EURUSD completes the down and up lap and too a new session high

A topside trendline tested and held on the first look

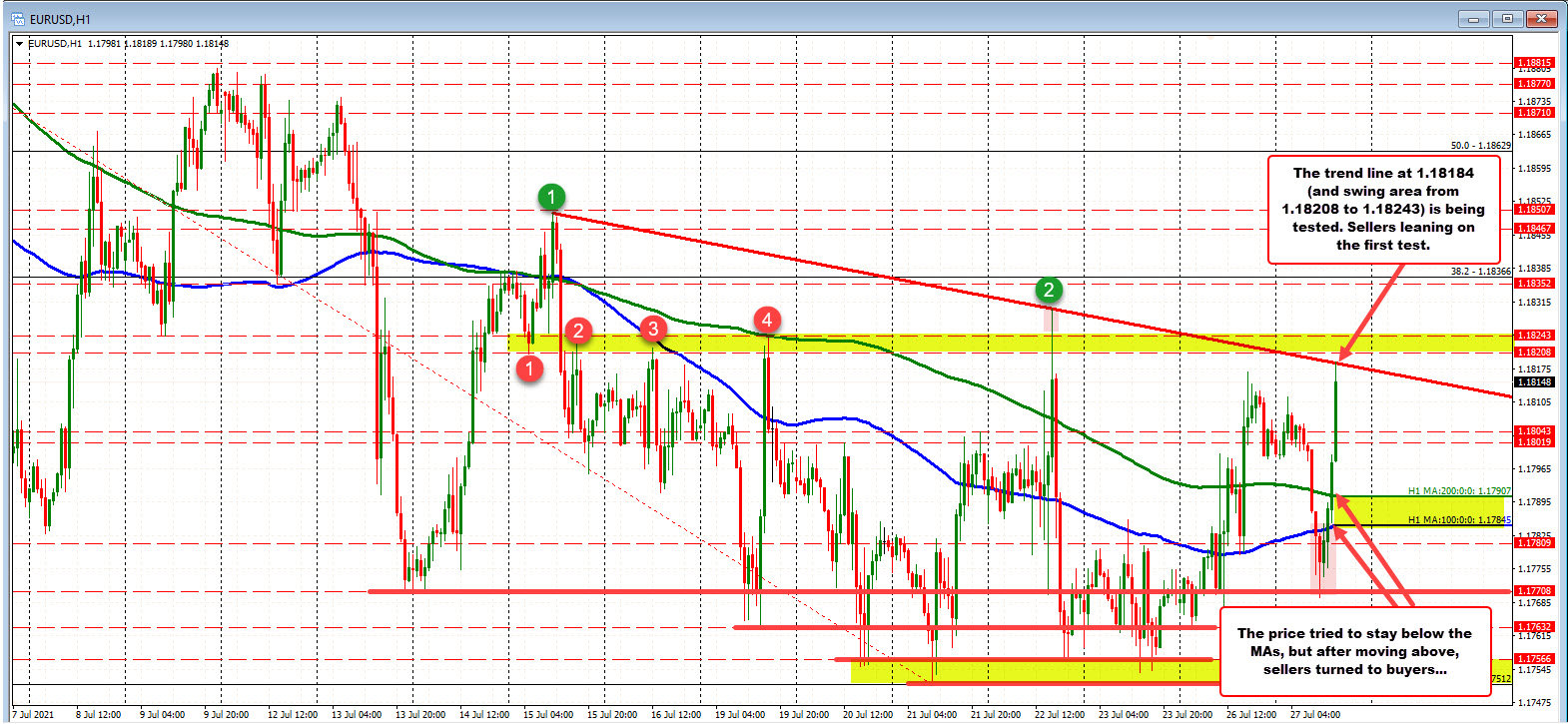

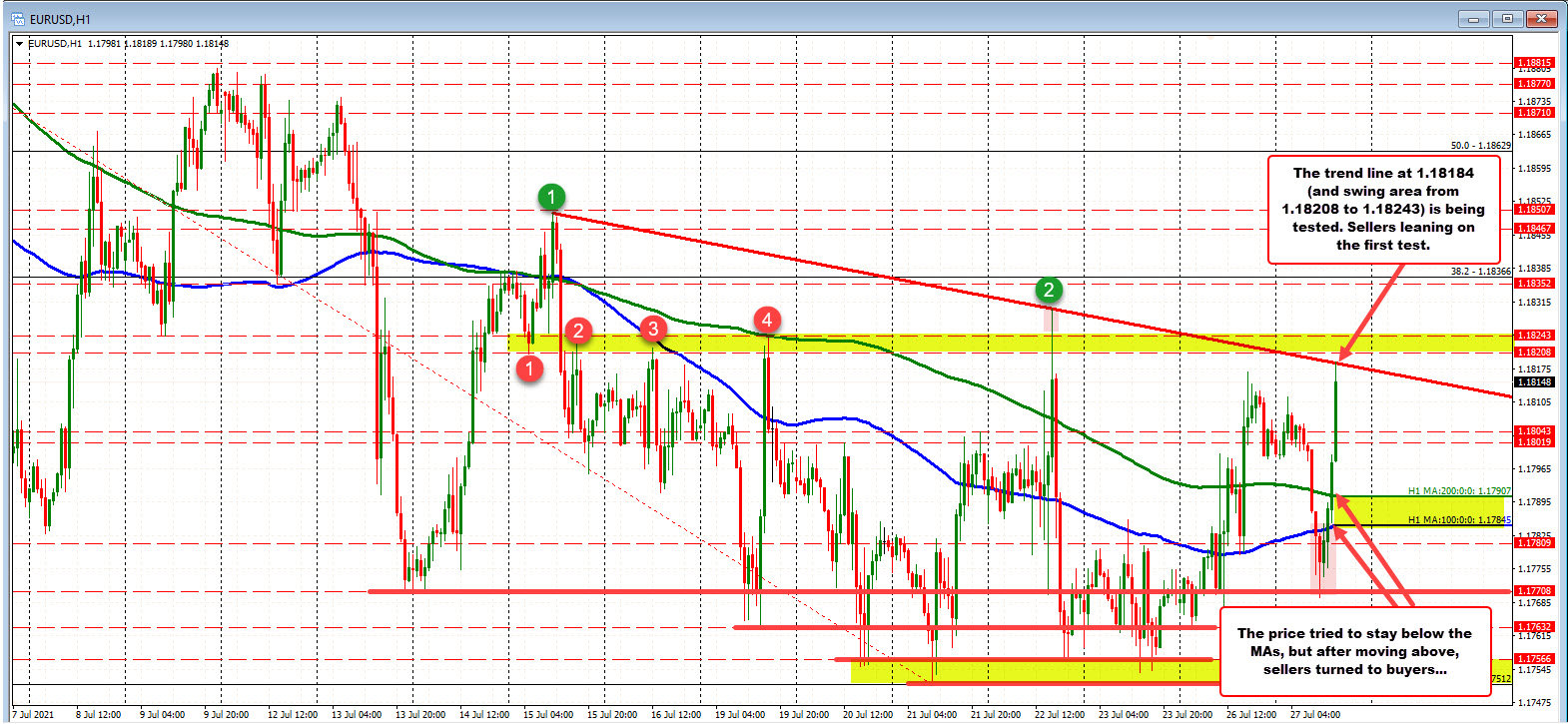

The EURUSD has completed the down and up "lap" which as seen the price first move lower in the late Asian and early European session, only to retrace all the declines and some over the last four trading hours.

Looking at the hourly chart, the price decline moved down to test the swing low going back to July 13 and July 14 near 1.17708. That move took the price below both the 200 hour moving average and 100 hour moving averages. The price tried to stay below the 100 hour moving average (at 1.17845) but ultimately moved back above a few hours ago. Sellers turned to buyers. The price move back above the 200 hour moving average in the early North American session, and the race to the upside was on.

The high just reached 1.18184. That tested a downward sloping trendline connecting the highs from July 15 and July 22 at the level. The first test held.

Watch the 1.18019 to 1.18043 now as close support. Hold, and we could see more upside momentum with a break of the trend line and swing area between 1.18208 to 1.18243 as the next target area. The high from last week at 1.1830 would be the next target above that level.

Hold the trend line and move below 1.1800 again, and we should see a retest of the 200 hour MA and 100 hour MA at 1.17907 and 1.17845.

BROAD OVERVIEW OF THE PRICE ACTION: The price of the EURUSD has had its share of ups and downs on the hourly chart. At the lows last week, the price over four days straight saw the price bottom between 1.1751 and 1.17566.

Recent highs have stalled near 1.1820 and 1.1830. The range going back to July 15 has only been around 78 pips (7 -8 trading days). The 100/200 hour moving averages are starting to move sideways and converge.

The "market" is unsure of the next move. Perhaps it is waiting for the FOMC decision or even the employment report next week (or the Delta virus path).

Technical levels can help (they always do even in choppy markets). Nevertheless traders need to keep all options open until that time when there is a break. Today we saw a sharp move down followed by a sharp move higher. It can be frustrating, but that is the trading environment for now. Watch the levels, cross your fingers and maybe you will catch a run (or breakout).

July 28, 2021 at 12:47AM

Greg Michalowski

https://ift.tt/3l2eoc4

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home