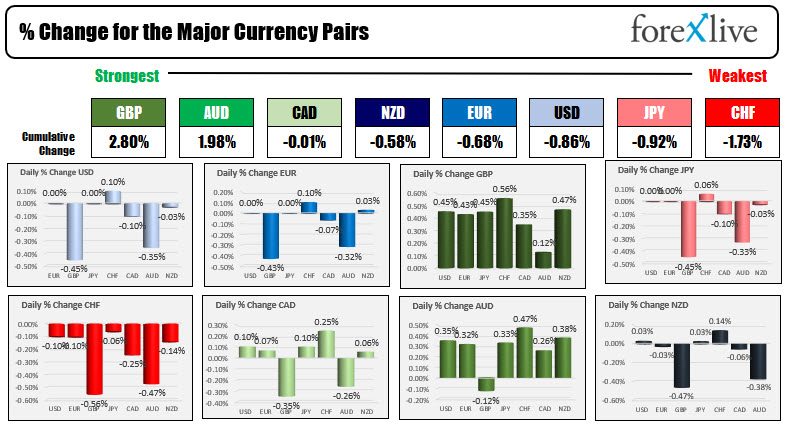

The GBP is the strongest and the CHF is the weakest as NA traders enter for the day

The USD is modestly lower/mixed. The EUR is also modestly lower in the morning snapshot after the ECB decision

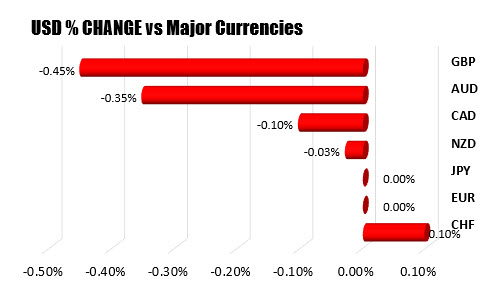

Looking more specifically at the US dollar, the pair is down -0.45% versus the GBP in the morning snapshot and unchanged vs the EUR (although it is now lower as I type). The greenback is also unchanged verse the JPY in down and up trading today. For the USDJPY, the pair bounced off the 200 hour MA near 110.043 and currently trades at 110.22. Versus the GBPUSD the pair has trended more to the upside but is testing it's 200 hour MA at 1.37708 and stalling a bit over the last few hours of trading.

In other markets:

In other markets:

- Spot gold is trading down $-9.05 or -0.51% at $1794.30.

- Spot silver is down $0.19 or -0.75% $25.03

- WTI crude oil futures remain above the $70 level at $70.77. That is up about $0.50 on the day

- Bitcoin is trading at $31,877 down marginally on the day. The high price reached $32,380. The low price extended to $31,690 in a relatively quiet and contained market.

In the premarket for US stocks, the futures are implying a modestly higher open. The major indices have been up for two consecutive days. The S&P and NASDAQ are less than 1% off their highs

- Dow Jones is up 24 points. Yesterday the Dow industrial average increase by 285.75 points

- NASDAQ index is up 22 points. Yesterday the NASDAQ index rose by 133.08 points

- S&P index is up 3.2 points. Yesterday the S&P rose by 35.59 points

In the European equity markets, the major indices are up for the third consecutive day:

- German DAX, +0.9%

- France's CAC, +0.8%

- UK's FTSE 100, +0.1%

- Spain's Ibex, +1.2%

- Italy's FTSE MIB, +1.0%

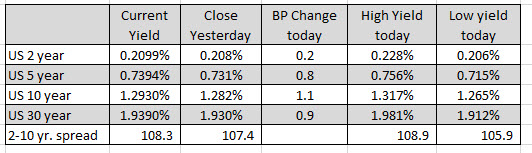

In the US debt market, yields are marginally higher with the 10 year up to 1.293% currently. The yield for that benchmark tenor did reach a overnight high of 1.317%. The 10 year yield traded as low as 1.129% earlier this week, before bouncing higher.

The 2-10 year yield spread increase by about one basis point to 108.3 from 107.4 at the close yesterday. It traded below 100 basis points earlier this week.

July 23, 2021 at 12:16AM

Greg Michalowski

https://ift.tt/3BwfDWQ

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home