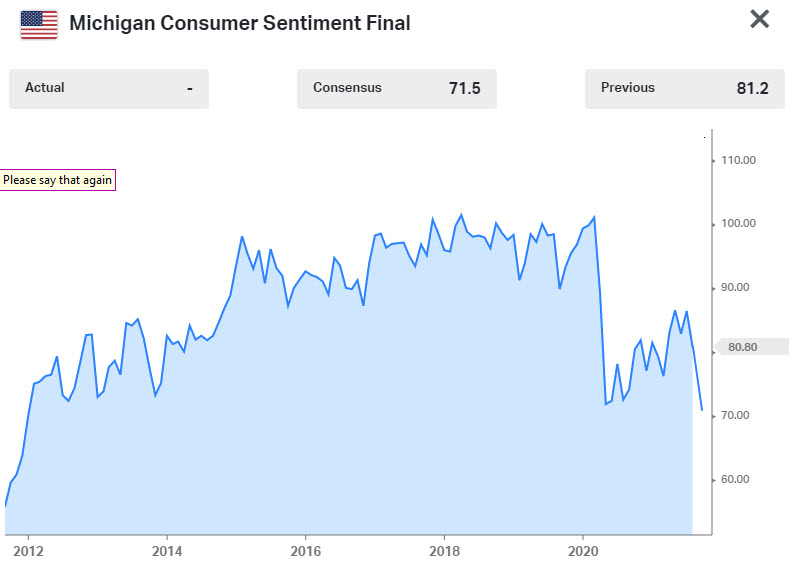

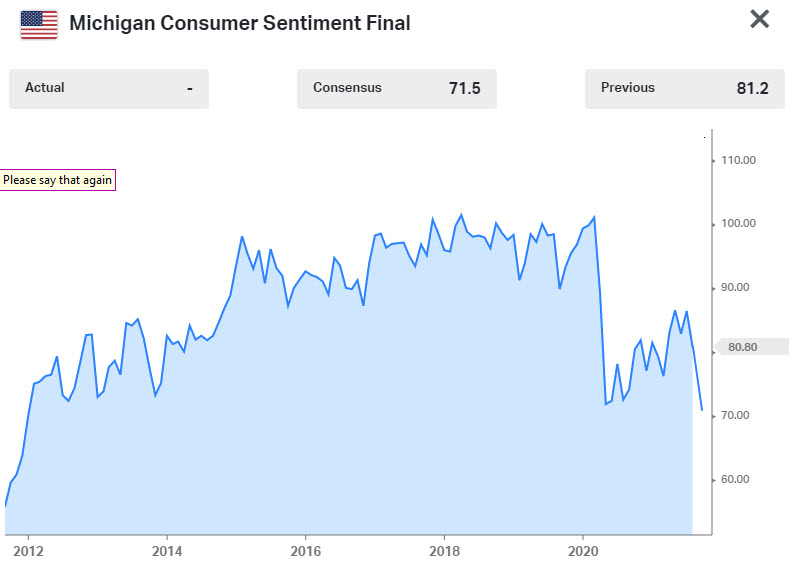

University of Michigan August consumer sentiment 70.3 versus 70.9 estimate

Revised August University of Michigan consumer sentiment index

- Preliminary report came in at 70.2.

- Current conditions 78.5 versus 77.9 preliminary (was 84.5 last month)

- expectations 65.1 versus 65.2 preliminary (was 79.0 last month)

- one year inflation 4.6% versus 4.6% preliminary (was 4.7 last month)

- 5– 10 year inflation 2.9% versus 3.0 preliminary (was 2.8% last month

Recall, the preliminary consumer sentiment index tumbled to 70.2 versus 81.2 expected/prior to the lowest level since 2011.

The report suggests that the collapse does not imply an imminent downturn in the economy citing a similar fall in 2005:

The August collapse of confidence does not imply an imminent downturn in the economy. There was a similar episode which occurred in September 2005, with comparable declines in the Sentiment Index (13.7% in 2005 vs. 13.4% in 2021). The cause of the steep falloff in 2005 was the devastation from hurricane Katrina and rising energy prices. The impact of 9/11 was another non-economic event that had an immediate impact on consumers' expectations and emotions. Although economic expectations began to improve by year-end, the emotional impact on spending patterns lasted for a much longer time. That same type of persistent impact on spending patterns is now likely to reoccur.

August 28, 2021 at 02:00AM

Greg Michalowski

https://ift.tt/3zpqrVh

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home