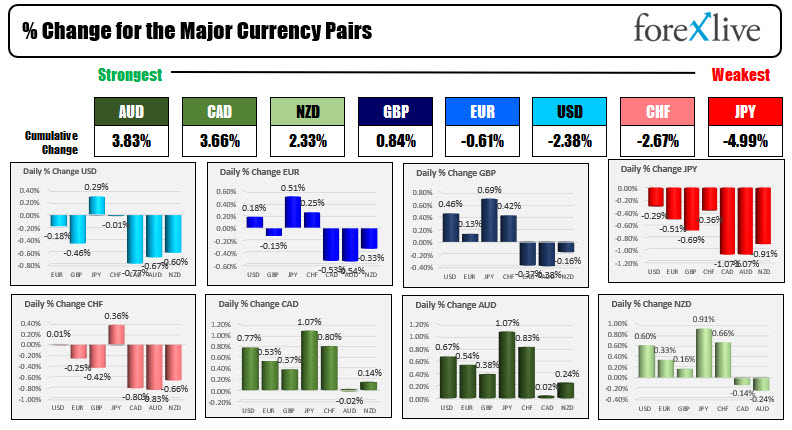

The AUD is the strongest and the JPY is the weakest as the NA traders enter for the day

The AUD is the strongest and the JPY is the weakest as the NA traders enter for the day

The USD is mostly lower

As the North American session begins, the AUD is the strongest and the JPY is the weakest. There is a better tone today which has the flows reversed from most of the price action last week, with the commodity currencies moving higher today, while the safe haven currencies (JPY, CHF and USD) are being hit. The Euro area PMIs were a mixed but they do remain comfortably above the 50 levels (indicative of growth). The US flash PMIs will be released by Markit at 9:45 AM ET/1345 GMT with modest dips from last months expected (62.4 vs 63.4 in manufacturing and 59.1 vs 59.9 in services). US existing home sales will also be released today. Stocks are higher in Europe and in pre-market for the US. Yields are higher in the US/lower in Europe. Jackson Hole is now a one days virtual summit that will take place on Friday. The schedule will be released at 8 AM ET on Thursday. Chair Powell is the highlighted speaker. Given the Kaplan's comments on Friday which were less hawkish, it takes some of the pressure off of chair Powell to announce a taper schedule (you kind of wonder if it was planned that way i.e. Kaplan takes one for the team).

In other markets:

- Spot gold is trading up $11 or 0.64% at $1792.

- Spot silver is trading at $0.45 or 1.96% at $23.45

- WTI crude oil futures are trading $2.19 or 3.54% at $64.11

- the price of bitcoin has moved back above the $50,000 level. It is currently trading at $50,355, not far off the high for the day $50,562.

- Dow +163 points after Friday's gains of around 226 points

- S&P index, +15 points after Friday's 23 point gain

- NASDAQ index +43 points after Friday's 173 point surge

in the European equity markets, the major indices are also higher:

- German DAX, +0.2%

- France's CAC, +0.85%

- Italy's FTSE MIB +0.4%

- Spain's Ibex, +0.5%

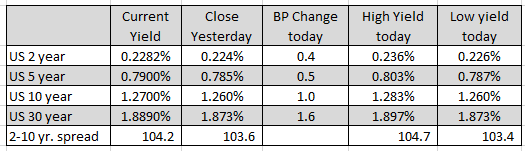

In the US debt market, the yields are modestly higher with the yield curve steepening modestly:

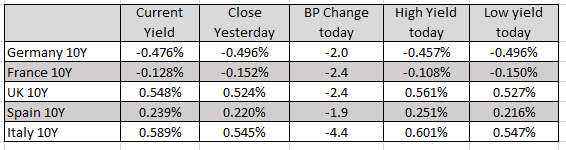

in the European debt market, the benchmark 10 year yields are trading lower with the 1010 year down -4.4 basis points and the UK and France 10 year down -2.4 basis points each.

Invest in yourself. See our forex education hub.

August 24, 2021 at 12:24AM

Greg Michalowski

https://ift.tt/2WasuOU

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home