Next Avenue: Lessons from the Bernie Madoff Ponzi scheme: 5 rules small investors should follow

This article is reprinted by permission from NextAvenue.org.

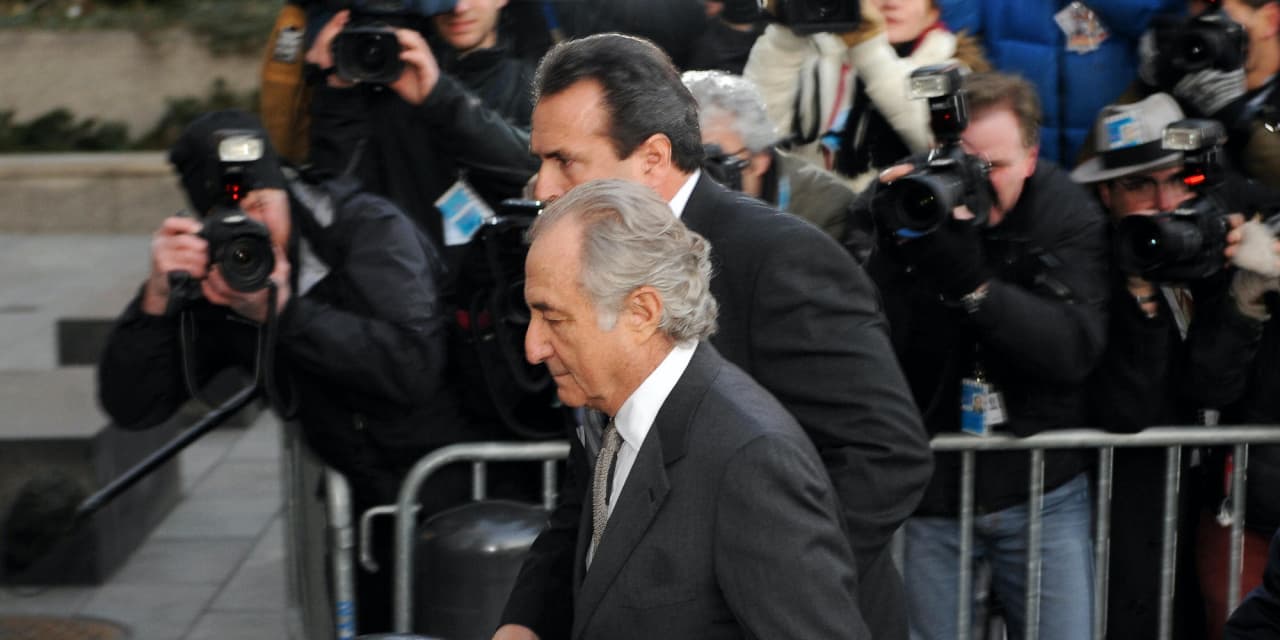

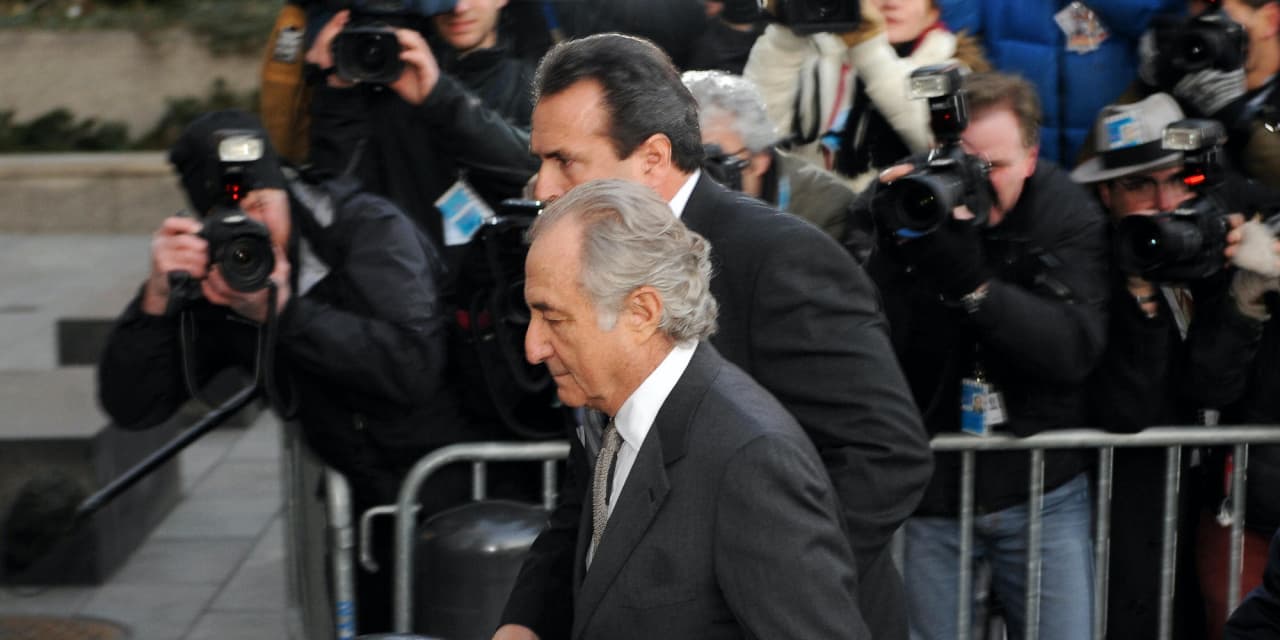

In his new book, “Madoff Talks,” investigative reporter Jim Campbell probes the $65 billion investment fraud perpetuated by the late Bernie Madoff, the largest Ponzi scheme in history. The book features Madoff’s handwritten letters and emails to Campbell, explaining how he pulled off the con, plus interviews with Madoff’s wife Ruth and son Andrew. In this excerpt, Campbell offers five rules to keep investors safe from such schemes.

“I stopped because the stress was killing me,” Bernie Madoff told me. “I was still being offered money in huge sums.”

It is likely that, in his mind, Madoff needed it to be his decision to throw in the towel — always in control, even when he wasn’t. (Madoff died in prison April 14, 2021, while serving a 150-year sentence for securities fraud, money laundering and other crimes.)

Also see: Bernie Madoff’s scam was hard to spot but this red flag was — and still is — a clue

Madoff’s scheme demonstrates that the warning “Too good to be true” needs to be mothballed in favor of a Hippocratic oath for financial services professionals: “First, do no harm.” However, investors must also do their part.

Here’s how to protect yourself against a crook like Madoff:

Avoid investments that guarantee investment returns up front. At the end of his fraud, Madoff would provide benchmark guarantees of 11% compounded on his investors’ portfolio statements.

But any investment that faces stock market exposure cannot deliver guaranteed performance.

Avoid investments that are not transparent or understandable. This includes understanding the investment strategy, knowing where the money is being invested, validating who has custody of the assets and proof of a track record, with independent corroboration.

It seemed few Madoff investors really understood what his “split strike conversion” strategy was, which defaulted to nothing more than “trust Bernie.” (The strategy is a sophisticated trading technique combining stocks and options.)

See: These everyday ‘scams’ have become so normalized that we hardly even notice them anymore

It should not have been conceptually challenging to understand that a strategy designed to be highly correlated to the market can’t then deliver results with little correlation to the market. If it’s not a market-driven rate of return, it must be a fraud-driven rate of return.

Avoid investments based on trust alone or simply on referral through an affinity network. One reason Madoff didn’t raise more red flags with investors is because people wanted to believe it. Madoff didn’t even have to solicit business. His was an affinity fraud, primarily targeting people in the Jewish community.

The fact is investments cannot go up in a straight line forever with no down years and no volatility.

Avoid placing all your investment eggs in one basket — diversify. Madoff got his money from what are known as feeder funds, professional money managers who said they conducted due diligence for their investors to select the most appropriate mix of funds to place their money. But too many investors were not told all their money was placed with just one manager: Bernie Madoff. Some were not even told who the manager was.

See: Stocks, bonds and more: A primer on diversification for new investors

Further, in reality, Madoff didn’t allow due diligence to look into his trading strategies and supposed returns.

Read: Watch your wallet — there are many ways to separate you from your money

Keep investing simple. Put a little money away consistently into a stock index fund (which buys a diversified basket of stocks) and in the long run, even with the vagaries of the market, wealth will build. It’s averaged 9% growth for a century. Legendary investor Warren Buffett’s advice to nonprofessionals is to invest in low-cost index funds.

I would add: Don’t even watch the daily movements of your portfolio. Take the 9% and sleep.

Jim Campbell is the author of “Madoff Talks” and host of the nationally syndicated radio show “Business Talk with Jim Campbell” and the crime show “Forensic Talk with Jim Campbell.” He is known for his hard-hitting interviews of leading figures from the worlds of business, politics and sports. He is founder and president at JC Ventures, Inc., a management consulting business.

This article is reprinted by permission from NextAvenue.org, © 2021 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue:

June 01, 2021 at 08:59PM

Jim Campbell

http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-745D-83CD3D24402F%7D&siteid=rss&rss=1

Labels: Top Stories

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home