: Stimulus checks helped American families to stay afloat — but for how long?

As families foundered in the pandemic’s early days, amid massive unemployment and economic uncertainty, the initial $2.2 trillion stimulus bill passed in late March 2020 kept their heads above water for almost four months.

That’s according to a new analysis from researchers at the Federal Reserve Bank of San Francisco.

The authors measured a household’s financial “resilience,” which was the number of weeks a household suddenly without employment income can keep its typical consumption rate with non-employment income and liquid assets like cash.

“We find that the CARES Act increased the median household’s ability to sustain its typical consumption expenditures by about 15 weeks,” they said.

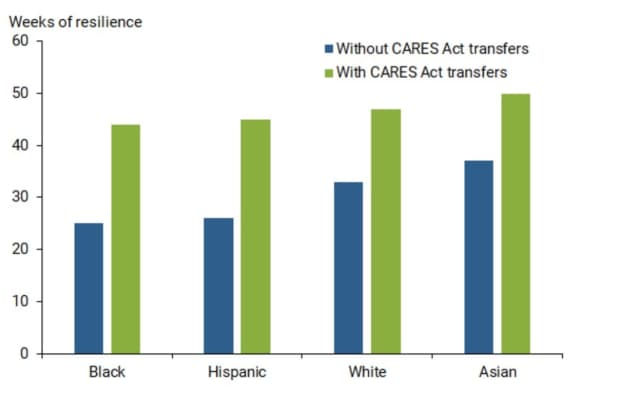

The stimulus package added a median 19 more weeks of resilience for Black and Hispanic households, the researchers noted, working off Census Bureau income data with a sample size over 10,500 households.

Chief driver

In all cases, the “chief driver” was the supplemental $600 weekly unemployment benefits that came on top of a state’s jobless benefits, the researchers said.

Median Household Resilience, graph courtesy Federal Reserve Bank of San Francisco

The $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act passed with bipartisan support and then-President Donald Trump signed it into law. The package authorized supplemental unemployment benefits through July 2020, $1,200 stimulus checks and potentially forgivable loans to small businesses.

The CARES Act’s recurring jobless benefits “supported household resilience to a much greater extent” than the one-time direct checks, the researchers said.

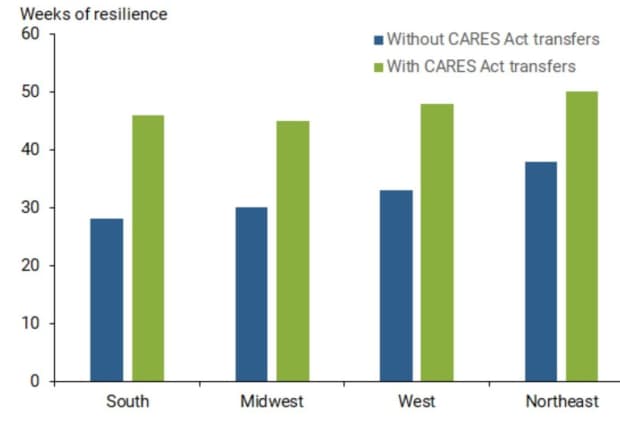

Median Household Resilience by Geographic Area, graph courtesy Federal Reserve Bank of San Francisco

Following the CARES Act, lawmakers passed another $900 billion stimulus package in late December. After Joe Biden became president, lawmakers passed a third relief package in March 2021, the $1.9 trillion American Rescue Plan. The most recent package authorized $300 weekly jobless benefits through early September.

“ The retrospective look at the CARES Act’s personal-finance effects comes as lawmakers now debate more large-scale federal government spending, this time for projects like infrastructure. ”

The retrospective look at the CARES Act’s personal-finance effects comes as lawmakers now debate more large-scale federal government spending, this time for projects like infrastructure.

It also comes in a labor market landscape that looks a lot different from early 2020.

Job openings in May climbed to a record 9.21 million. Economists say the labor shortage may be attributed to a mix of factors, like the jobless benefits sidelining would-be workers and a lack of childcare options. Fear of getting COVID-19 is the top reason jobless workers are hesitant to join the workforce, according to one recent survey.

The new Federal Reserve Bank of San Francisco’s analysis looked at financial resilience, but previous research has dug into the psychological effects of the cash assistance from the stimulus bills.

There was a 20% drop in people reporting frequent symptoms of depression and anxiety following passage of the $900 billion stimulus bill and the $1.9 American Rescue Plan, according to University of Michigan researchers tracking Census data.

“The sharpest declines in hardship immediately followed the passage of these two relief bills,” the researchers wrote.

July 08, 2021 at 05:50AM

Andrew Keshner

http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7502-F26D463F664E%7D&siteid=rss&rss=1

Labels: Top Stories

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home