April 2018 high (133.49) into play.

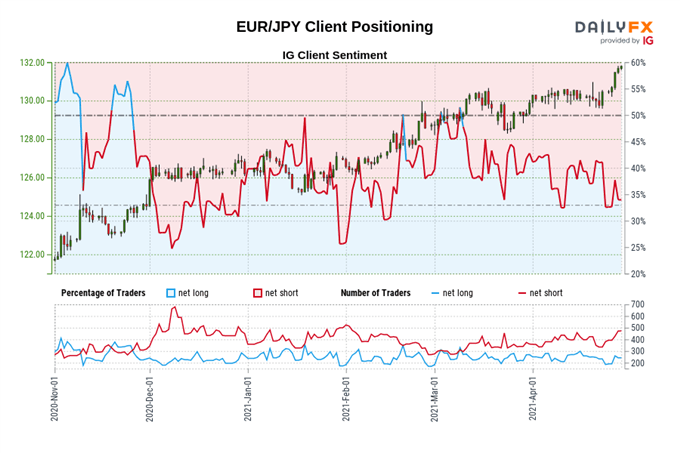

The IG Client Sentiment Report shows 34.11% of traders are net-long with the ratio of traders short to long at 1.93 to 1. The number of traders net-long is 3.31% higher than yesterday and 1.19% lower from last week, while the number of traders net-short is 7.57% higher than yesterday and 34.54% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/JPY-bullish contrarian trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss

April 29, 2021 at 07:00PM

Daniel Moss

https://www.dailyfx.com/forex/fundamental/daily_briefing/session_briefing/euro_open/2021/04/29/Euro-Price-Forecast-EURUSD-EURJPY-May-Slide-Ahead-of-Sentiment-Print.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home