Canadian dollar seen higher as BoC tightening cycle comes into view: Reuters poll

Canadian dollar seen higher as BoC tightening cycle comes into view: Reuters poll

Forex 1 hour ago (Aug 05, 2021 08:13AM ET)

Forex 1 hour ago (Aug 05, 2021 08:13AM ET)

© Reuters. FILE PHOTO: A Canadian dollar coin, commonly known as the "Loonie", is pictured in this illustration picture taken in Toronto January 23, 2015. REUTERS/Mark Blinch/File Photo

© Reuters. FILE PHOTO: A Canadian dollar coin, commonly known as the "Loonie", is pictured in this illustration picture taken in Toronto January 23, 2015. REUTERS/Mark Blinch/File Photo

By Fergal Smith

TORONTO (Reuters) - Forecasts for the Canadian dollar were raised in the latest Reuters poll as analysts expect the Bank of Canada to begin interest rate hikes before the Federal Reserve, alongside a high rate of COVID-19 vaccinations, to support the domestic economy.

The median forecast of more than 30 strategists in an Aug. 2-4 Reuters poll was for the Canadian dollar to strengthen around 2.4% in three months to 1.2250 per U.S. dollar, or 81.63 U.S. cents.

The unit, nicknamed the loonie , was then expected to rise further to 1.21 in a year's time, compared with a forecast of 1.22 in July's poll.

"We look for the loonie to rise a bit over the coming year," said Greg Anderson, global head of foreign exchange strategy at BMO Capital Markets in New York. "The BoC will likely be beginning to prep markets for its first rate hike at about this time next year, while the Fed will be trailing behind."

Canada's central bank last month cut its weekly net purchases of Canadian government bonds to a target of C$2 billion from C$3 billion and maintained guidance for the first rate hike to come as soon as the second half of 2022.

The Fed's latest guidance for liftoff is 2023.

The Canadian dollar has gained more than 1.5% this year, lagging only the British pound among G10 currencies. In June, the loonie notched a six-year high near 1.20.

Improvement in Canada's current account balance has added to the positive outlook for the loonie, with foreign exchange flows moving more in favor of the currency, Anderson said.

Canada posted its first quarterly current account surplus since 2008 at the start of the year as prices rose for some major exports, including oil.

Oil touched a near seven-year high around $77 a barrel in July but has since been pressured by a more uncertain outlook for demand as the Delta variant of the coronavirus spreads in some major economies, including the United States.

The variant has reached Canada but a high rate of inoculation could reduce the risk of wide-ranging economic restrictions. About 72% of Canada's population has received at least one dose of a vaccine and 60% has been fully vaccinated, a Reuters tally shows.

Canada is "a clear leader on the vaccine front," said Erik Nelson, a currency strategist at Wells Fargo (NYSE: WFC ), adding this could raise Canada's growth prospects compared with the United States, boosting the Canadian dollar.

(Reporting and polling by Fergal Smith; Editing by David Holmes)

Related Articles

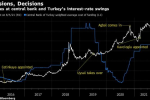

Lira Bears Awaken as Erdogan Renews Calls for Turkish Rate Cut By Bloomberg - Aug 05, 2021

Lira Bears Awaken as Erdogan Renews Calls for Turkish Rate Cut By Bloomberg - Aug 05, 2021

(Bloomberg) -- Three days was all it took to wipe out about half the Turkish lira’s gains since June. The decline was compounded by President Recep Tayyip Erdogan’s latest call for...

Dollar holds gains after Fed comments, sterling ticks up after BoE By Reuters - Aug 05, 2021

Dollar holds gains after Fed comments, sterling ticks up after BoE By Reuters - Aug 05, 2021

By Ritvik Carvalho and Wayne Cole LONDON (Reuters) - The dollar held gains against a basket of currencies on Thursday after hawkish comments from the U.S. Federal Reserve led...

Crown, forint expected to firm as interest rates rise: Reuters poll By Reuters - Aug 05, 2021

Crown, forint expected to firm as interest rates rise: Reuters poll By Reuters - Aug 05, 2021

By Miroslava Krufova and Krisztina Than BUDAPEST (Reuters) - The Czech crown and the Hungarian forint will extend gains in the coming year as their central banks hike rates to...

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

August 06, 2021 at 12:13AM

Reuters

https://ift.tt/2Vqd60i

Labels: Forex News Investing.Com Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home