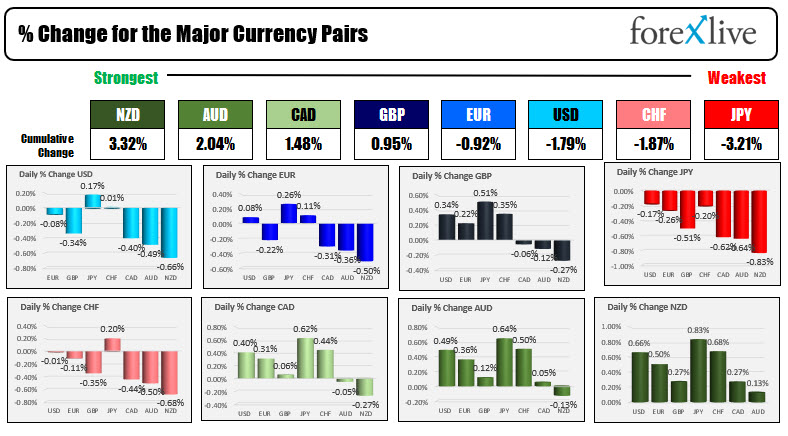

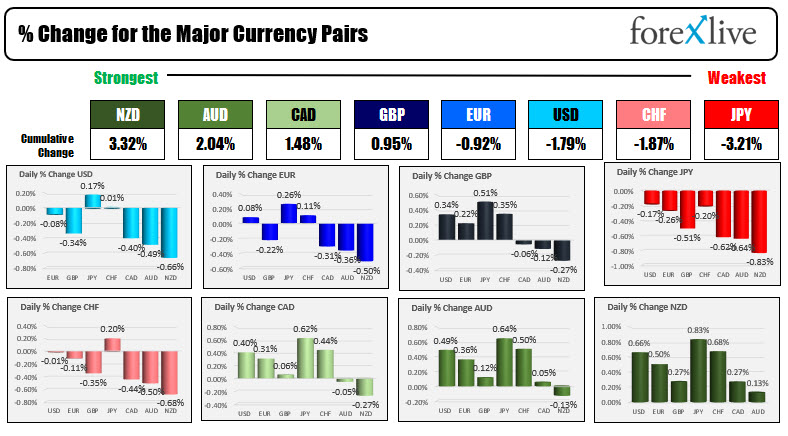

The NZD is the strongest and the JPY is the weakest as NA traders enter for the day

The USD is mostly lower ahead of PPI. Canada jobs report will also be released

As the North American session begins, the NZD is the strongest of the majors, while the JPY is the weakest. The USD is mostly lower with modest gains versus the JPY and CHF. The the greenback is down the most verse the commodity currencies (NZD, AUD and CAD) and the GBP in the morning snapshot. Stocks are trading higher after four straight down sessions in the Dow and S&P and to down sessions in the NASDAQ. The indices are lower on the week. US PPI will be released at the bottom of the hour with the headline number expected to rise by 0.6% and core up 0.5%. The Canada employment report will also be released with expectations of employment change of 67.2K vs 94.0K last month. The one point rate is expected to dip to 7.3% from 7.5%. Canada capacity utilization will also be released with 81.4% expected versus 81.7% last month.

Taking a snapshot of other markets as the US session gets underway shows:

Taking a snapshot of other markets as the US session gets underway shows:

- Spot gold up three dollars or 0.14% at $1796.50.

- Spot silver is up six cents or 0.24% at $24.09.

- WTI crude oil futures up $1.30 or 1.93% at $69.44

- Bitcoin is trading near unchanged at $46,350

- S&P index futures imply a 19.47 point gain. Yesterday the index fell -20.81 points

- Dow industrial average up 176 points after yesterday's -151.69 point decline

- NASDAQ index up 65 points after yesterday's -38.38 point decline

in the European equity market, the major indices are mixed:

- German DAX, +0.4%

- France's CAC, +0.3%

- UK's FTSE 100 +0.25%

- Spain's Ibex -0.8%

- Italy's FTSE MIB -0.1%

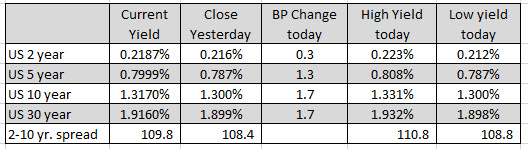

In the US debt market, yields have rebounded to the upside after declines over the last few days on the back of strong demand for US 10 and 30 year issues. The tenure yield is up 1.7 basis points at 1.317%. The low yield reached 1.30% earlier today.

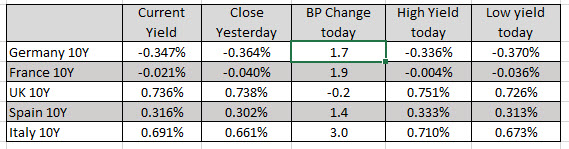

In the European debt market, the benchmark 10 year yields are mostly higher.

September 11, 2021 at 12:03AM

Greg Michalowski

https://ift.tt/38ZlZRH

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home