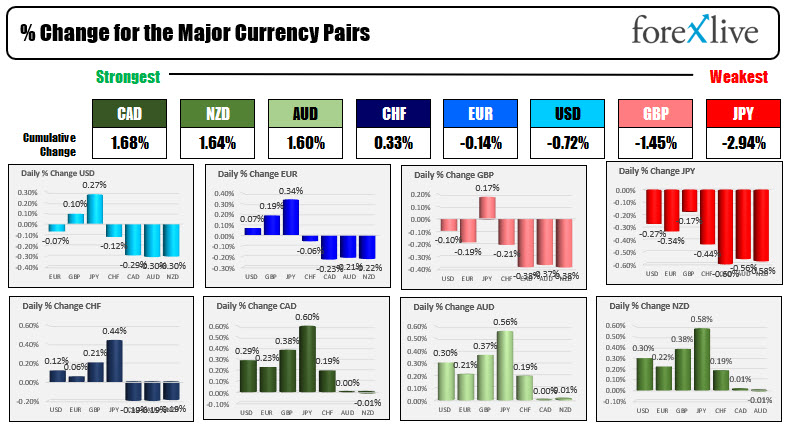

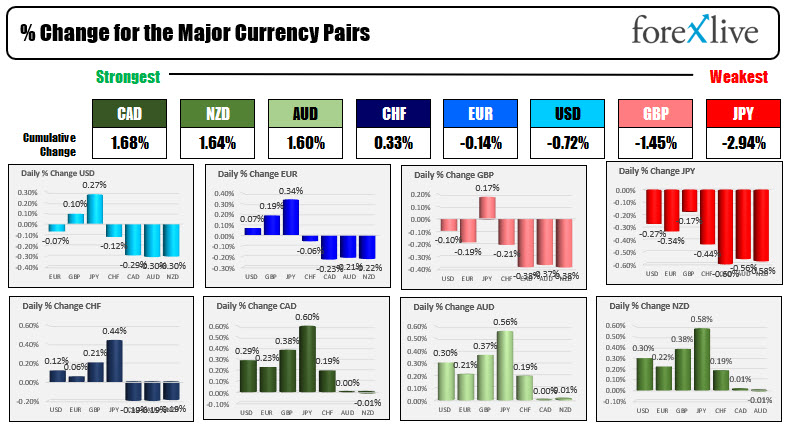

The CAD is the strongest and the JPY is the weakest as NA traders enter for the day

FOMC day. The USD is mixed/lower to start the North American session

As traders in North America enter for the day, the CAD it is the strongest, while the JPY is the weakest. The USD is mixed to lower as the market prepares for the FOMC decision and press conference at 2 PM ET. The market will be focused on any concrete clues as to the start of taper (by the end of year?). They also will be focused on the dot plot which at the last release showed tightening starting in 2023 at the earliest. Will that show more expectations for a tightening in 2022 to stave off inflation? German estimates for GDP in 2021 was cut to 2.5% from 3.3% from the Ifo Institute, but they see strong growth in 2022 with the expectations for 5.1% versus 4.3%. US stocks are higher in premarket trading. Yields are mostly higher The Evergrande default will be partially delayed or at least part of it. The onshore payments seem to live on after a negotiations on restructuring with bondholders. The offshore bonds may still go into dafault when the payments are due tomorrow. That chunk is the biggest.

- Spot gold is trading down a modest $0.50 or -0.03% at $1773.10

- Spot silver is up $0.24 or 1.1% at $22.71.

- WTI crude oil futures are up one dollar or 1.52% at $71.56

- The price of bitcoin is up $1441 and $42,037.84

- Dow +200 points after yesterday's -50.63 point decline

- S&P index +23.56 points after yesterday's -3.54 point decline

- NASDAQ index up 57 points after yesterday's 32.49 point rise

in the European equity markets, the major indices are trading higher:

- German DAX, +0.6%

- France's CAC, +1.1%

- UK's FTSE 100, +1.2%

- Spain's Ibex, +0.6%

- Italy's FTSE MIB, +0.8%

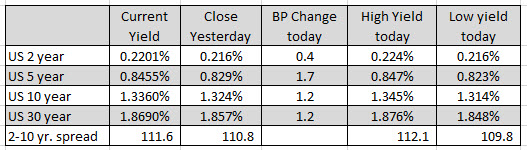

In the US debt market, the yields are trading higher by about 1 to 2 basis point:

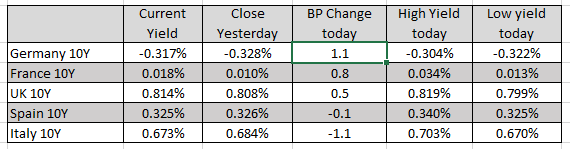

In the European debt market, the benchmark 10 year yields are mixed with Germany, France, UK modestly higher and Spain, Italy modestly lower:

September 23, 2021 at 12:13AM

https://ift.tt/3hWBS03

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home