EUR/USD Breaks Key Support as Dollar Rise Continues

EUR/USD Breaks Key Support as Dollar Rise Continues

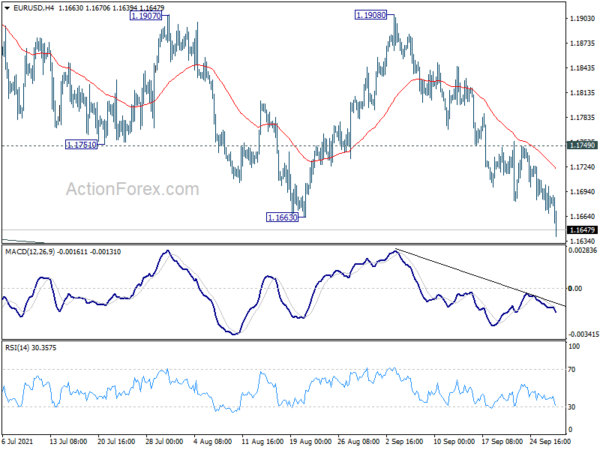

Dollar is generally strong today, but buying focus is temporarily shifted from against Yen to Euro and Sterling. In particular, EUR/USD has taken out key support level at 1.1663. Overall markets are mixed though, with stocks recovering while treasury yields retreat. Yen and Swiss Franc are the stronger ones for today followed by the greenback. New Zealand Dollar is the worst performing, followed by the Pound.

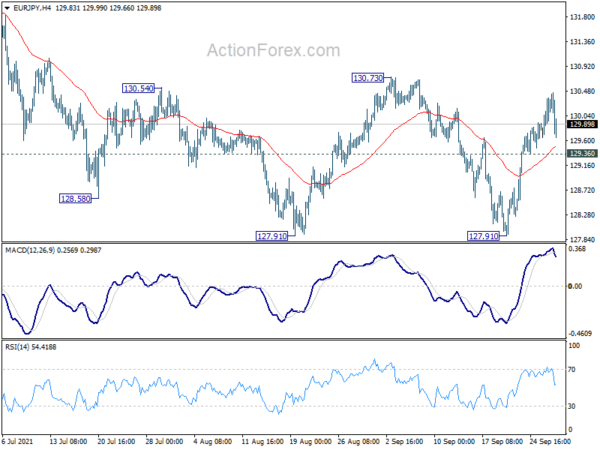

Technically, EUR/USD’s break of 1.1663 should confirm resumption of whole fall from 1.2265. The pair should now target 1.1602 key medium term structural support. While USD/JPY is struggling to break through 111.65/71 resistance cleanly, retreat is so far shallow. As noted before, firm break of 111.71 will carry larger bullish implications for USD/JPY. We’d now also look at EUR/JPY, to see if it would break through 130.73 resistance to align with Yen selling, or break through 129.36 minor support to align with Euro selling.

In Europe, at the time of writing, FTSE is up 0.0%. DAX is up 0.87%. CAC is up 1.03%. Germany 10-year yield is down -0.0139 at -0.210. Earlier in Asia, Nikkei dropped -2.12%. Hong Kong HSI rose 0.67%. China Shanghai SSE dropped -1.83%. Singapore Strait Times dropped -0.11%. Japan 10-year JGB yield dropped -0.0057 to 0.069.

ECB Makhlouf not looking to raise rates or respond to transitory inflation

ECB Governing Council member Gabriel Makhlouf warned in a Bloomberg TV interview, “we must be very vigilant of the risks out there.” He referred to the risk of persistently high inflation sue to supply bottlenecks.

“That’s the risk that we at the ECB need to be very cautious of and very aware of and ready to respond to if it happens,” Makhlouf said. “Right now I don’t think we should be looking to raise rates or respond to transitory inflation.”

The crisis program “was set up for an emergency at the start of the pandemic. As we see the emergency disappear there are logical consequences to that particular program,” Makhlouf said. “On the other hand there’s a long discussion to be had at the ECB, there’s a lot of uncertainty around with what’s happening in economies.”

Eurozone economic sentiment rose to 117.8, employment expectation rose to 113.6

Eurozone Economic Sentiment Indicator rose slightly from 117.6 to 117.8 in September, above expectation of 116.9. Employment Expectation Indicator rose 0.8 pts to 113.6, highest since 2018. Industrial confidence rose from 13.8 to 14.1. Services confidence dropped from 16.8 to 15.1. Consumer confidence rose from -5.3 to -4.0. Retail trade confidence dropped from 4.6 to 1.3. Construction confidence rose from 5.5 to 7.5.

EU ESI was unchanged at 116.6 while EEI rose 1 pt to 113.6 (highest since 2018). Amongst the largest EU economies, the ESI rose in Spain (+1.7), Germany (+0.8), the Netherlands and Poland (both +0.6), while it worsened in France (-1.3) and Italy (-0.9).

Also released, Swiss ZEW economic expectations rose from -7.8 to 25.7 in September. UK mortgage approvals dropped to 74k in August. UK M4 money supply rose 0.5% mom in August.

Japan’s GPIF will not investment in Chinese government bonds

Japan’s Government Pension Investment Fund (GPIF) said it will not investment in Chinese government bonds, even though FTSE Russell’s World Government Bond Index starts to include them in October. GPIS is the world’s largest pension fund, with total assets of JPY 192T.

Masataka Miyazono, president of GPIF, said, “Chinese government bonds cannot be settled in an international settlement system that can be used for other major government bonds. The market’s liquidity is still limited compared with the size of GPIF’s investment scale. Trading of futures is not allowed for foreign investors.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1667; (P) 1.1685; (R1) 1.1702; More …

EUR/USD’s break of 1.1663 support indicates resumption of fall from 1.2265, which is seen as the third leg of the pattern from 1.2348. Intraday bias is back on the downside for 1.1602 key support level next. Sustained break there will argue that it’s at least on larger scale correction. Next target would be 1.1289 medium term fibonacci level. On the upside, break of 1.1749 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | -0.50% | -0.80% | ||

| 08:00 | CHF | ZEW Expectations Sep | 25.7 | -7.8 | ||

| 08:30 | GBP | Mortgage Approvals Aug | 74K | 73K | 75K | |

| 08:30 | GBP | M4 Money Supply M/M Aug | 0.50% | 0.30% | 0.10% | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Sep | 117.8 | 116.9 | 117.5 | 117.6 |

| 09:00 | EUR | Eurozone Services Sentiment Sep | 15.1 | 16.5 | 16.8 | |

| 09:00 | EUR | Eurozone Industrial Confidence Sep | 14.1 | 12.5 | 13.7 | 13.8 |

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -4 | -4 | -4 | -5.3 |

| 09:00 | EUR | Eurozone Business Climate Sep | 1.72 | 1.75 | 1.74 | |

| 14:00 | USD | Pending Home Sales M/M Aug | 1.10% | -1.80% | ||

| 14:30 | USD | Crude Oil Inventories | -2.5M | -3.5M |

Featured Analysis

Load moreLearn Forex Trading

The Psychological Utility of Technical Analysis

How Global Events Can Affect the Foreign Exchange Market

What CPI Is and How to Trade Inflation Data

Why Trade FX: 7 Key Differences Between FX and Other Instruments

Finding Great Entries With Fibonacci Analysis

The EUR/USD

September 30, 2021 at 12:50AM

ActionForex.com

https://ift.tt/2ZLGxvL

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home