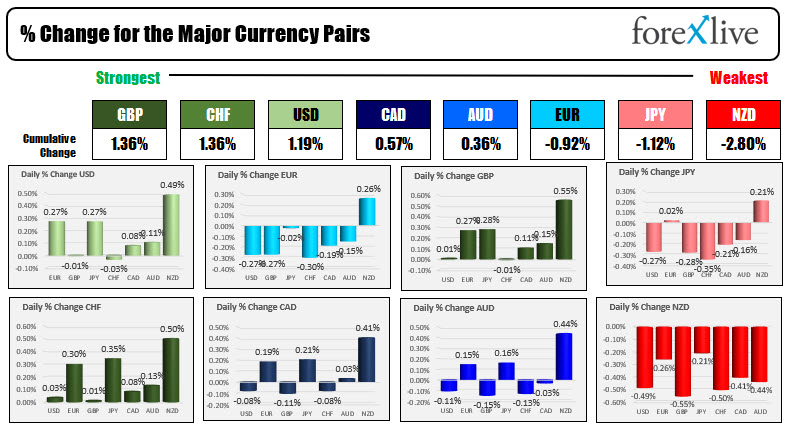

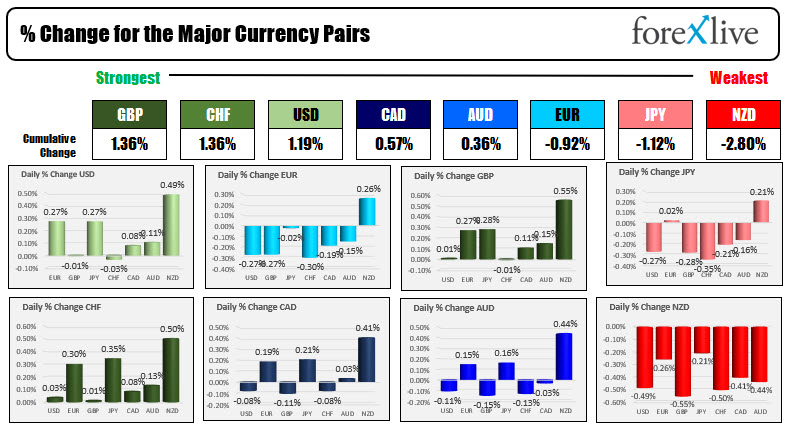

The GBP (and CHF) are the strongest and the NZD is the weakest as NA traders enter for the day

The GBP (and CHF) are the strongest and the NZD is the weakest as NA traders enter for the day

The USD is mostly higher after the decline yesterday

The GBP and CHF both hold the top spot as the strongest of the major currencies today, while the NZD is the weakest. The USD is also mostly stronger with gains vs the EUR, JPY and NZD and more modest positive moves vs the GBP, CAD and AUD. The greenback is a touch lower vs the CHF in the morning snapshot. US stocks are set to open lower with the Nasdaq the hardest hit one day after making a new all-time high (first since September 7th). Apple and Amazon both disappointed with earnings after the close and are down sharply. US and European yields are higher. Core PCE inflation data will be released at the bottom of the hour. That inflation measure is traditionally said to be a favorite of Fed officials (est 0.3% MoM and 3.7% YoY). Employment cost index (Q3 est 0.9%), Personal income (est -0.2%%) and spending (+0.5%), the second cut of the Michigan confidence will also all be released (est 71.4 unchanged vs preliminary figures). In Canada, the Raw material (est 0.1% MoM) and Industrial product price (est 0.5%) indices will also be released today.

In other markets as North American traders enter for the day shows:

- Spot gold $-11 or -0.61% at $1788.18.

- Spot silver $-0.24 or -1.02% at $23.81

- WTI crude oil futures $82.49, -0.39%

- The price of bitcoin is trading up about $400 and $60,980 after trading in the $56,000 range yesterday on a intraday tumble that was quickly reversed

in the premarket for US stocks, the NASDAQ index is leading the way to the downside. The Dow was marginally lower

- Dow industrial average -25.48 points after yesterday's 239.79 point rise

- S&P index -20 points after yesterday's +44.7 point rise (and new all time record close)

- NASDAQ index -121.5 points after yesterday's 212.28 point rise (record close)

In the European equity markets, the major indices are mostly lower:

- German DAX, -0.6%

- France's CAC, -0.3%

- UK's FTSE 100 -0.3%

- Spain's Ibex unchanged

- Italy's FTSE MIB -0.45%

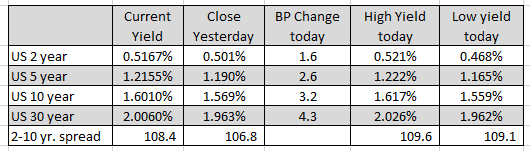

In the US debt market, yields are higher across the maturity spectrum. The yield curve is steeper with the 2 year yield is up 1.6 basis points while the 10 year yield is up 3.2 basis points:

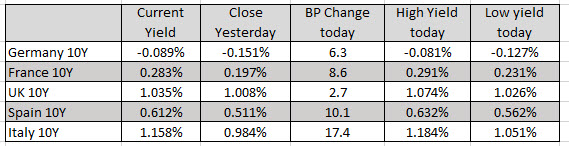

In the European debt market the benchmark 10 year yields are moving sharply to the upside with Italy up 17.4 basis points. Germany 10 year is getting closer to 0.0% with a high yield today of -0.081%.

Invest in yourself. See our forex education hub.

October 30, 2021 at 12:16AM

https://ift.tt/3Bp1Dx2

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home