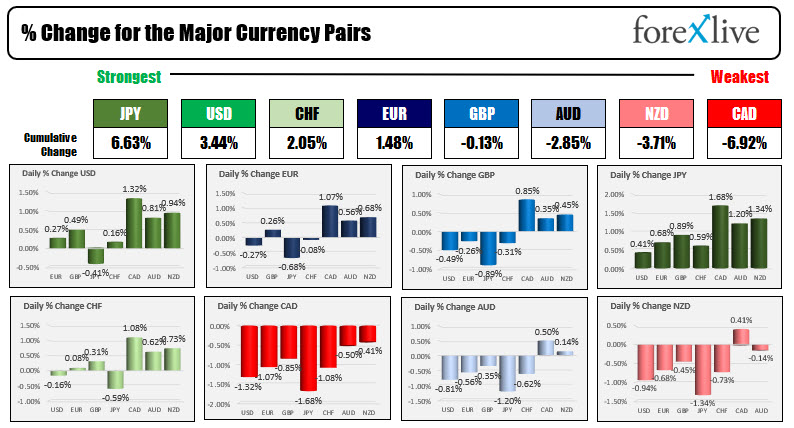

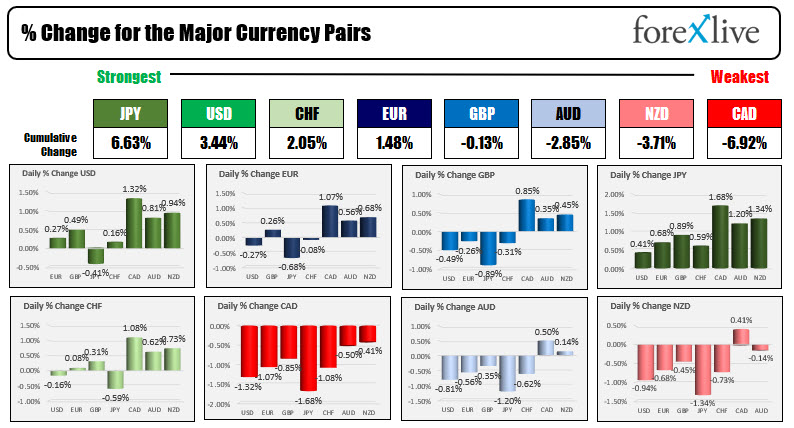

The JPY is the strongest and the CAD is the weakest as the NA session begins.

The USD is stronger as flight to safety flows dominate

The week is getting off to a weak start as Covid fears grip the markets. Cases are rising and that is prompting fears of slower economic growth. Airlines are lower (including Boeing). Energy stocks are lower. The Dow is down 500 points. The Nasdaq is down -133 points.

Overall, in addition to the stock markets moving lower, yields are lower, crude oil is lower, the USD is higher as flows of funds run to safety of the treasuries and the relative safety of the JPY and the USD and out of stocks and crude. The JPY and the USD are the strongest of the major currencies today, the CAD, NZD and AUD are the weakest.

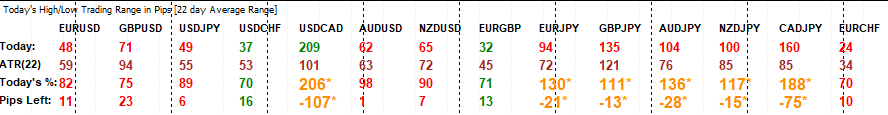

The USDCAD (and CAD pairs) have been running with the low to high trading range over 200 pips. That is twice the normal range helped by tumbling oil prices. The AUDUSD and NZDUSD have trading ranges near their 22 day averages at the start of the NA session as they trend lower (risk off flows in those pairs too).

- Spot gold is down $-11.58 or -0.64% at $1799.26.

- Spot silver is down $0.50 or -1.91% at $25.20

- WTI crude oil futures are trading down $2.71 or -3.77% at $69.10

- bitcoin is trading at $31,340. The low for the day reached $31,172 a high for the day was up at $31,923. As a point of reference, the price low in June reach $28,600. The low last week reached $31,012

In the US stock market:

- Dow -500 points or -1.5% . On Friday the Dow lost -299.17 points

- S&P index -50.66 points or -1.2%. The S&P index fell by -32.87 points on Friday.

- NASDAQ index -133 points or -1.04%. The NASDAQ index fell by -115.9 points on Friday

In the European equity markets, the major indices are also lower:

- German DAX, -2.6%

- Frances CAC, -2.55%

- UK's FTSE 100, -2.3%

- Spain's Ibex, -2.61%

- Italy's FTSE MIB, -3.46%

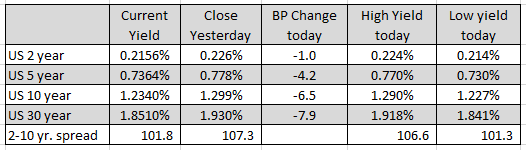

In the US debt market, the 10 year yield is down -6.5 basis points. The 30 year yield is down -7.9 basis points. The two – 10 year spread is down to just over 100 basis points at 101.8 basis points from 107.3 basis points at the close on Friday

July 20, 2021 at 12:15AM

https://ift.tt/2Ur3yl1

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home