US October Philly Fed 23.8 vs 25.0 expected

US October Philly Fed 23.8 vs 25.0 expected

The Philly Fed's regional economic survey

- Prior was 30.7

- New orders 30.8 versus 15.9 prior

- Employment 30.7 versus 26.3 prior

- Avg workweek 27.8 vs 29.3 prior

- Capex 32.4 vs 23.6 prior

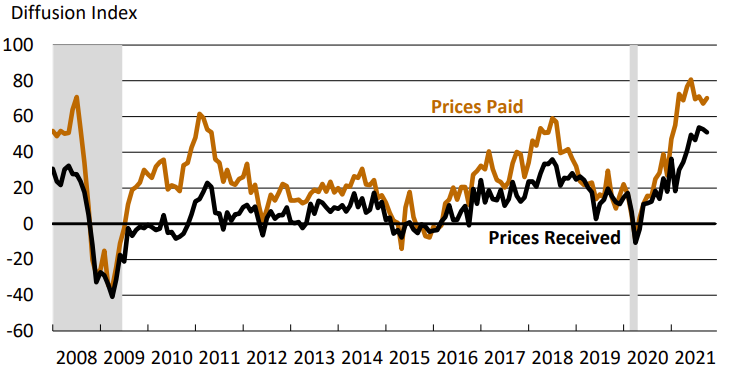

- Prices paid 70.3 versus 67.3 prior

- Future activity 24.2 vs 20.0 prior

- Delivery times 32.2 vs 20.4 prior

- Full report (pdf)

A dip isn't a sign of a slowdown after it jumped to 30.7 from 18.8 last month. It's just noise with the index reflecting solid demand, rising prices and a difficulty finding workers. The rise in capex intentions is a good sign for longer-term growth.

The market is focused on pricing at the moment but you can see signs of a topping out in pressures in the survey.

Invest in yourself. See our forex education hub.

October 22, 2021 at 12:30AM

Adam Button

https://ift.tt/2Zi5IpJ

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home