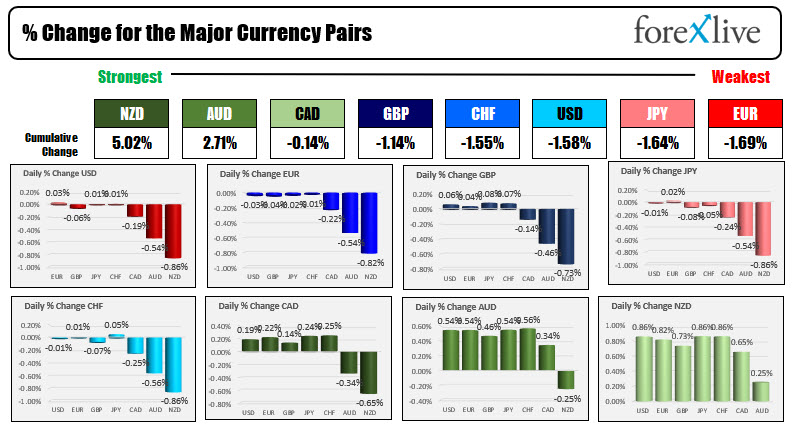

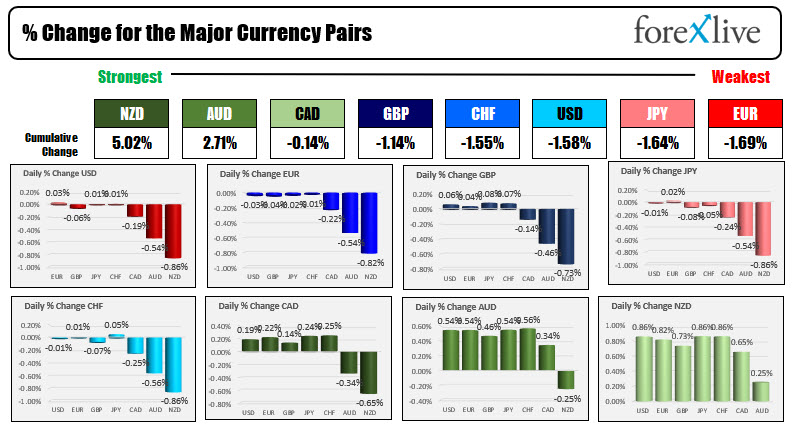

The NZD is the strongest and the EUR is the weakest as NA trading begins

The USD is weaker as risk on flows dominate

The NZD is the strongest and the EUR is the weakest as North American trading begins. The NZD was boosted by risk on flows helped by surging China stocks which had their best day in a year. The Hang Seng index rose by 2.46% while the Tech index surged 5.3%. Retail sales in New Zealand were stronger than expected which also helped to push up their currency as well. The moves higher helped to drag up the AUD as well, while the flow of funds saw moves out of the EUR, JPY, USD and CHF at relatively the same pace (actually all the changes are vs the the NZD, AUD and CAD. The Nasdaq closed at a record level yesterday, and the S&P moved to a new intraday record but closed below the highest closing level (although it was still higher). Rated are up modestly. The US new home sales will be released (698K est). The Existing home sales yesterday were stronger than expected at 5.99M vs 5.82M expected. The Richmond Fed index will be released as well (25 to 27 last). The US House of Reps is struggling with the budget battle.

Looking around the other markets:

Looking around the other markets:

- Spot gold is down $0.83 -0.05% at $1803.95.

- Spot silver is up $0.16 or 0.70% at $23.74.

- WTI crude oil futures are up $1.04 or 1.58% at $66.50

- the price of bitcoin is down $-291 at $49,269.93

in the premarket for US stocks, the major indices are higher after the record closing the NASDAQ index yesterday:

- Dow futures implying a gain of 58 points

- NASDAQ futures implying a gain of 20 points after yesterday's 228 point

- S&P futures implying a gain of five points

in the European equity markets, the major indices are mixed:

- German DAX +0.3%

- France's CAC -0.5%

- UK's FTSE 100 -0.3%

- Spain's Ibex -0.6%

- Italy's FTSE MIB -0.3%

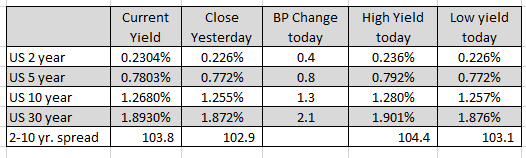

in the US debt market, the yields are higher with a steeper yield curve. The 10 year yield is up 1.3 basis points. The 30 years up 2.1 basis points, but both are still comfortably in their range.

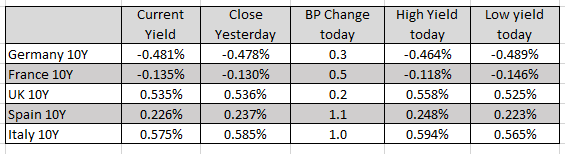

In the European debt market, the benchmark 10 year yields are marginally higher.

In the European debt market, the benchmark 10 year yields are marginally higher.

August 25, 2021 at 12:16AM

Greg Michalowski

https://ift.tt/2WoKJjr

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home