It's usually best for the dollar to follow bonds, but not this time

Head-fake in bonds is not the signal you're looking for

Treasury yields are higher after non-farm payrolls and I get the sense that many FX traders are looking that. It explains the reversal back to unchanged in USD/JPY.

The prevailing theory is that the drop in unemployment and higher wages outweigh the decline in jobs. I don't buy and I don't think that's what the bond market is saying either.

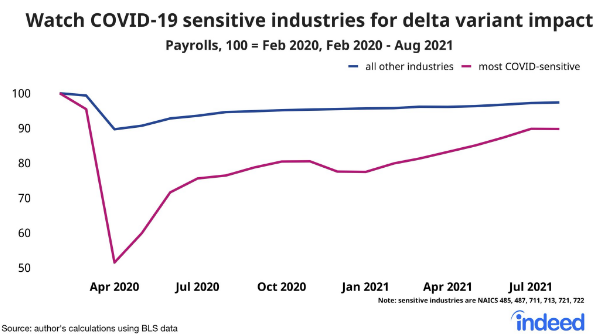

While the drop in unemployment is good, rising wages is because people in the low-wage hospitality industry weren't hired. We saw the same dynamic at the start of the pandemic. No doubt there's wage pressure in the US but as Nick Buncker from Indeed shows, jobs in pandemic-affected industries fell, showing that delta had a real effect on the economy.

So what's the bond market saying?

If you remember back to recent strong jobs reports the exact same thing happened in inverse. There was an initial pop in yields and then they fell.

To me, that argues the bond market is 1) Looking further out towards when rate hikes will start and the Fed's propensity to allow an inflation overshoot 2) Pricing in a policy error.

In other words, the bond market has been worried about the Fed prematurely tapering and hiking in moves that would snuff out inflation. A miss in non-farm payrolls increases the odds they will wait longer and actually achieve durable inflation.

That might strike some as overly deep and that's a fair criticism but the same thing happened on strong jobs data. There's a re calibration of investors understanding of the Fed's relationship with inflation under the new framework. I also think the market is attuned to the coming collision between bottleneck-induced inflation and the Fed.

So what's a forex trader to do?

For the dollar, rate differentials do matter but the front-end is more important and it's much more straight forward here as a more-patient Fed gives other central bankers a chance to catch up and a chance for global reflation.

September 04, 2021 at 01:05AM

Adam Button

https://ift.tt/3DK6ZFr

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home