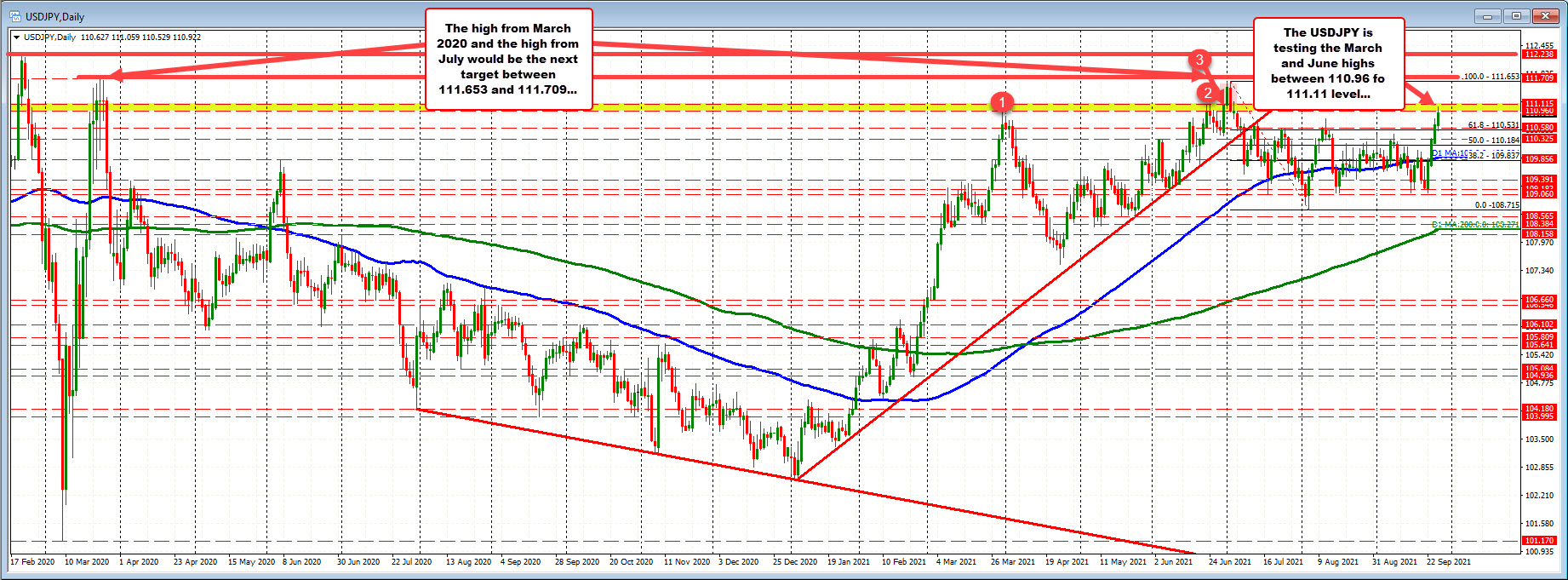

The USDJPY trades to the highest level since July

The pair moved into a swing area between 110.96 and 111.11

The USDJPY is traded to the highest level since July 5 today. The price peaked at 111.059.

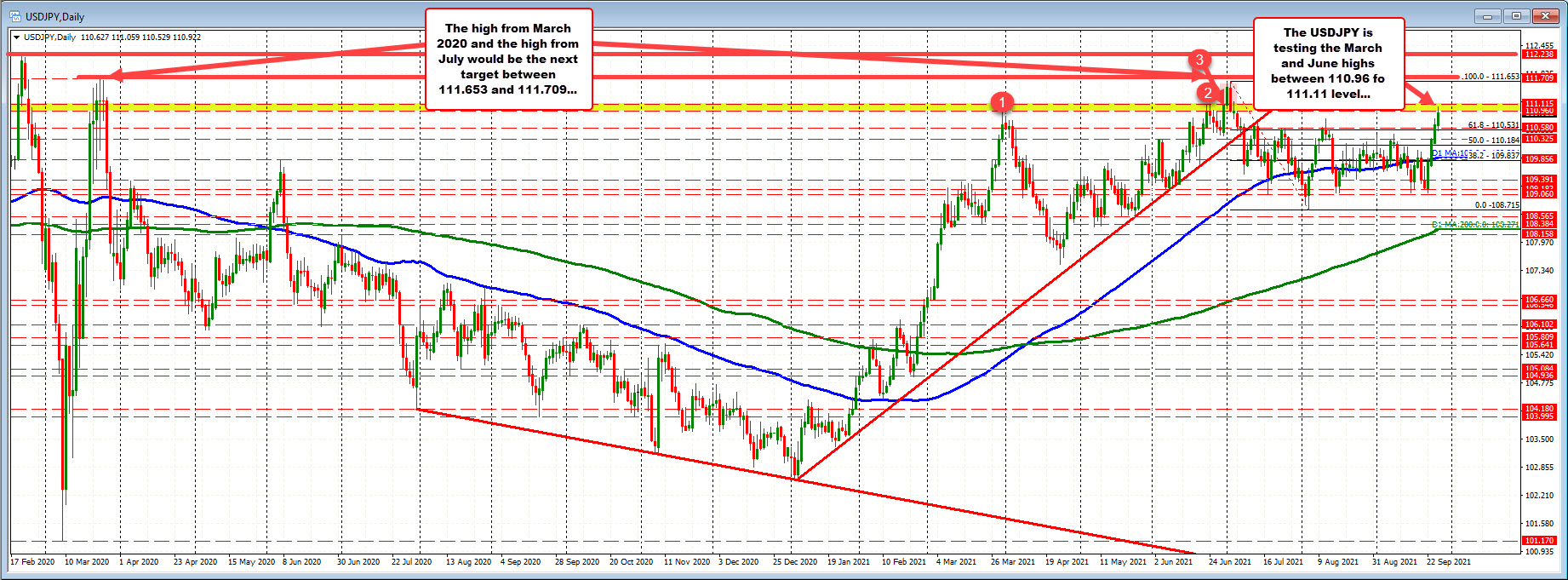

That move to the upside took the price between a swing area defined by the March 2021 high, and the the June 21 highs (see daily chart above). A move above that level would next target the high for the year at 111.653. That is also within seven pips of the March 2020 high at 111.709.

The price has backed off against that swing area and currently trades at 110.90.

Although interest rates are higher with the 10 year cracking above the 1.50% level today (currently trades at 1.516% - higher rates support the USD and the USDJPY), the USDJPY can also be impacted by "risk off" flows with flights into the relative safety of the JPY pairs (could limit the USDJPYs advance).

Pay attention to the technicals to give the clues, and right now, the 110.96 to 111.115 area is providing some resistance.

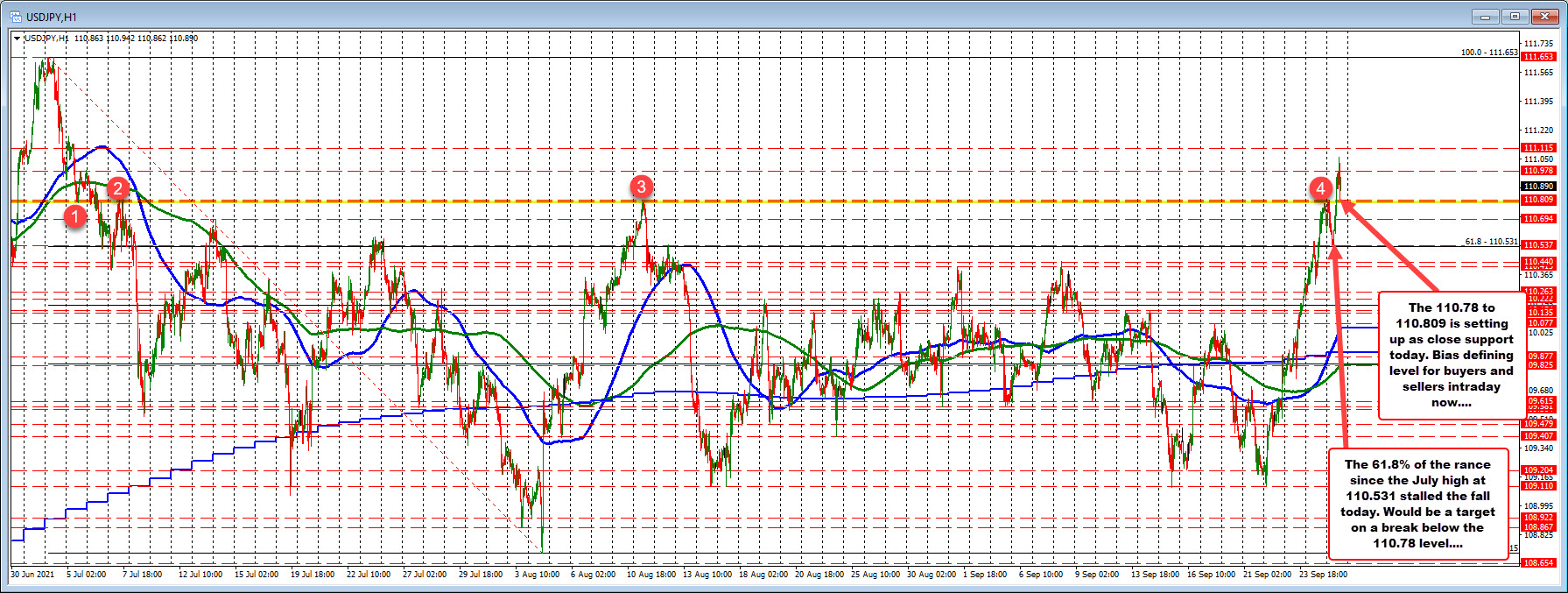

Drilling to the hourly chart, the July 7 and August 11 highs stalled at 110.782 to 110.809. The low corrective price off the high today stalled at 110.862 so far. If the price can stay above that swing area, the buyers remain in control in the short term. Move below that area, and there should be further downside probing with 110.69 and 110.53 (the low today and 61.8% of the range since the July high) as support targets.

September 28, 2021 at 01:29AM

Greg Michalowski

https://ift.tt/3ASq3j6

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home