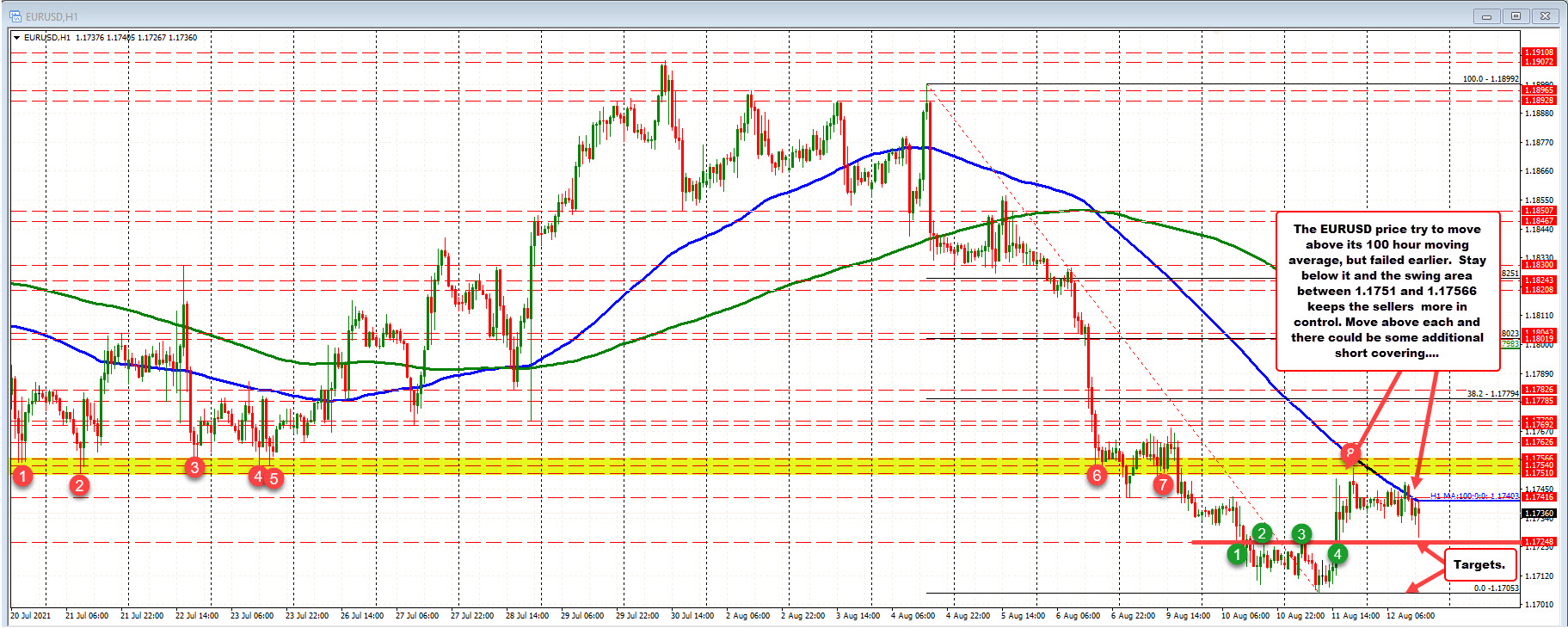

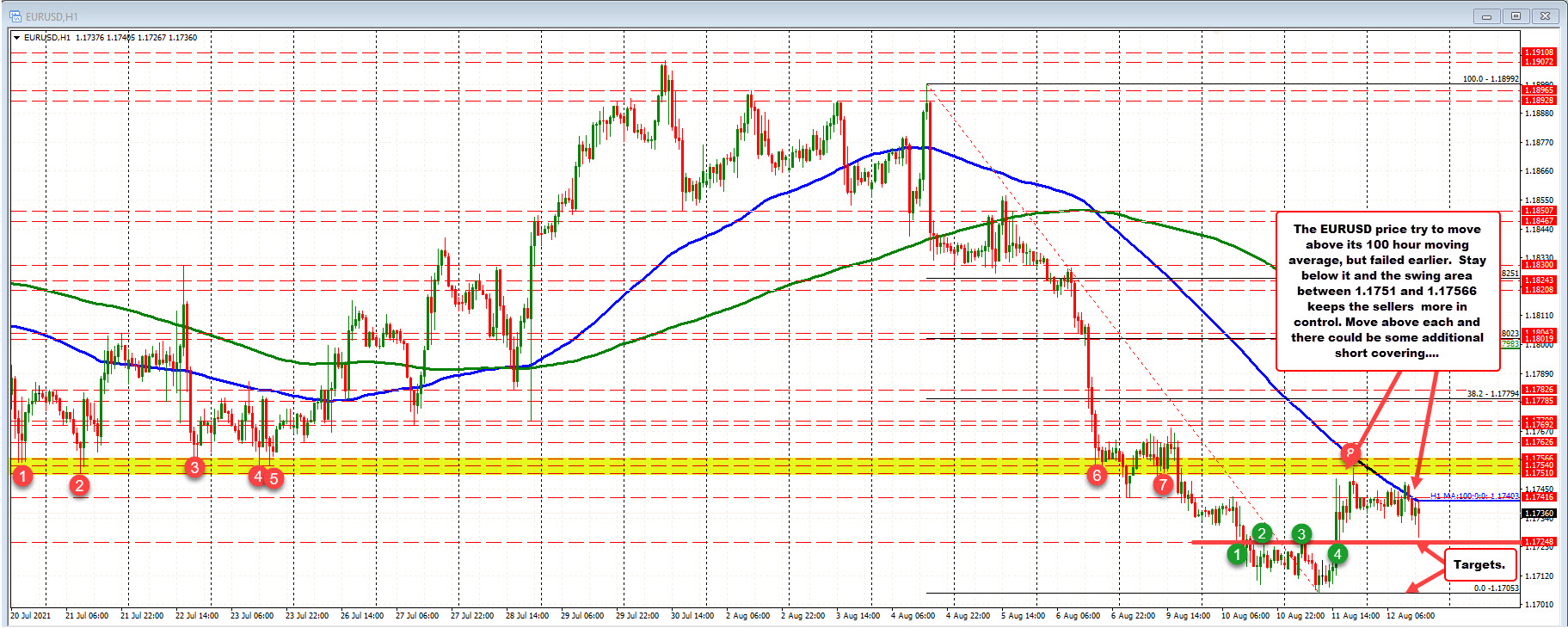

EURUSD extends the range after PPI but not by much

The range is a small 21 pips so far

The EURUSD made a new low after the US PPI and claims data. That's the exciting news. The not so exciting news is that the range was extended to 21 pips for the DAY (it was 16 pips). The average is 51 pips over the last month as summer doldrums keep the trading ranges confined.

The good news is there is room to roam. If the average is met, there are 30 pips to go.

The pair has a more bearish bias:

- The price tried to move above the falling 100 hour MA (closed one bar above), but that momentum could not be sustained and the price has stayed below the falling line over the last 3 hourly bars.

- The high today stalled below a swing area above between 1.1751 to 1.17566 (see yellow area and red numbered circles). Stay below is more bearish

Although the technicals still point to the downside on the hourly chart, there is work to do. The 1.17248 has developed as a swing area from Tuesdays and Wednesdays trade (see green numbered circles). The price needs to get below that level to increase the bearish bias and have traders targeting the low from yesterday at 1.17053 and the low from 2021 at 1.17035.

August 13, 2021 at 12:55AM

Greg Michalowski

https://ift.tt/3yHhy9n

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home