Indian central bank looking at phased launch of its own digital currency

Indian central bank looking at phased launch of its own digital currency

Forex 16 minutes ago (Jul 23, 2021 08:30AM ET)

Forex 16 minutes ago (Jul 23, 2021 08:30AM ET)

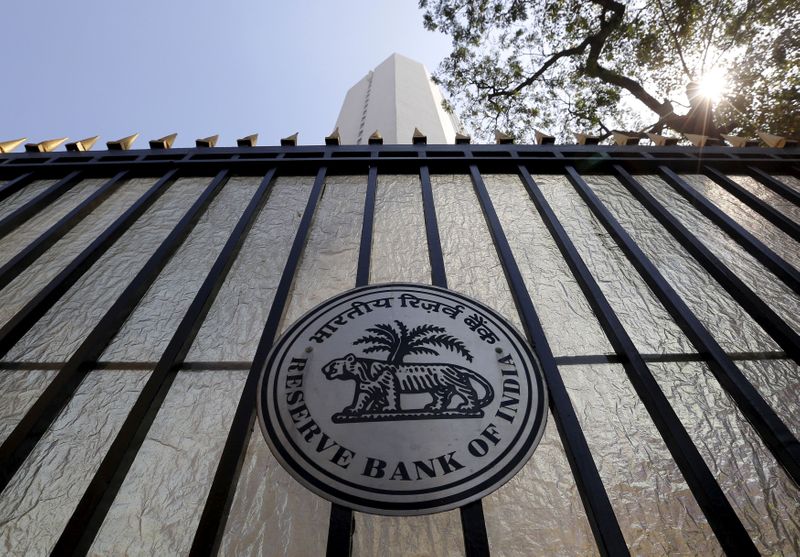

© Reuters. FILE PHOTO: The Reserve Bank of India seal is pictured on a gate outside the RBI headquarters in Mumbai, India, February 2, 2016. REUTERS/Danish Siddiqui/File Photo

© Reuters. FILE PHOTO: The Reserve Bank of India seal is pictured on a gate outside the RBI headquarters in Mumbai, India, February 2, 2016. REUTERS/Danish Siddiqui/File Photo

By Swati Bhat

MUMBAI (Reuters) - The Reserve Bank of India is considering a phased introduction of its own central bank digital currency (CBDC), deputy governor T. Rabi Shankar said, and is examining various issues including the underlying technology and issuance method.

"CBDCs are likely to be in the arsenal of every central bank going forward. Setting this up will require careful calibration and a nuanced approach in implementation," Shankar said according to a speech released late on Thursday.

"As is said, every idea will have to wait for its time. Perhaps the time for CBDCs is nigh," he added.

According to a 2021 survey by the Bank for International Settlements, 86% central banks were actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects.

China leads the space and has already started trials of a digital currency in several cities while the U.S. Federal Reserve and Bank of England are looking into it for a future launch.

RBI has been working on the idea of CBDC for years. Virtual currencies (VCs) like bitcoin have gained popularity in India in recent years and unofficial estimates suggest the country has around 15 million investors holding over 100 billion rupees ($1.34 billion) in crypto assets.

The RBI has repeatedly voiced its concern over the spread and use of cryptocurrencies which it sought to outlaw in April 2018. It had to withdraw the ban in March 2020 when the country's top court said the move was unconstitutional.

"CBDCs are desirable not just for the benefits they create in payments systems, but also might be necessary to protect the general public in an environment of volatile private VCs," Shankar said with regards to the need for CBDCs for emerging economies.

Sameer Narang, chief economist at Bank of Baroda said investors would still look to private digital currencies, which have appreciated in value despite recent falls.

"Some users may want to use the private digital currencies as store of value and not only for payments," he added.

($1 = 74.4080 Indian rupees)

Related Articles

Dollar set for second week of gains as focus turns to Fed By Reuters - Jul 23, 2021

Dollar set for second week of gains as focus turns to Fed By Reuters - Jul 23, 2021

By Ritvik Carvalho LONDON (Reuters) - The U.S. dollar was set for a second week of gains after a turbulent few days when currencies were buffeted by shifting risk appetite, with...

Fed Seen Speeding Taper of MBS in Early-2022 Start to Pullback By Bloomberg - Jul 23, 2021

Fed Seen Speeding Taper of MBS in Early-2022 Start to Pullback By Bloomberg - Jul 23, 2021

(Bloomberg) -- The Federal Reserve will start scaling back asset purchases next year with an emphasis on mortgage-backed securities, according to economists surveyed by Bloomberg,...

Dollar Edges Higher; Fed in Focus After ECB Turns More Dovish By Investing.com - Jul 23, 2021

Dollar Edges Higher; Fed in Focus After ECB Turns More Dovish By Investing.com - Jul 23, 2021

By Peter Nurse Investing.com - The dollar pushed higher in early European trading Friday, with attention turning to next week’s Federal Reserve meeting after the European Central...

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

July 24, 2021 at 12:30AM

Reuters

https://ift.tt/3wYhU9R

Labels: Forex News Investing.Com Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home