FTSE 100 Poised to Extend Gains Despite AstraZeneca Vaccine Concerns

FTSE 100, AstraZeneca Vaccine, UK PMI, UK Reopening, IGCS – Talking Points:

- Equity markets were buoyant during APAC trade on the back of dovish FOMC commentary.

- The UK benchmark FTSE 100 index may shrug aside coronavirus vaccine concerns and push to fresh post-crisis highs in the coming days.

Discover what kind of forex trader you are

Asia-Pacific Recap

Equity markets followed through on a relatively positive Wall Street session overnight in Asia-Pacific trade, as the release of the FOMC’s March meeting minutes reinforced the central bank’s commitment to maintaining its accommodative monetary policy approach.

Australia’s ASX 200, China’s CSI 300, and Hong Kong’s Hang Seng Index all marched higher, while tightening virus restrictions in Tokyo weighed on Japan’s Nikkei 225. In FX markets, AUD, NZD and GBP gained ground alongside the lower-beta JPY and CHF. Gold prices consolidated around $1740 per troy ounce as yields on US 10-year Treasuries drifted 1 basis point lower.

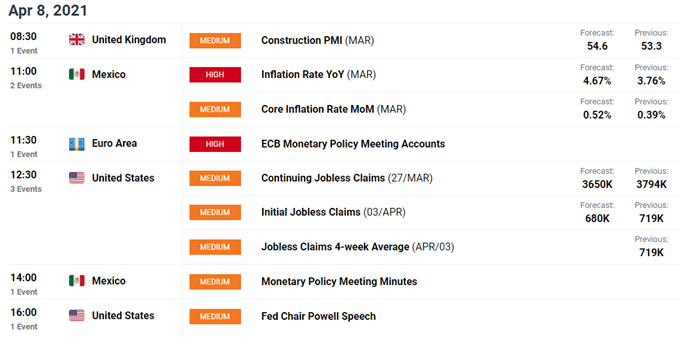

Looking ahead, US weekly jobless claims figures and minutes from the European Central Bank’s monetary policy meeting in March headline the economic docket.

DailyFX Economic Calendar

FTSE 100 May Dismiss Vaccine Concerns and Extend Gains

The UK benchmark FTSE 100 index may shrug aside recent coronavirus vaccine concerns, and continue pressing higher as the economy progresses into the next stage of Prime Minister Boris Johnson’s four-stage reopening plan.

After the discovery of several rare blood clotting issues in people who had received AstraZeneca’s Covid-19 vaccine, the government’s vaccine advisory committee has recommended that people aged between 18 and 29 should be given an alternative shot. This could ultimately rock confidence in the heavily-utilized vaccine and result in a marked reduction in overall inoculation rates.

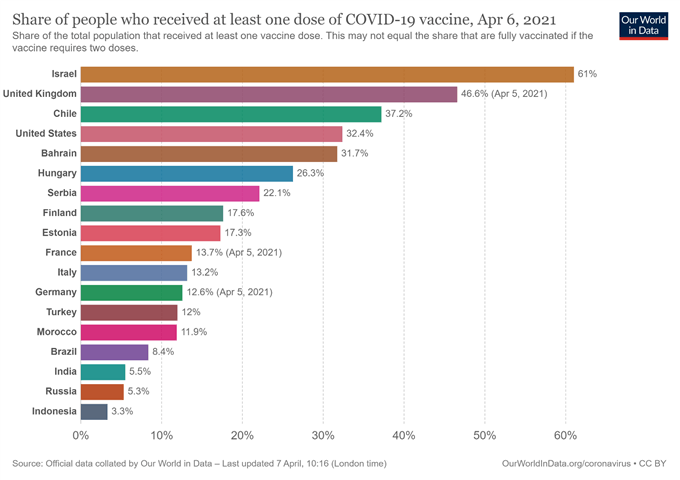

However, with 46.6% of the population having received at least one dose of a vaccine, and the 7-day moving average tracking infections falling to 3,000 for the first time since September last year, it seems relatively unlikely that these development will impact the reopening process.

Moreover, a flurry of robust PMI figures signal that the local economy is bouncing back strongly from the pandemic and will probably direct capital flows into regional risk-associated assets.

The UK’s Markit Composite PMI climbed from 49.6 to 56.4 in March, while the Manufacturing PMI signalled the largest expansion in factory activity since February 2011.

With that in mind, swelling optimism and return to a level of economic normality may pave the way for the FTSE 100 to climb to fresh post-crisis highs in the coming weeks.

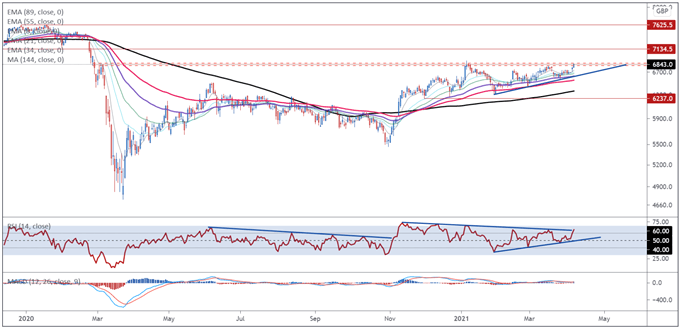

FTSE 100 Daily Chart – Gearing Up To Extend Recent Gains

Chart prepared by Daniel Moss, created with Tradingview

From a technical perspective, the outlook for the FTSE 100 suggests that further gains are in the offing, as prices coil up below key range resistance at 6830 – 6870.

With the index tracking above all six moving averages, and the RSI snapping its downtrend extending from the November extremes, the path of least resistance seems higher.

Gaining a firm foothold above 6870 on a daily close basis would probably signal the resumption of the primary uptrend extending from the March 2020 nadir and propel prices to challenge the December 2019 low (7129).

However, if range resistance holds firm, a short-term pullback to the trend-defining 55-EMA (6632) could be on the cards.

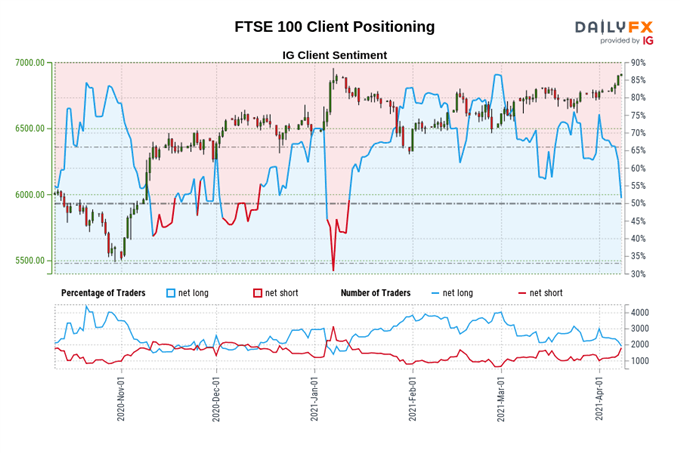

The IG Client Sentiment Report shows 51.79% of traders are net-long with the ratio of traders long to short at 1.07 to 1. The number of traders net-long is 13.10% lower than yesterday and 36.52% lower from last week, while the number of traders net-short is 31.25% higher than yesterday and 77.96% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests FTSE 100 prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current FTSE 100 price trend may soon reverse higher despite the fact traders remain net-long.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss

Recommended by Daniel Moss

Top Trading Lessons

April 08, 2021 at 07:00PM

Daniel Moss

https://www.dailyfx.com/forex/fundamental/daily_briefing/session_briefing/euro_open/2021/04/08/FTSE-100-Poised-to-Extend-Gains-Despite-AstraZeneca-Vaccine-Concerns.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home