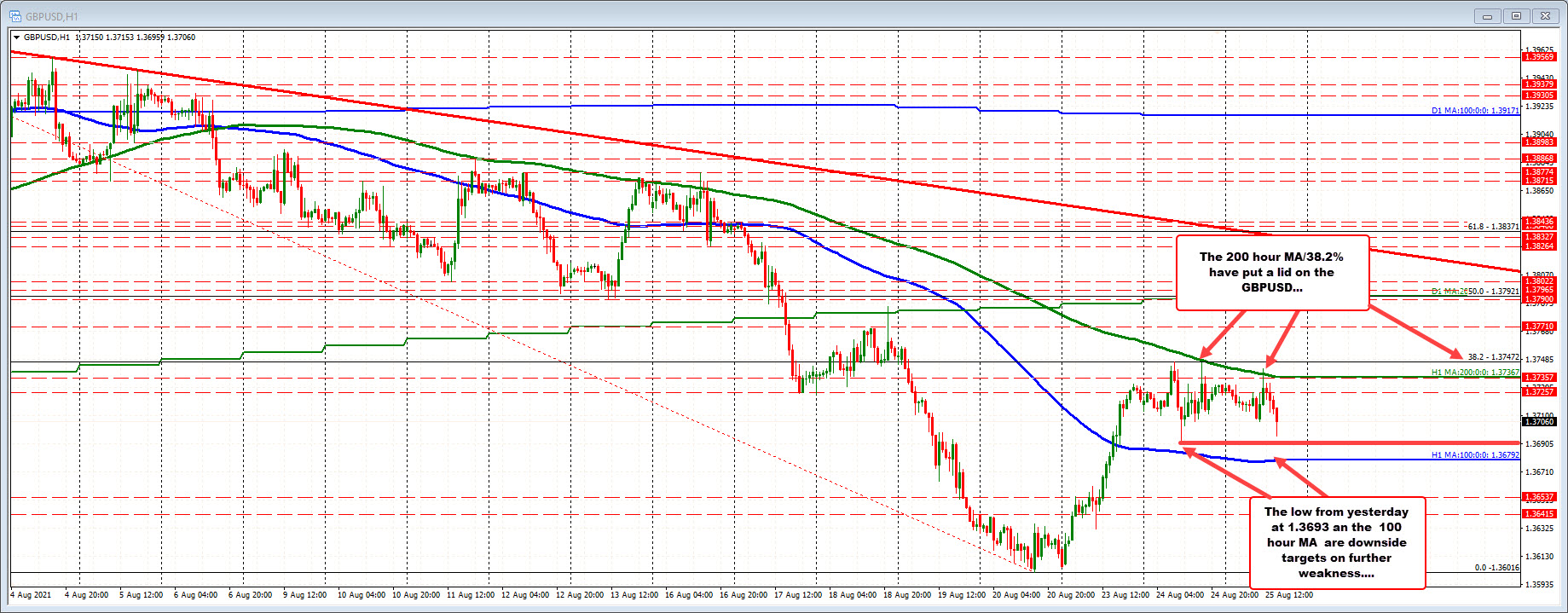

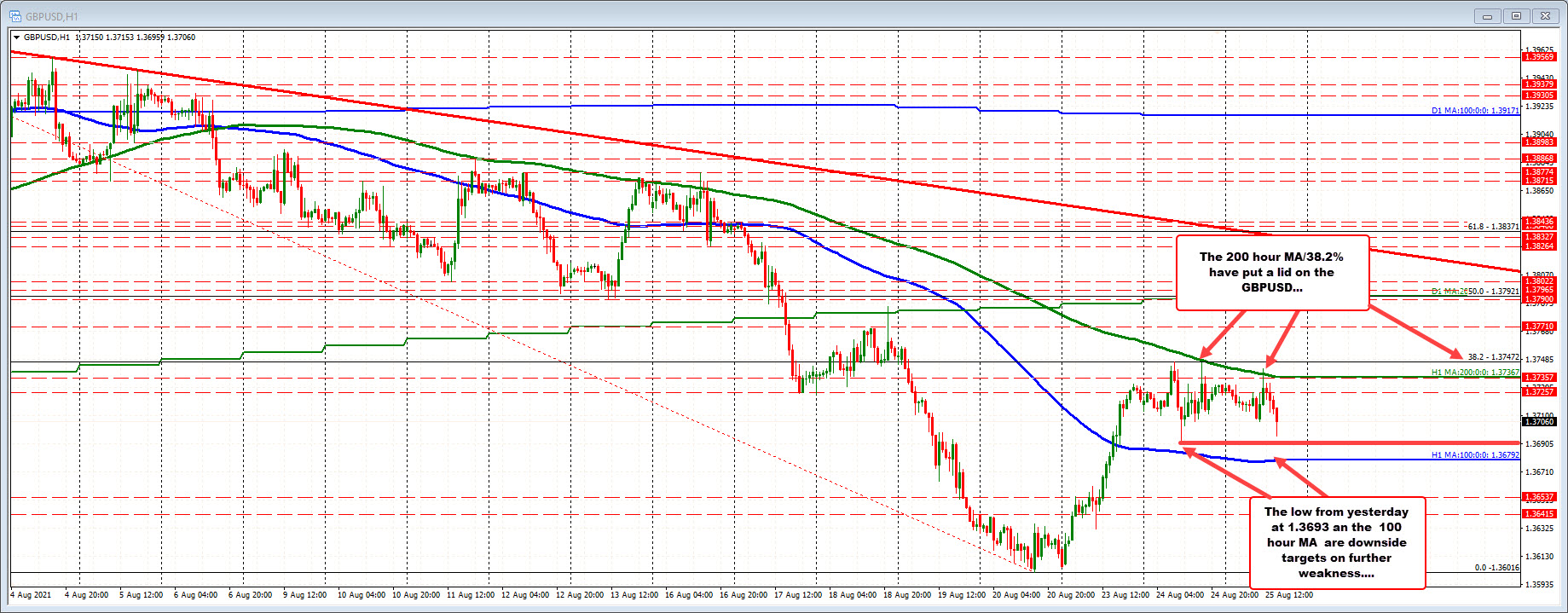

GBPUSD stays/trades within hourly moving averages. The sellers hold the strongest hand

200 hour MA at 1.37367. 100 hour MA at 1.36792.

The GBPUSD is another currency pair (like the EURUSD) which has seen up and down price action.

For this pair, yesterday the price found sellers at the 200 hour MA/38.2% (of move down from July 30 high) at 1.37472.

Today, the 200 hour MA drifted lower and it was breached at 1.37385 making an intraday high at 1.3742, but the break did not last long (traded above and below that MA for 10-15 minutes before giving up and moving lower). It also stayed below the 38.2% at 1.37472.

Sellers have taken more control and are now pushing the price to a new session low and extending the trading range for the day to 46 pips (so far). The 22 day average (around a month of trading days) is at 77 pips.

The next downside target comes in at the low from yesterday held 1.3693. Below that is the sideways 100 hour moving average 1.36792. Move below the 100 hour moving average increases the bearish bias even more.

Overall, the GBPUSD has been trending more to the downside since July 30 high at 1.39827. The low price from last Friday and Monday took the price down to test the 1.360 0 level (-381 pips). The correction higher since then stalled right at the 38.2% and 200 hour moving average. Getting above those levels is the minimum if the buyers are to take more control. They could not do it. The sellers still hold the strongest hand as a result with the 100 hour MA the next card to be played.

August 26, 2021 at 01:02AM

Greg Michalowski

https://ift.tt/3sJWgFZ

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home