Market Extra: Here’s why a flood of cash could be creating a conundrum for the Fed

Even as bond traders fret over another potential selloff in long-term U.S. Treasurys, those relying on shorter-dated maturities are facing the opposite issue.

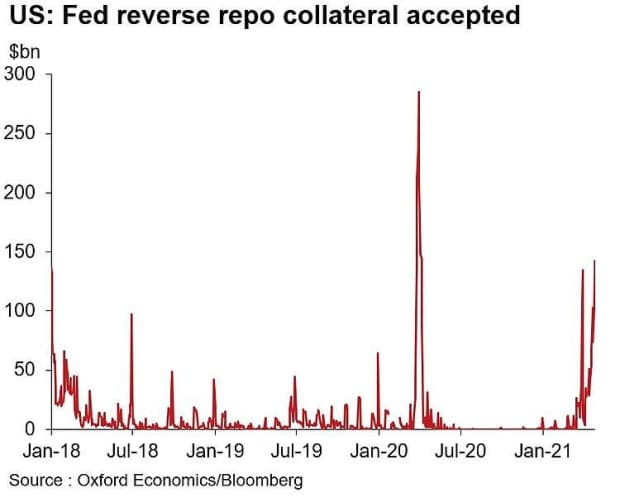

A flood of cash making its way into money markets has been putting pressure on overnight interest rates, while increasing the take-up of an obscure Federal Reserve facility to its highest levels since the pandemic first sparked a global flight to safety last year. This, in turn, has raised concerns the U.S. central bank, may be moving closer to the brink of losing control of its benchmark policy rate.

The Fed’s overnight reverse repo facility took in $142.17 billion Tuesday, the largest such operation since April 2020.

The facility allows lenders to offer funds to the central bank in return for U.S. Treasurys and similar safe-haven assets at negligible interest rates. By doing so, the Fed can limit downward pressure on the Fed’s benchmark interest rate and keep it within its prescribed range.

Part of the reason for the increased take-up of this Fed’s facility, said John Canavan, an analyst at Oxford Economics, is that the inflow of cash in money market funds needs somewhere to find a home.

The U.S. Treasury Department accounts held at the Fed are expected to shrink as the Treasury runs down its cash hoard to finance the Biden administration’s fiscal stimulus plans. That increases reserves at banks who will search for places to temporarily park the funds, with one of the outlets being the Fed’s repo facility.

See: 5 reasons why negative repo rates are different than the last overnight-funding crisis

But its increased usage has thrown a light on a conundrum facing the central bank over the past few months.

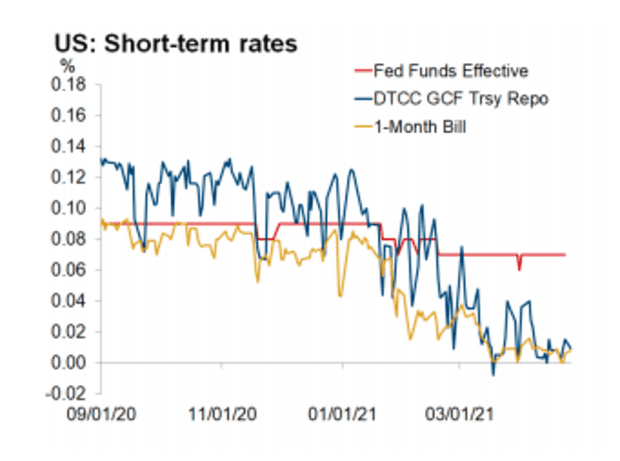

Overnight lending rates, either in the repo or Treasury bills market, have periodically threatened to fall below zero. The worry is the slide in these short-term borrowing rates may, in turn, drag down the Fed’s own interest rate closer to the bottom of its range of 0.25% to 0%. The Fed’s effective fed funds rate was at 0.07% on Tuesday.

That has raised calls for the Fed to tweak the interest rate paid on excess reserves that banks park at the central bank or the rate on the overnight reserve repo facility, fixes that could alleviate pressure on money markets.

Yet, Stephen Stanley of Amherst Pierpont says as long as the Fed’s benchmark rate stays well into positive territory, the central bank was unlikely to act at Wednesday’s meeting.

April 29, 2021 at 04:58AM

Sunny Oh

http://www.marketwatch.com/news/story.asp?guid=%7B21005575-02D4-D4B5-4572-D3CC1E0F20FA%7D&siteid=rss&rss=1

Labels: Top Stories

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home