US dollar trading pushes to the downside

New lows for the greenback versus majors

The USD is making new lows versus nearly all the major currencies in the current hour of trading. The one exception is the USDCAD which remained just above it's low from the previous hourly bar.EURUSD.

The EURUSD is trading at its highest level since September 29 and in the process has broken above the 38.2% retracement of the move down from the September high to the October low. That level comes in at 1.16712. The high price just reached 1.1682. The 1.1700 level is the next upside target followed by the 50% retracement of the same move lower at 1.17165.

GBPUSD:

The GBPUSD has broken above the cluster of moving averages including the 100 hour moving average at 1.3760, the 200 hour moving average 1.37738 and the 100 day moving average 1.37809 on its way to a high of 1.3803. The next target would be around the 1.312 to 1.38149 area. Above that and the high for the week at 1.38287 and the highs from October 19 to Silver 21 near 1.38337 would be targeted.

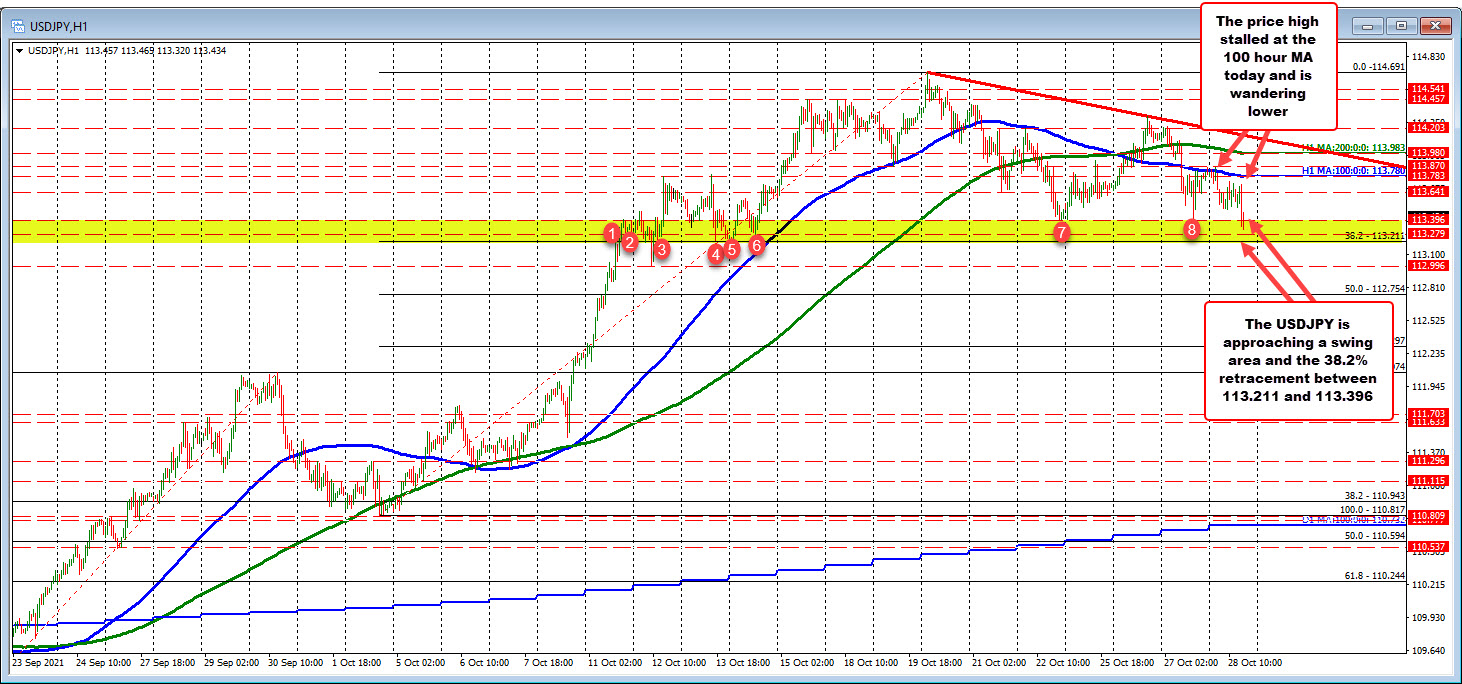

USDJPY:

The USDJPY as moved to a new low of 113.32, and in the process has moved into a swing area between 113.279 and 113.396. The 38.2% retracement is just below that area 113.211. Holding this level would keep the buyers more control. Moving below this area would increase the bearish momentum with the swing low from October 12 at 112.99 the next target followed by the 50% retracement of the move up from the October low at 112.754 as the next targets.

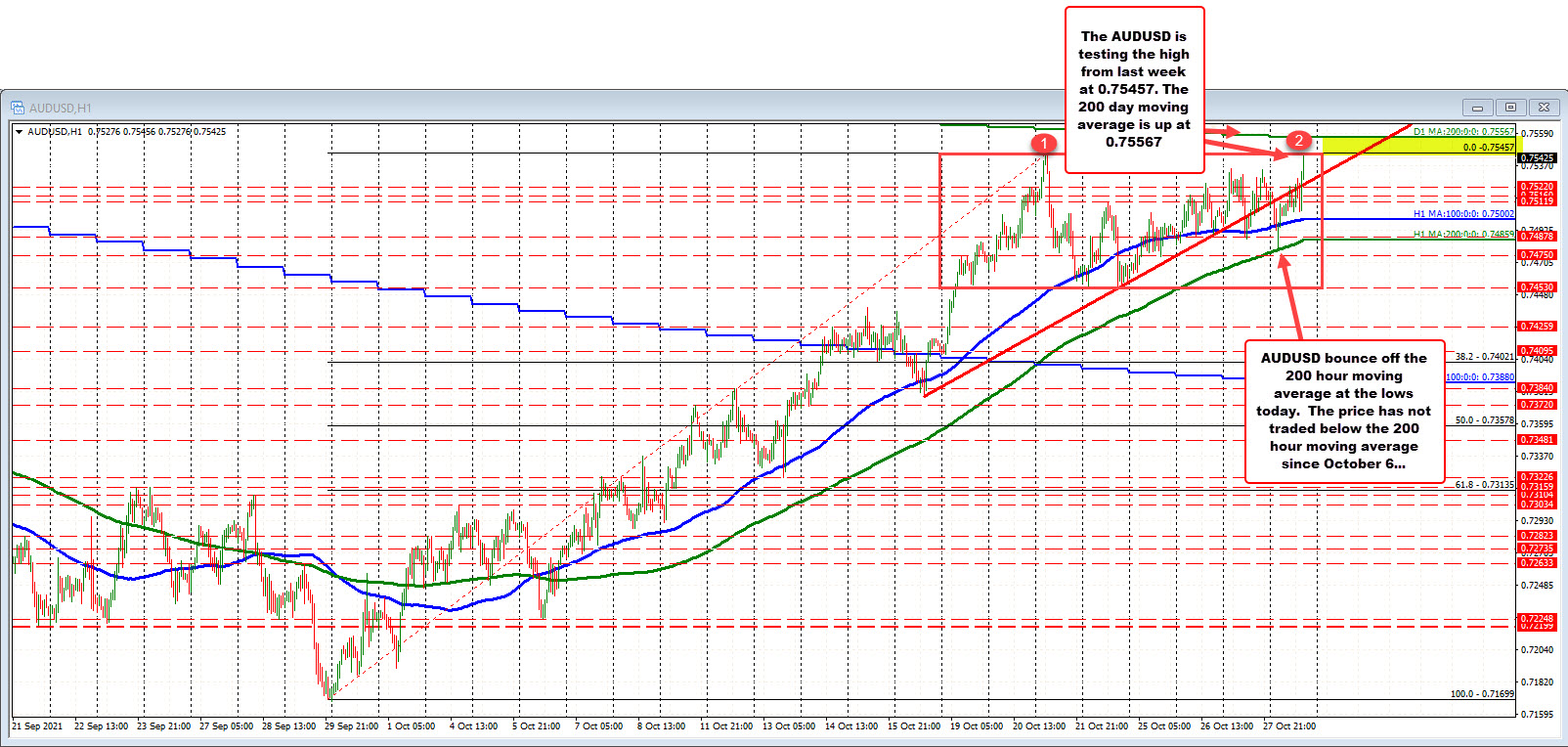

AUDUSD:

The AUDUSD is up testing the high from last week at 0.75457. A break above that level would next target the falling 200 day moving average at 0.75567. The price has not traded above its 200 day moving average since July 7. Looking at the daily chart below, the 200 day moving average is also right at the 50% midpoint of the 2021 trading range (February high).

October 29, 2021 at 02:27AM

Greg Michalowski

https://ift.tt/3pPuFUe

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home