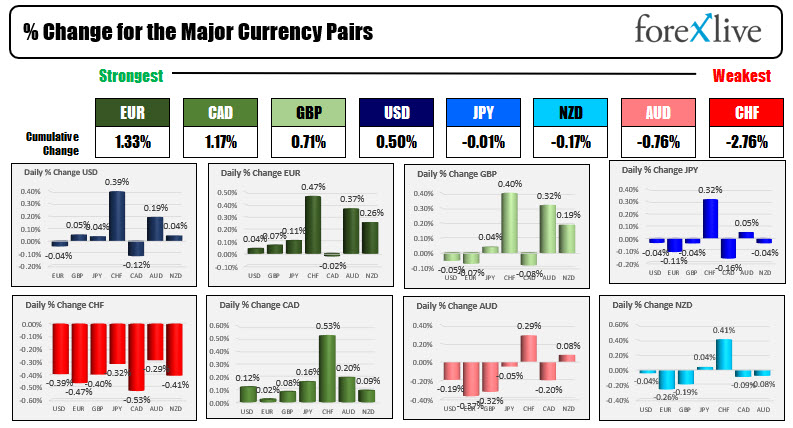

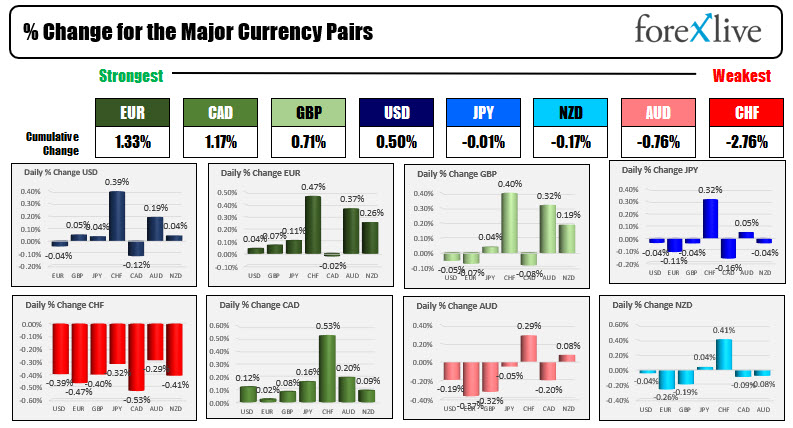

The EUR is the strongest and the CHF is the weakest as NA session begins

The USD is mixed with modest gains and losses

As the North American session begins, the EUR is the strongest and the CHF is the weakest The USD is mixed after the tumble on Friday on the back of a less hawkish/more dovish comments from Fed Chair Powell at the Jackson Hole virtual summit. The USD is stronger vs the CHF (+0.39%) and NZD (+0.19%), and lower vs the CAD (-0.12%). The greenback is little changed vs the EUR, GBP, JPY and NZD (0.05% or less change). Hurricane Ida is now a tropical storm but in addition to human tragedy, will disrupt business and commerce in the region and along the Mississippi River. London traders are off for a bank holiday. The economic calendar is empty today.

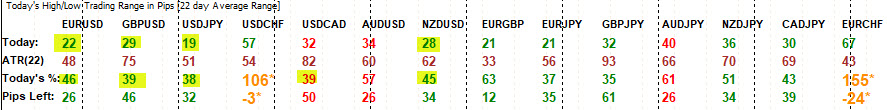

Looking at some of the major high to low ranges versus the US dollar, there are four of the 7 major pairs with less than 30 pips (the USDJPY only has a 19 pip trading range). Looking at the percentage of the ranges versus what is normal over the last month of trading five of the seven had ranges less than 50% of what is normal.

In other markets:

- Spot gold is trading near unchanged at $1816.49.

- Spot silver is up $0.17 or 0.67% $24.16.

- WTI crude oil futures are down $-0.12 or -0.17% at $68.62

- Bitcoin is trading down around one thousand dollars and $47,819

In the premarket for US stocks, the futures are implying a modestly higher opening after Friday's moves higher that saw the S&P and NASDAQ index closed at record levels:

- Dow +33 points after Friday's 242.68 point rise

- S&P up 5.6 points after Friday's 39.37 point rise

- NASDAQ index +21 points after Friday's 183 point rise

- German DAX +0.15%

- France's CAC, +0.15%

- UK's FTSE 100, +0.3%

- Spain's Ibex, -0.2%

- Italy's FTSE MIB unchanged

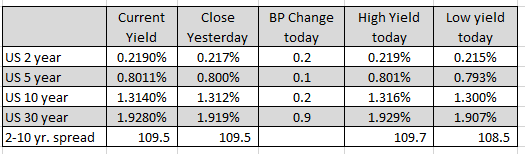

In the US debt market, the yields are mostly higher after the declines on Friday. The tenure yield is trading at 1.314% up 0.2 basis point.

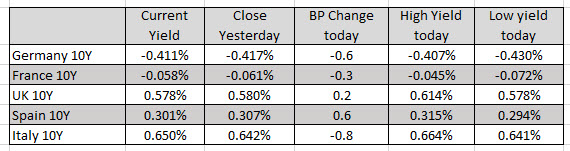

In the European debt market, the benchmark 10 year yields are mixed with UK and Spain yields up modestly and German, France, Italy yields down modestly.

In the European debt market, the benchmark 10 year yields are mixed with UK and Spain yields up modestly and German, France, Italy yields down modestly.

August 31, 2021 at 12:13AM

https://ift.tt/3ztsAPH

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home