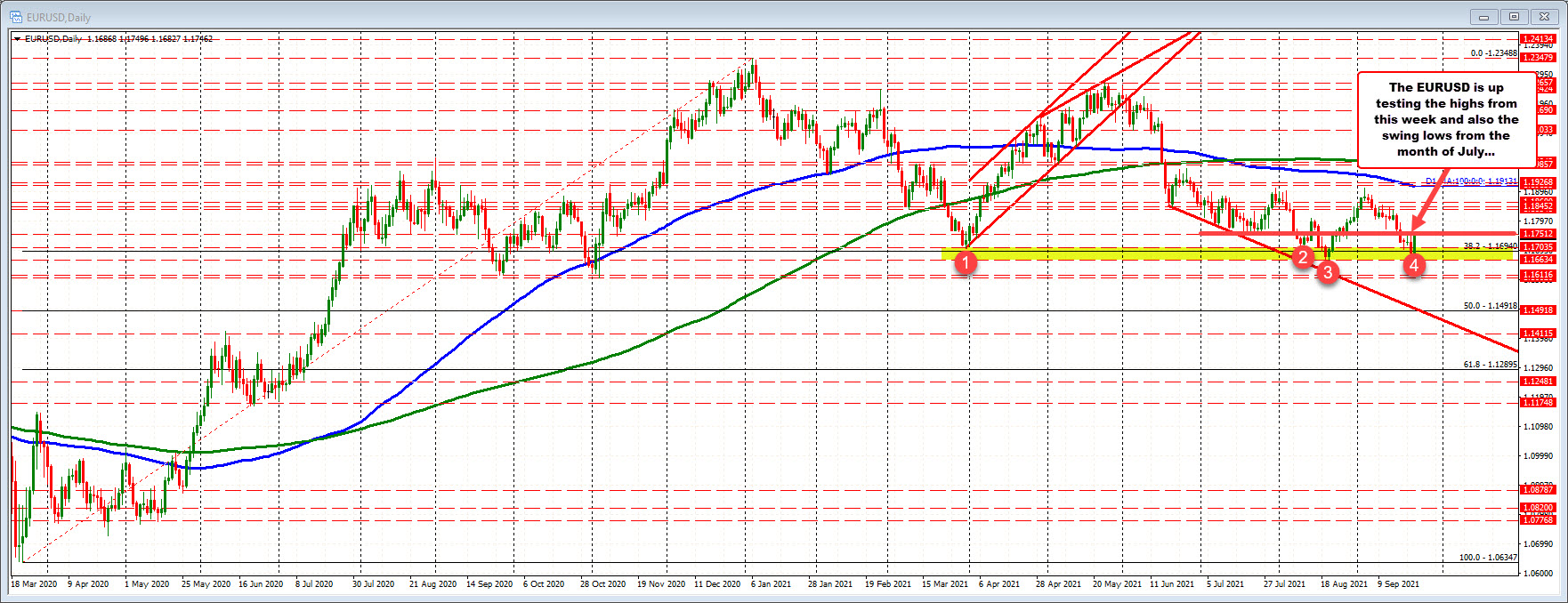

EURUSD cracks below the 100 hour MA after the run higher stalls near swing resistance

The swing area near 1.1750 stalled the high yesterday. The 100 hour MA is now resistance.

I couldn't find it The EURUSD moved higher yesterday and in the process extended above its 100 hour moving average but also stalled near a swing area between 1.1748 and 1.1755. The pair also stayed comfortably below its 200 hour moving average.

Today the drift was more to the downside with the pair moving back toward the support near the 100 hour moving average at 1.12250. The last hour or so has seen that moving average broken and the price has scooted to the downside. It is currently trading at session lows near 1.1710. There is some interim support between 1.16996 and 1.17054 (see red numbered circles) before the swing low for the week (and September) at 1.16827.

As pointed out yesterday (i.e. on Wednesday), the range for the EURUSD in 2021 is only 682 pips. The low was in August at 1.16634. The pair reached a low at 1.16827 today. If the range is to extended in 2021, the best chance is still lower.

IF this resistance area on the hourly chart can hold the rally in check HERE (i.e near 1.1750), we could see a rotation back to the downside for a retest of the low, with the hope for a break and run."

The "hope for a break and run" is in play, as long as the 100 hour MA can now hold close resistance.

September 25, 2021 at 12:45AM

https://ift.tt/3lPCk1g

1 Comments:

This isn't always recommendable because many users soon forget the password and have to resort to programs like idm crack download to show the hidden passwords.

Post a Comment

Subscribe to Post Comments [Atom]

<< Home