Australian Dollar Forecast: AUD/USD Takes Hit on New Covid Lockdowns

Australian Dollar, AUD/USD, Covid, RBA, Technical Outlook - Talking Points

- Asia Pacific markets look to extend last week’s upbeat trading activity

- New Covid cases in Australia prompt lockdowns, Delta variant feared

- AUD/USD faces trendline resistance as price holds above 200-day SMA

Monday’s Asia-Pacific Outlook

Asia Pacific markets look to start a new round of trading with an optimistic outlook following a generally upbeat week. Investors will look to further assess the path ahead for monetary policy. The highly anticipated US non-farm payrolls report (NFP) is on tap, potentially shifting global market sentiment. Meanwhile, the risk-sensitive Australian Dollar is taking a small step back against its US cousin.

The regional economic docket appears rather light for the week ahead, which will leave traders at the whim of the broader market mood. Investors will key in on central bank commentary and price action leading up to Friday’s NFP report. Reserve Bank of Australia (RBA) Governor Philip Lowe is slated to speak on Tuesday, according to the DailyFX Economic Calendar.

Earlier this month, he said that some economic scenarios reviewed by the RBA warrant a rate hike, while others don’t. The outlook for Australian economic growth saw some discouraging news when more lockdowns were announced due to rising COVID-19 cases. Sydney – Australia’s biggest metropolis – began a two-week lockdown on Saturday, and the northern city of Darwin went into a 48-hour lockdown on Sunday. Health officials suspect the Delta variant is responsible for the batch of newly reported cases.

Elsewhere, Chinese factories’ industrial profits look to have come under more pressure in May as the National Bureau of Statistics (NSB) reported another monthly decline. Rising prices across key commodities like iron ore and copper have eaten into margins when supply chains are already facing Covid-induced disruptions. Chinese regulators have taken actions to confront the rise in metal prices, but it may take months to see any meaningful impact in the space.

AUD/USD Technical Outlook:

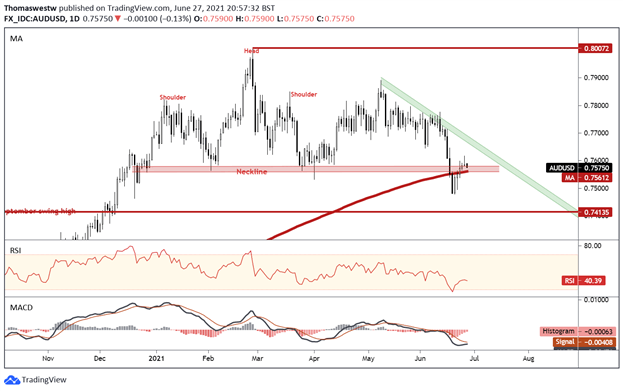

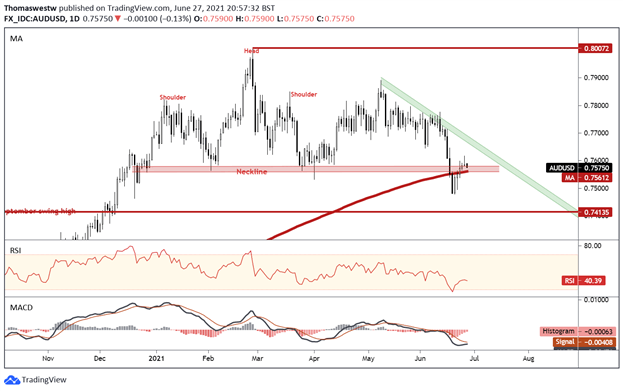

The Australian Dollar faces an interesting week when viewing the technical position against the US Dollar. AUD/USD has overtaken the closely-watched 200-day Simple Moving Average (SMA) once again after sinking below it last week.

Now, at the former neckline of a Head and Shoulders pattern, AUD/USD faces trendline resistance from the May swing high. If the currency pair manages to break higher, price may continue to run, potentially setting up for a test of the May high. Alternatively, slipping back below the 200-day SMA would likely see bearish re-engagement.

AUD/USD Daily Chart

Chart created with TradingView

Australian Dollar TRADING RESOURCES

--- Written by Thomas Westwater, Analyst for DailyFX.com

Contact Thomas at @FxWestwateron Twitter

June 28, 2021 at 11:00AM

Thomas Westwater

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/asia_am_briefing/2021/06/27/Australian-Dollar-Forecast-AUDUSD-Takes-Hit-on-New-Covid-Lockdowns.html

Labels: Forex Market Outlook

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home