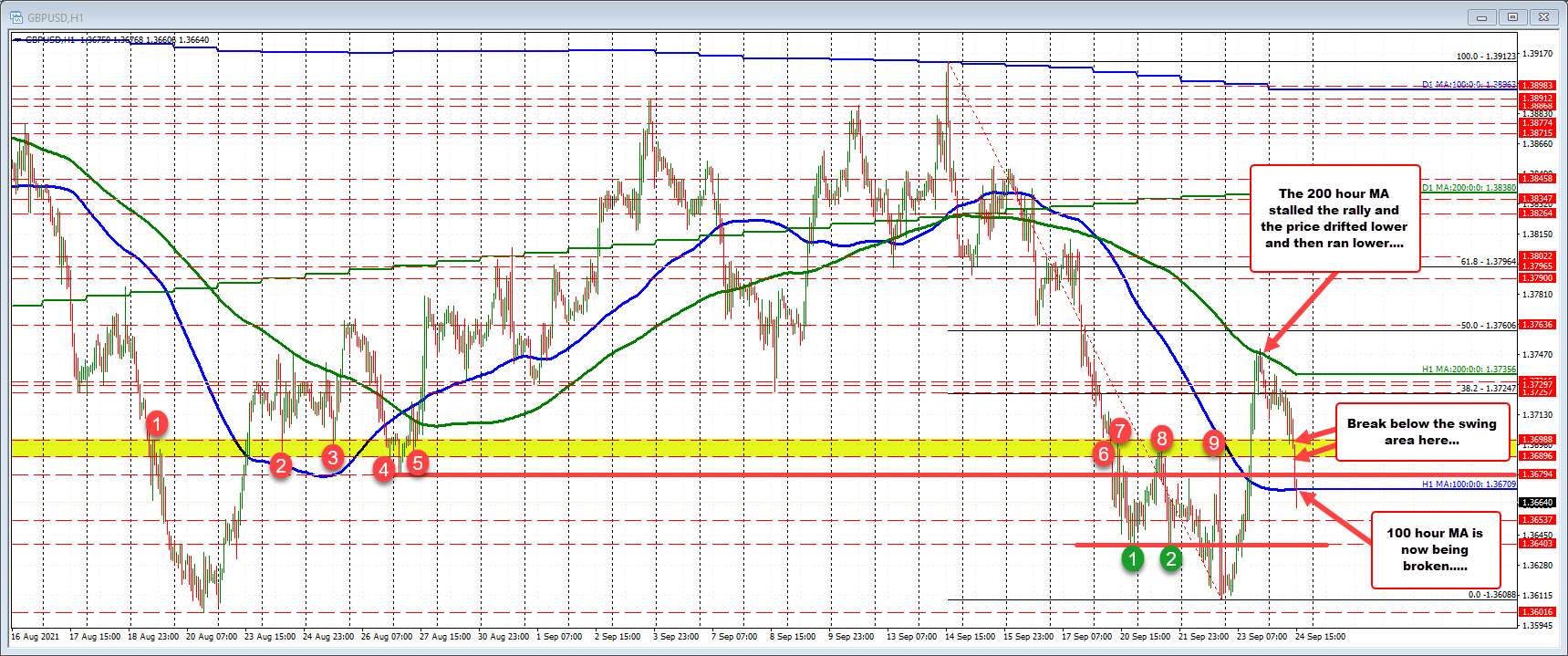

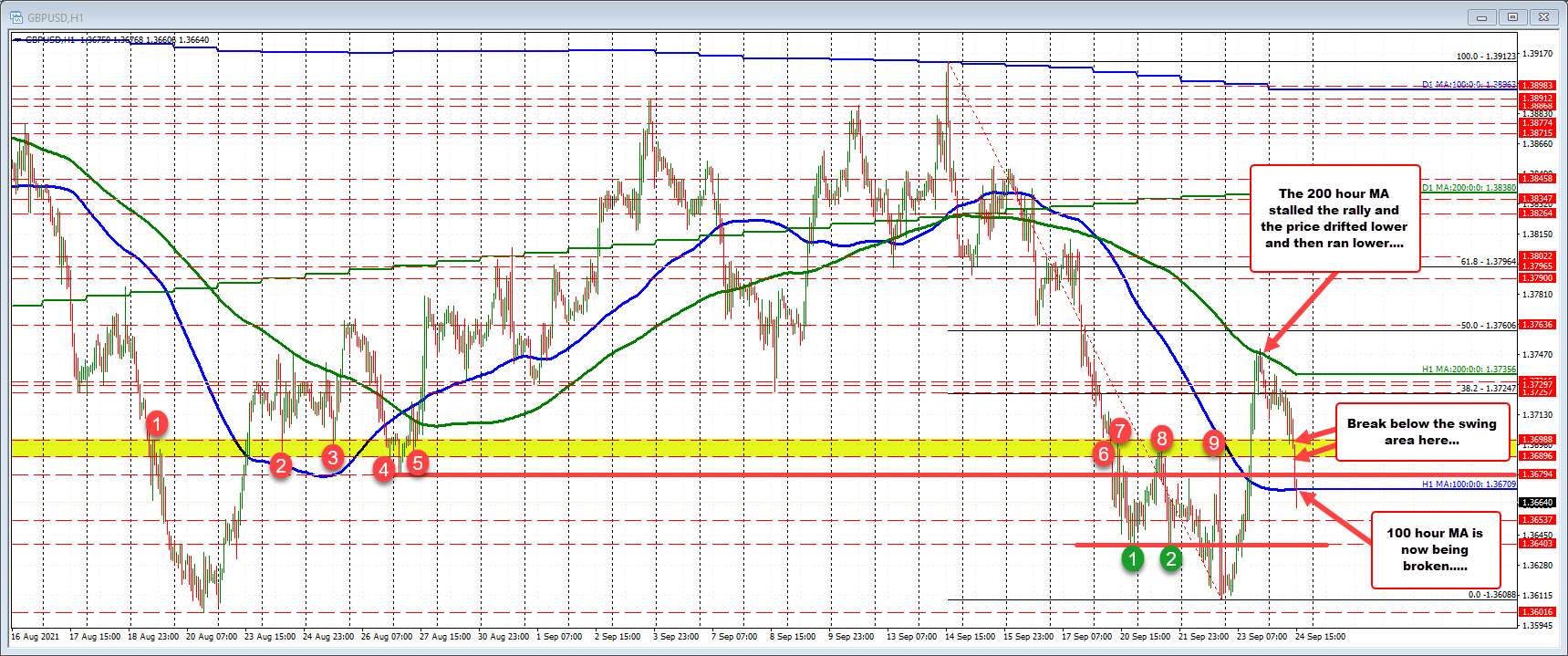

GBPUSD falls below the 100 hour MA

The gains from yesterday are being eroded

The GBPUSD moved sharply higher yesterday after the BOE rate statement painted a more hawkish picture. That rally extended all the way up to the 200 hour moving average (green line) where sellers started to lean.

The price started to drift lower in the new trading day. The last few hours have seen an acceleration to the downside after the pair broke back below the 1.36896 to 1.36988 swing area. More recently, the price has moved below its 100 hour moving average at 1.36708 and is increasing the bearish bias

The next down side targets come at 1.36537 and 1.36403. Below those levels and traders will start to high the swing lows from September at 1.36088 reached earlier this week followed by the August swing low at 1.36016.

The 100 hour moving average is now close risk. The best case scenario for shorts is stay below that level. Traders looking for a rebound would want to see the price move back above that level and then start to extend toward the 1.36896 to 1.36988 area.

September 25, 2021 at 01:13AM

https://ift.tt/3ucz9EO

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home