Lira Falls to Record Low as Erdogan Signals New Syria Offensive

Lira Falls to Record Low as Erdogan Signals New Syria Offensive

Forex 3 hours ago (Oct 12, 2021 05:00AM ET)

Forex 3 hours ago (Oct 12, 2021 05:00AM ET)

© Reuters. Lira Falls to Record Low as Erdogan Signals New Syria Offensive

© Reuters. Lira Falls to Record Low as Erdogan Signals New Syria Offensive

(Bloomberg) -- The Turkish lira extended its slide to a record low after President Recep Tayyip Erdogan hinted at a possible military offensive into neighboring Syria.

The currency depreciated as much as 0.4% to 9.0398 per U.S. dollar after Erdogan said late Monday that Turkey is determined to eliminate threats emanating from Syria “either through forces that are active there, or by our own means.”

While Ankara has been embroiled in the conflict for years, the move threatens to stoke tensions with the U.S., which is backing Kurdish militants in the region that Turkey opposes. And it comes at a fraught time for the NATO allies, with Washington warning it could impose sanctions on the country again.

“Market players seem to perceive these comments as a cross-border operation,” Emre Degirmencioglu, a group manager at the treasury department at Iktisatbank in Nicosia, wrote in a note.

The losses were exacerbated by a bout of dollar strength and fragile global risk appetite. An unexpected rate cut last month reduced the allure of Turkish assets and fueled concern that inflation -- already running at the fastest pace in two years -- would continue to accelerate.

The lira has weakened more than 6% against the dollar since the Turkish central bank governor last month shifted focus to a narrower set of core prices, stirring speculation he was giving policy makers more room to ease rates despite the risks.

“We could be witnessing the beginning of yet another vicious cycle of monetary policy easing,” said Piotr Matys, a senior currency analyst at InTouch Capital in London. A precipitous fall in the value of the lira could force the central bank to “abruptly make a U-turn and raise rates to stabilize the currency,” he said.

Turkey Rate Shock Imperils Reserves, Hurts Credibility: Analysts

For its part, the central bank says the latest jump in inflation is transitory. Governor Sahap Kavcioglu told investors and analyst in a teleconference last week that Turkey’s monetary policy stance remains sufficiently tight.

©2021 Bloomberg L.P.

Related Articles

Rising U.S. yields push yen to lowest in nearly 3 years By Reuters - Oct 12, 2021

Rising U.S. yields push yen to lowest in nearly 3 years By Reuters - Oct 12, 2021

By Saikat Chatterjee LONDON (Reuters) - The Japanese yen held near its weakest levels versus the U.S. dollar in almost three years on Tuesday as a relentless rise in Treasury...

Dollar Drifts Higher Ahead of 10Y Auction; Lira Slumps, U.K. Data Leaves GBP Cold By Investing.com - Oct 12, 2021

Dollar Drifts Higher Ahead of 10Y Auction; Lira Slumps, U.K. Data Leaves GBP Cold By Investing.com - Oct 12, 2021

By Geoffrey Smith Investing.com -- The dollar was little changed in early trading in Europe Tuesday but still firmly in an upward trend, supported by rising long-term interest...

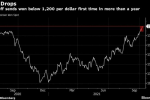

Won Drops Below Key 1,200 Per Dollar First Time Since July 2020 By Bloomberg - Oct 11, 2021

Won Drops Below Key 1,200 Per Dollar First Time Since July 2020 By Bloomberg - Oct 11, 2021

(Bloomberg) -- South Korea’s won dropped below the psychological barrier of 1,200 per dollar level for the first time in more than a year, as concerns over faster inflation and...

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

October 12, 2021 at 09:00PM

Bloomberg

https://ift.tt/3oQvdsA

Labels: Forex News Investing.Com Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home