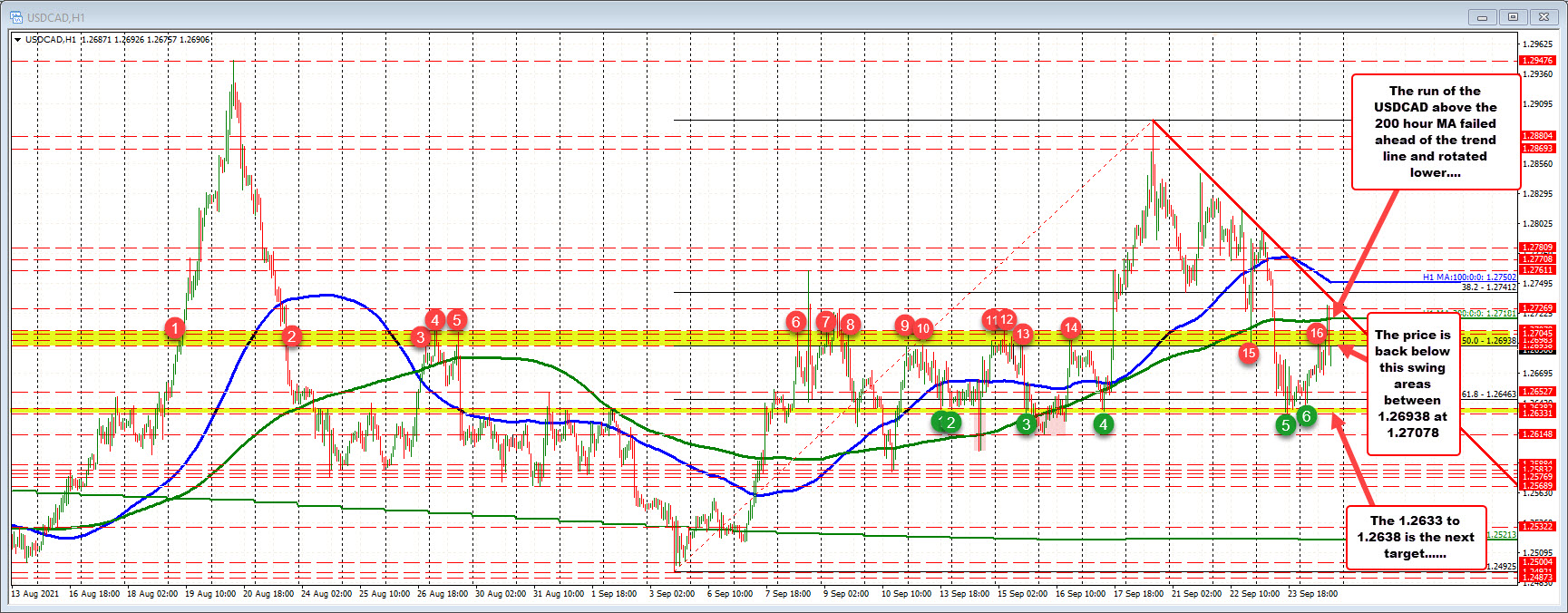

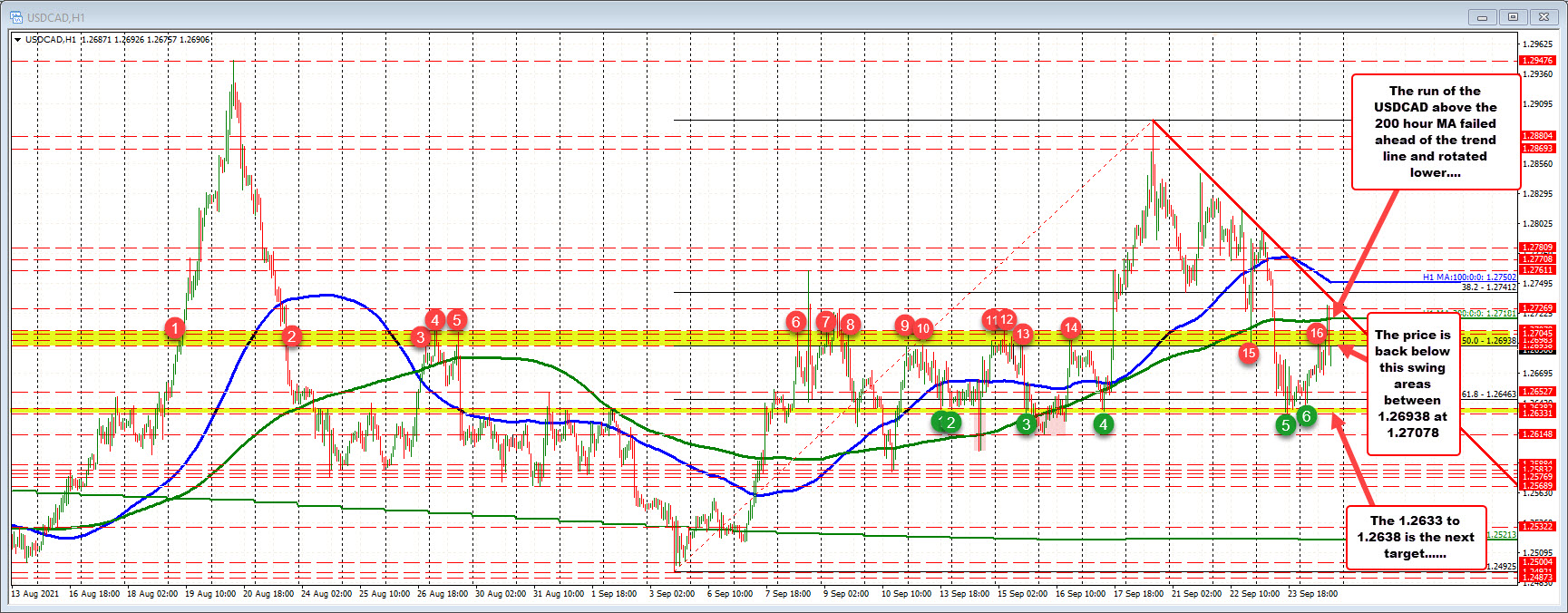

USDCAD rotates back to the downside after run above the 200 hour MA fails

Crude oil is back higher helping to push the CAD higher

The USDCAD moved higher on "risk off" flows and lower oil prices earlier today. The price of crude oil reached a low of $72.81. It has since reversed higher and currently trades up at $73.57.

The pair's move to the upside took the pair above a swing area between 1.26938 (that is the 50% retracement level too) and 1.27078, and also above its 200 hour moving average 1.27181. The high prices reached 1.27298, but could not reach a downward sloping trendline near 1.2739.

The subsequent fall back below the swing area (and the 50% at 1.26938), has now tilted the bias more in the favor of the sellers. It would take a move back above the 1.27078 and ultimately the 200 hour moving average at 1.27181 to give the buyers more of an edge technically. Absent that, and the sellers are more in control

On the downside, the low price from yesterday stalled near the low price from September 17. Today's Asian session low stalled ahead of those levels before moving to the upside. Those lows come between 1.2633 and 1.2638. On further downside momentum, getting below that level would be the next major hurdle.

September 25, 2021 at 02:28AM

Greg Michalowski

https://ift.tt/3lZL0ST

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home