Recovery day after yesterday's sharp fall

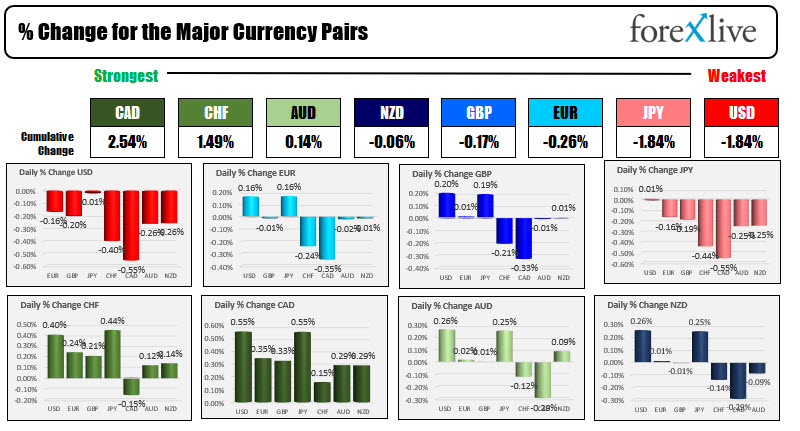

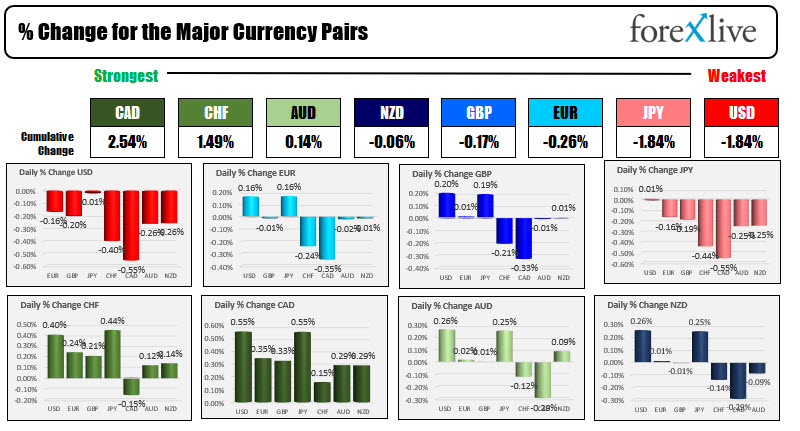

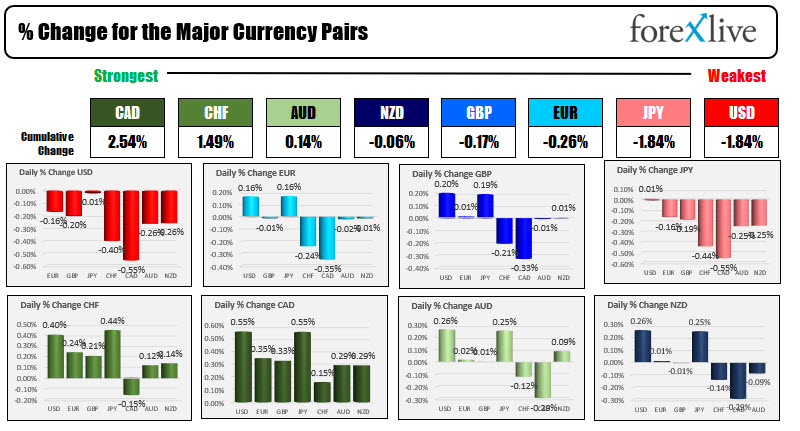

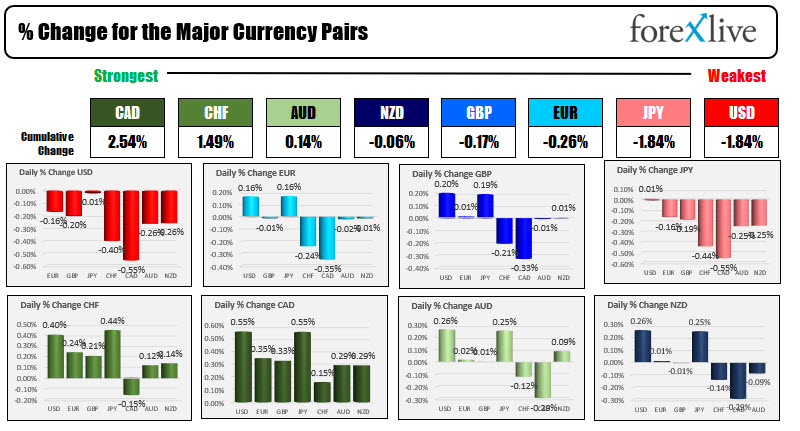

The CAD is the strongest and the USD is the weakest as the markets recover from yesterday's sharp declines that saw the NASDAQ index shed -2.19% and the Dow industrial average fall by -1.78%. The declines yesterday were spurred by fears of China's Evergarde default being a bigger deal globally (i.e. a "Lehman" moment). Today, stocks are higher in premarket trading and erasing some of the declines from yesterday. Yields in the US are modestly higher as well after yesterday's decline flight to safety. In the forex market, the flight to safety flows have abated with the US dollar and the JPY moving lower (they are tied for the weakest of the majors). The CAD is the strongest after

Prime Minister Trudeau's Liberal party gathered the most seats but not a majority. It could've been worse. Still ahead are central bank decisions from the Fed tomorrow where they could lay out plans for a taper along with the Bank of England on Thursday (shifts toward a more dovish may be in the cards as growth slows).

In other markets this morning:

- Spot gold is trading up $3.43 or 0.27% at $1767.95.

- Spot silver is up $0.33 or 1.42% at $22.58

- WTI crude oil futures are up $0.87 or 1.23% at $71. Oil has been supported today on news that shall output from the Gulf of Mexico will be less through the year and due to damage from the storms

- Bitcoin is up $207 at $43,243 after yesterday's sharp decline

In the US pre-market for US stocks, the futures are implying a higher opening for the major indices erasing some of the losses from yesterday's sharp move to the downside:

- Dow 264 points after yesterday's -614.41 point decline

- S&P + 33 points after yesterday's -75.26 point decline

- NASDAQ index +120 points after yesterday's -330 point decline

In the European equity markets, the major indices are also moving higher in trading today:

- German Dax +1.4%

- Francis CAC, +1.3%

- UK's FTSE 100 +1.1%

- Spain's Ibex, +1.25%

- Italy's FTSE MIB +1.3%

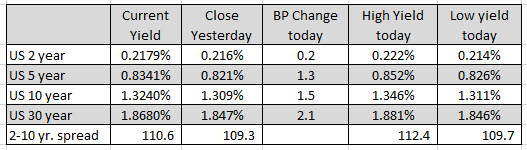

In the US debt market, yields are higher after the declines yesterday. The yield curve as measured by the 2-10 year spread is a touch steeper at 110.6 basis point versus 109.3 basis point:

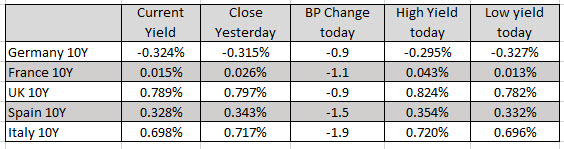

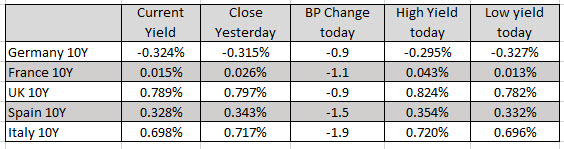

In the European debt market, the benchmark 10 year yields are trading down between about one and two basis point:

Unchanthe in other markets this morning ged

September 22, 2021 at 12:12AM

Greg Michalowski

https://ift.tt/3tW2Nha

Labels: Forexlive RSS Technical Analysis Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home