USD/CHF Weekly Outlook

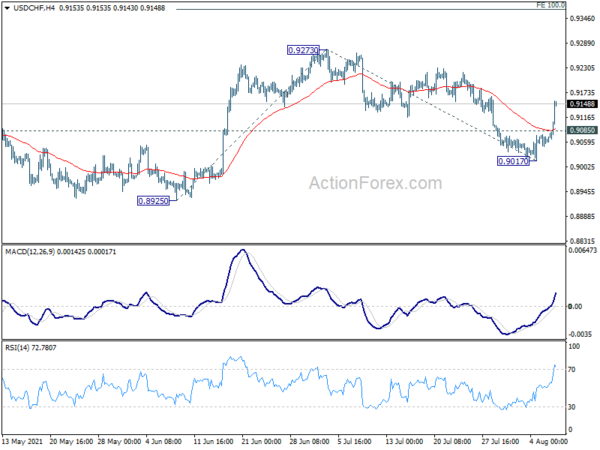

USD/CHF’s strong rebound last week suggests that pull back from 0.9273 has completed with three waves down to 0.9017. Initial bias is back on the upside for 0.9273 resistance first. Break there will resume rise form 0.8925 to 100% projection of 0.8925 to 0.9273 from 0.9017 at 0.9365. On the downside, below 0.9085 minor support will turn bias back to the downside for 0.9017 support instead.

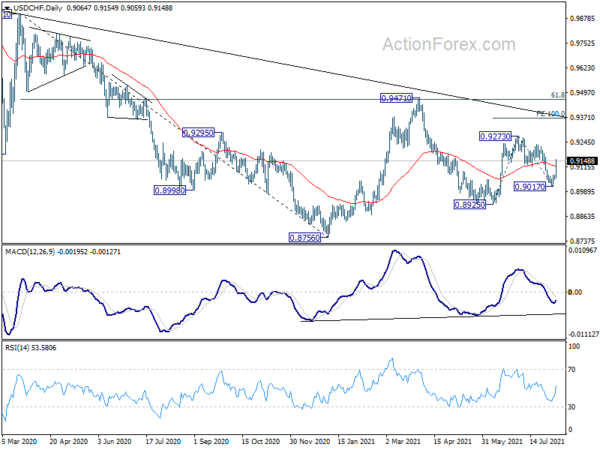

In the bigger picture, the failure to sustain above 55 week EMA (now at 0.9183) retains medium term bearish in USD/CHF. Break of 0.8925 support should resume the whole decline form 1.0342 (2016 high) through 0.8756 low. However, break of 0.9273 resistance and sustained trading above 55 week EMA will be an early sign of bullish trend reversal. Focus will then turn to 0.9471 resistance for confirmation.

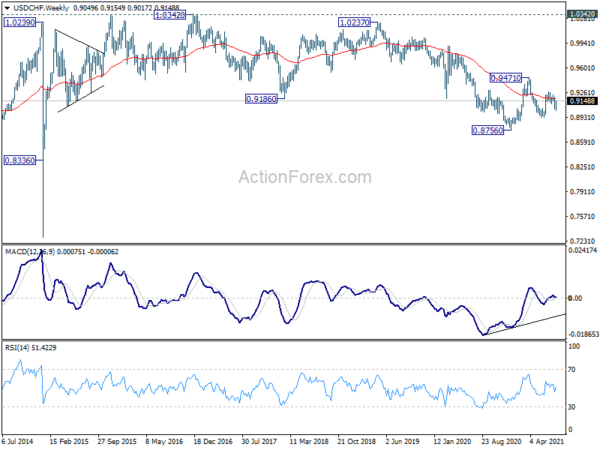

In the long term picture, price actions from 0.7065 (2011 low) are currently seen as developing into a long term corrective pattern, at least until a firm break of 1.0342 resistance.

August 08, 2021 at 12:43AM

ActionForex.com

https://ift.tt/3juPOhT

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home