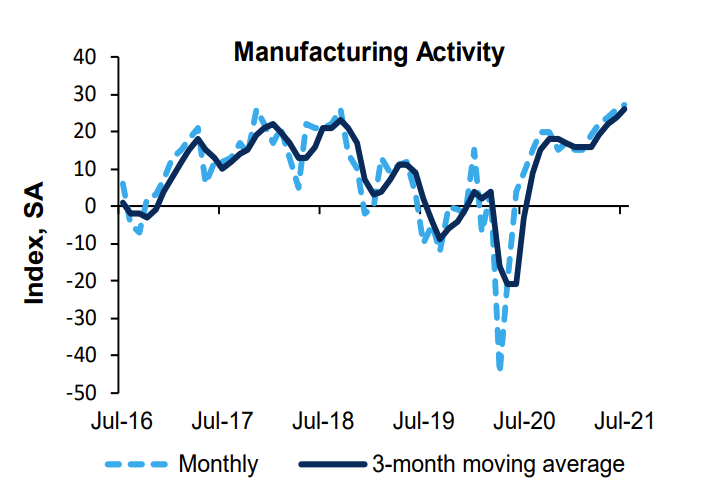

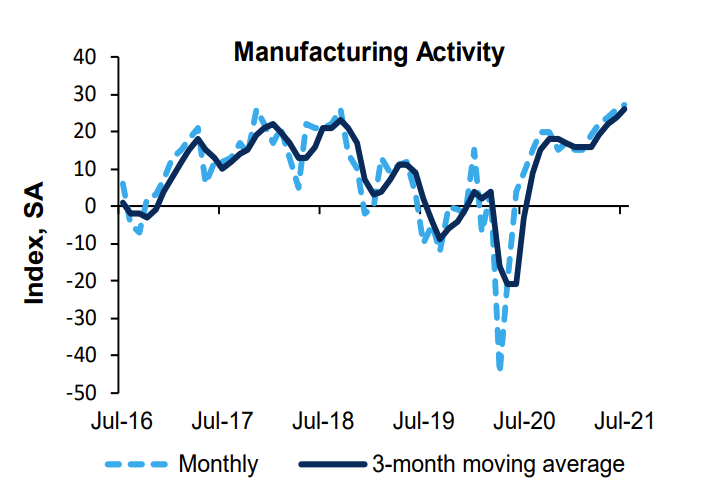

Richmond Fed manufacturing index for July 27 versus 20 estimate

Richmond Fed manufacturing index for July 27 versus 20 estimate

Richmond Fed manufacturing index 4 July 2021

- prior report was at 22 revised to 26

- Shipments 21 versus 15 last month

- New orders25 versus 36 last month

- Employees 36 versus 23 last month

- Wages 47 versus 40 last month

- Order backlog 25 versus 26 last month

- Capacity utilization 21 versus 11 last month

- Equipment and software 19 versus 18 last month

- Prices paid 11.16% versus 8.57% last month

- Prices received 6.93% versus 4.7% last month

- vendor leadtime 63 versus 63 laast month

- local business conditions 20 versus 25 last month

- capital expenditures 24 versus 17 last month

- finished goods inventories -21 versus -16 last month

- raw materials inventories -24 versus -14 last month

- services expenditures four versus 11 last month

- shipments 41 versus 46 last month

- new orders 30 versus 35 last month

- number of employees 53 versus 48 last month

- wages 60 versus 66 last month

- capacity utilization 20 versus 33 last month

- capital expenditures 44 versus 36 last month

- prices paid 5.63% versus 5.02% in June and 6.38% in May

- prices received 4.98% versus 4.57% in June and 4.2% in May

The increase in the index was supported by increases in the shipments and employment indexes. New orders-declined but remained in expansionary territory.

The indexes for inventories of raw materials and of finished goods declined, as both of these indexes hit record lows, and vendor lead times continued to lengthen.

Manufacturers were optimistic that business conditions would improve further in the coming months.

The price indices continue to remain high. Prices paid and prices received by survey participants increased in July to 11.16% and 6.93% respectively, as growth of prices paid continued to outpace that of prices received.

However the price indices are expected to move lower going forward with the price is paid at 5.63% in prices received expected to down toward 4.98%.

For the full report click here

Invest in yourself. See our forex education hub.

July 28, 2021 at 01:59AM

https://ift.tt/3x7fC8x

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home