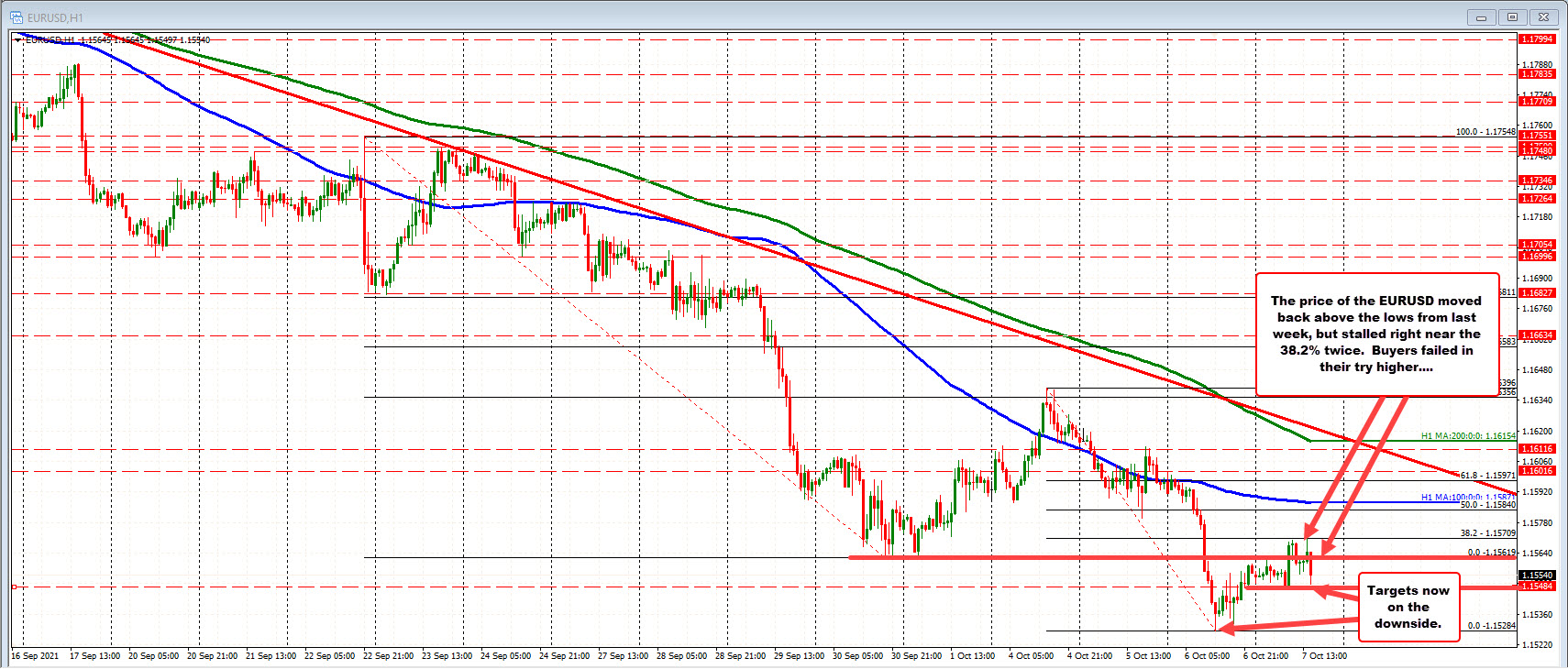

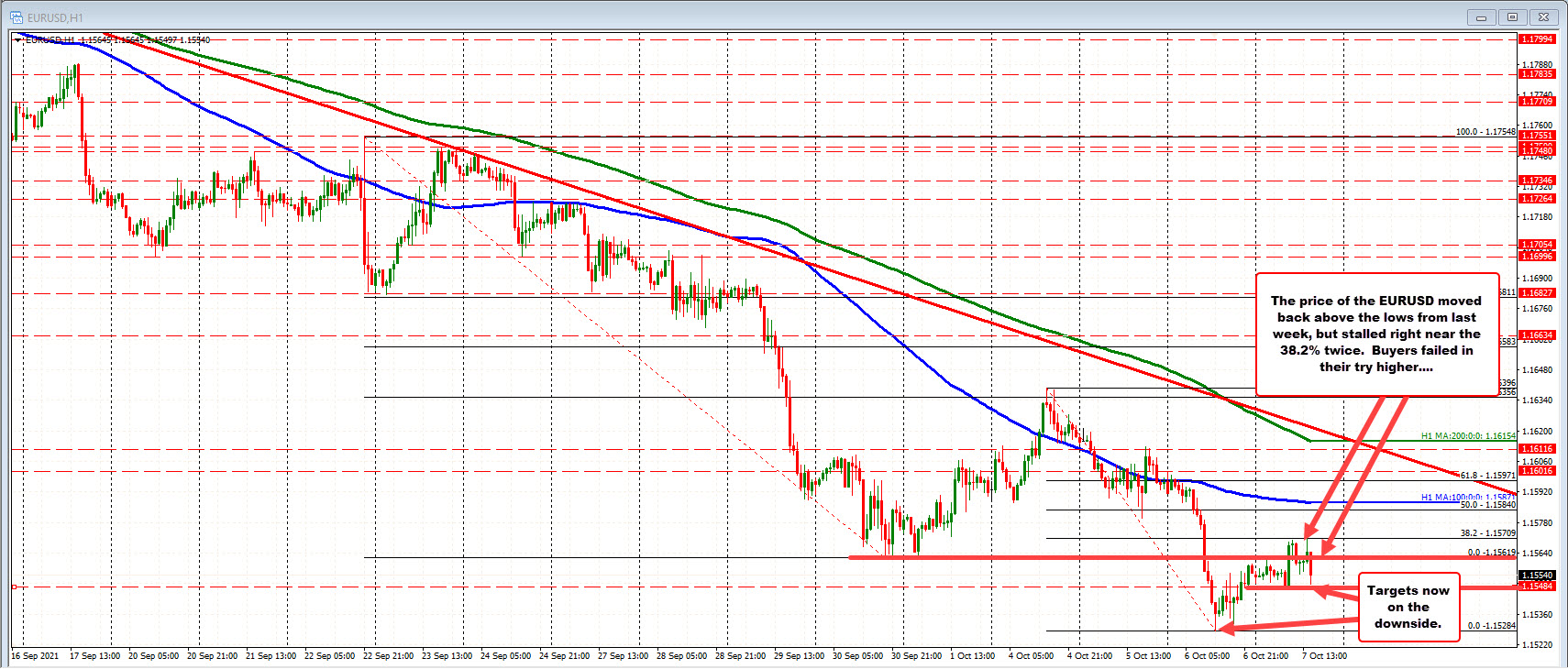

EURUSD mired in a very narrow trading range

23 pip trading range is well below the 50 pip average over the last 22 trading days (about a month of trading)

The EURUSD is mired within a narrow 23 pip trading range for the day which is well below the 50 pip range over the last 22 trading days (about a month of trading). That is good and bad. The good is there is room to roam. Hopefully on a break the market continues in the direction of the break. The bad is that the market is unsure of the directional bias and that could continue to freeze market.

Nevertheless technically, the price has moved up to test the 38.2% retracement of the range this week at 1.15709. That move did see the price get back above the swing lows from last week's trading at 1.15619, but the price has moved back below that level indicative of the market uncertainty from the traders. On the downside, the low in the current bar just held support against the European early session low at 1.15484. UGH.

Despite the price inaction, the sellers still have the edge. The prices below the 100 hour moving average and the 50% midpoint of the week's trading range at 1.1587 and 1.1584 respectively. The price tested the 38.2% retracement but backed off. The price could not sustain momentum above the lows from last week after breaking below those levels during yesterday's trade. All those levels would need to be broken and stay broken to give the buyers some hope that the bottom is in place.

Those are all not the bullish signals. There is some reluctance in the price action.

Having said that, getting and staying below the 1.15484 level and then making a run toward the low from yesterday (and the new low for the year) at 1.15284 are the next hurdles for the sellers.

October 08, 2021 at 01:01AM

https://ift.tt/3FqTlaT

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home