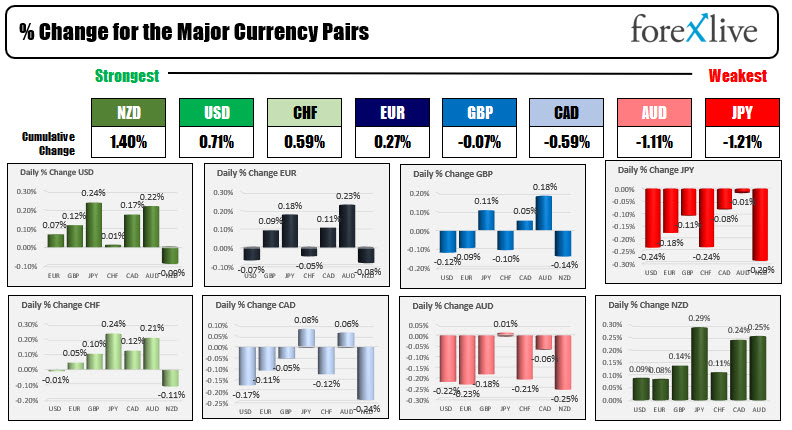

The NZD is the strongest and the JPY is the weakest as NA traders enter for the day

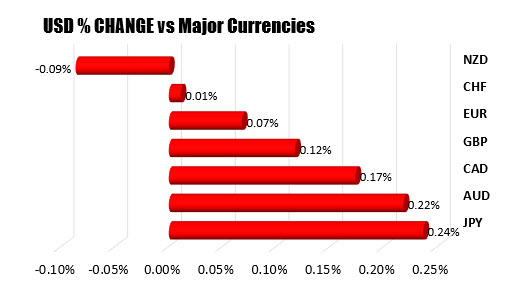

The USD is modestly higher vs most currencies

As the North American session begins, the NZD is the strongest and the JPY is the weakest. US mortgage applications -4% versus +16% last week. The economic calendar is late with Canada new house price index for June expected at 8:30 AM. US weekly inventory will data will be released at 10:30 AM. Last week the crude inventories fell -7.89 million barrels. The private data released toward the end of the New York session yesterday showed a surprise build of +0.806 million barrels.

The USD is modestly stronger vs most currencies (it is unchanged vs the CHF and lower vs the NZD to start the day). The greenback is the strongest vs the JPY (+0.24%). US stocks are mixed in pre-market trading with the Dow higher and the Nasdaq lower (Netflix earnings and guidance disappointed). The S&P is near unchanged. US yields are higher. European shares are higher ahead of the ECB meeting on Thursday.

In other markets as American traders enter for the day

In other markets as American traders enter for the day- Spot gold is trading down around $12.50 or -0.7% at $1790.75. The high price extended to $1814.35. The low fell to $1790.25

- Spot silver is trading up eight cents or 0.33% at $25.08

- WTI crude oil futures are trading up $1.83 at $68.22. The rise is despite a surprise build inventories of 0.806 million versus expectations of a -4.5 million drawdown from the private data late yesterday.

In the premarket for US stocks, the Dow is leading the way higher while the NASDAQ likes the S&P is near unchanged:

- Dow industrial average is up 84 points after yesterday's rebound of 550 points. On Monday the Dow lost over 700 points

- S&P index futures are implying a 3.69 point advance after yesterday's 64.72 point gain

- NASDAQ index is down -36.21 points after yesterday's a surge of 223.90 points erased the Monday declines

- German DAX, +0.5%

- France's CAC, +1.0%

- UK's FTSE 100, +1.4%

- Spain's Ibex, +1.5%

- Italy's FTSE MIB, +1.3%

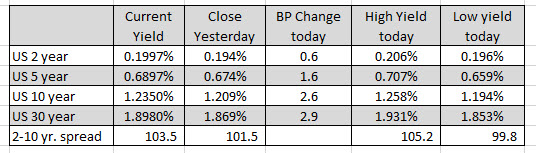

in the US debt market, the yields are higher with the tenure up about 2.6 basis points and the 30 year up 2.9 basis points leading the way. The two – 10 year spread has risen to basis .2 103.5 from 101.5. The 10 year yield yesterday moved down to a cycle low going back to February of 1.12%.

July 22, 2021 at 12:10AM

Greg Michalowski

https://ift.tt/3kTXqgj

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home