The EURUSD muddles along - but below the falling 100 hour MA - to start the US day

21 pip trading range as traders wait for a FOMC shove.

The EURUSD is muddling along in a 21 pip trading range as traders wait for the FOMC "shove".

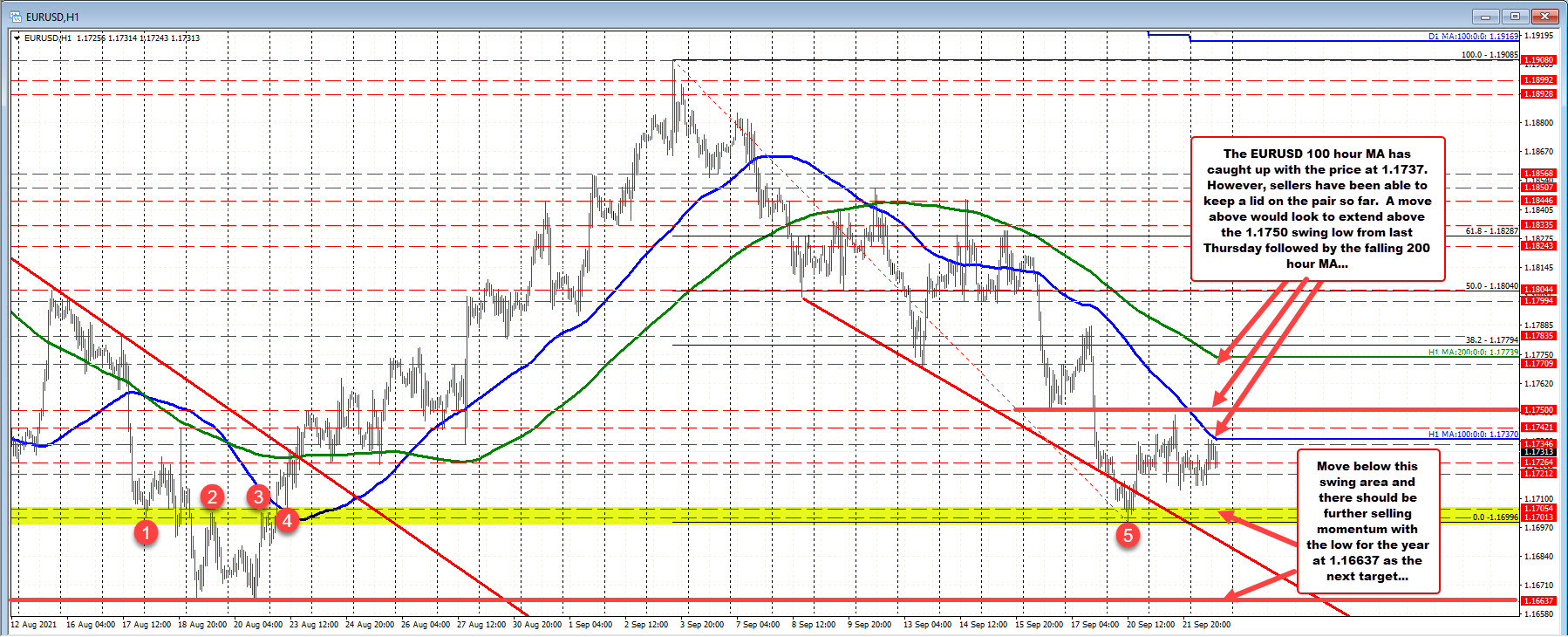

Looking at the hourly chart above, the pair's falling 100 hour moving average (blue line) is catching up with the price, but so far, the price has been able to stay below that moving average level as traders lean in the direction of a higher dollar. The moving average currently comes in at 1.1737 (and moving lower).

That moving average will likely be the closest barometer for the short term at least. Move above and the short term bias turns more bullish with the one low from last Thursday's trade at 1.1750 followed by the falling 200 hour moving average at 1.17739 as the next upside targets needed to get to and through to increase the bullish bias. The 38.2% retracement of the recent move down in September is also a target to get above at 1.17794..

Stay below the 100 hour moving average and traders will attack the swing area between 1.1700 and 1.17054 (see red numbered circles).

Move below that area, and the low from August at 1.16634 (which is the lowest level going back to early November) would be targeted.

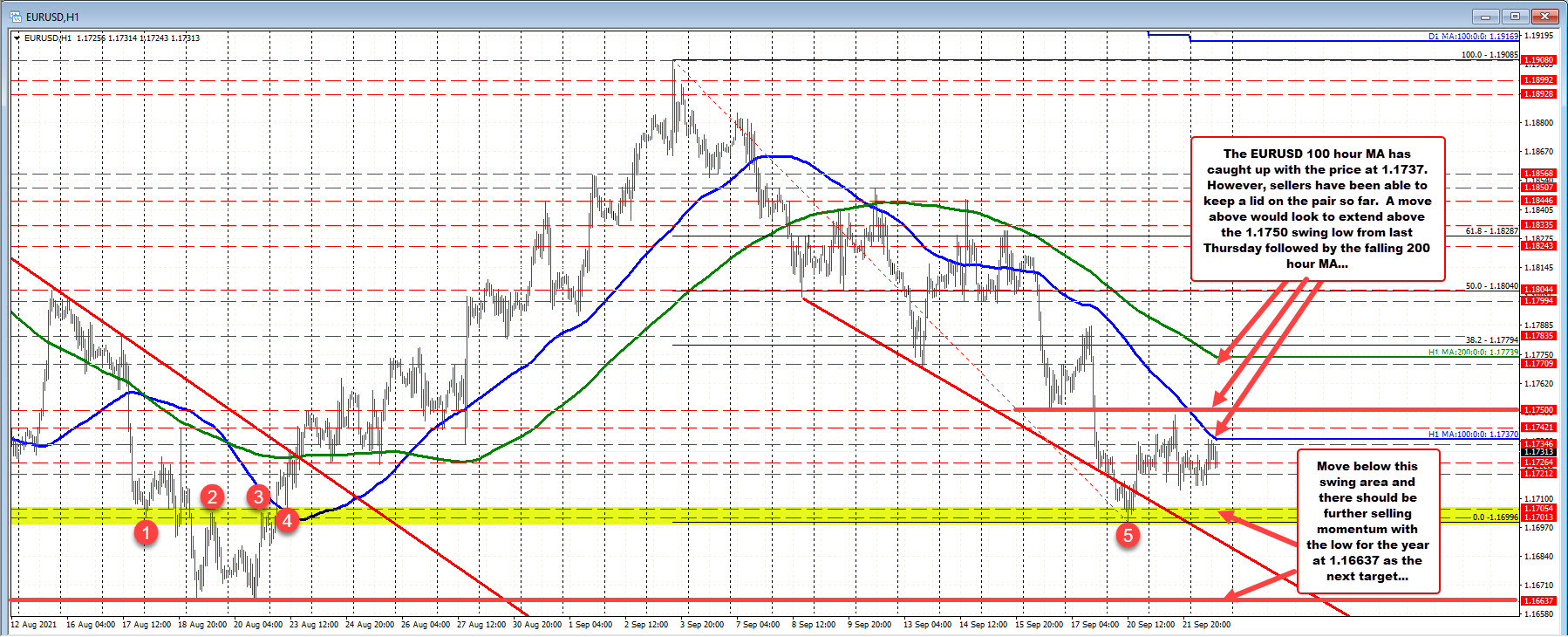

To be considered by traders is that the range for the trading year so far is only 682 pips (see daily chart below). Looking at last year's trading range, the low to high was over 1600 pips.

So at 682 pips the range is very narrow

Will there be an extension and run?

Keep that in mind on a move lower. We are days away from the month of October. There is not a lot of time left between now and the end of the year. The year has been non-trending as the market awaits for a change in Fed policy. That may be in the cards today. The market is leaning in that direction. It's a matter of getting the shove in the follow-through afterwards.

September 23, 2021 at 12:53AM

Greg Michalowski

https://ift.tt/3zuRu0H

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home