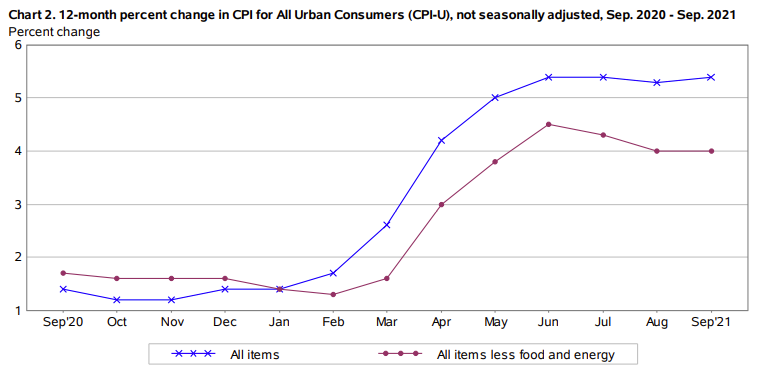

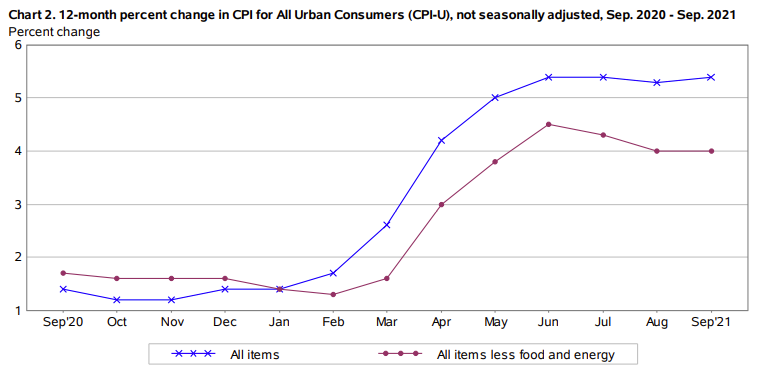

US September CPI +5.4% y/y vs +5.3% expected

Highlights of the US September 2021 CPI report

- Prior was +5.3%

- m/m CPI +0.3% vs +0.3% expected

- Prior m/m reading was +0.3%

- Real weekly earnings +0.8% vs +0.3% prior (revised to +0.2%)

- Ex food and energy +4.0% vs +4.0% y/y expected

- Prior ex food and energy +4.0%

- Core m/m +0.2% vs +0.2% exp

- Prior core m/m +0.1% -- was lowest since Fed

- Full report

The main numbers are all close to expectations and that's led to a mostly muted response. The dollar is a bit higher on the higher headline but it's likely to be the strong wage numbers that get a response. Wage growth is the real crux of inflation and that's something that was also evident in the non-farm payrolls report.

The caveat is that delta job cuts of food services and low wage workers could be skewing the picture. That something that would quickly resolve with US covid cases plunging. However rising yields suggest the market isn't so sure. That's filtering through to USD gains as well.

- Used cars -0.7% m/m vs -1.5% prior

- Used cars +24.4% vs +31.9% y/y prior

- New vehicles +1.3% vs +1.2% m/m prior

- New vehicles +8.7% vs +7.6% y/y prior

- Shelter +0.4% vs +0.2% m/m prior

- Energy +1.3% m/m vs +2.0% m/m prior

- Energy +24.8% y/y

- Food +0.9% m/m vs +0.4% prior

- Airline fares -6.4% vs -9.1% prior

Viewing

Touch / Click anywhere to close

October 14, 2021 at 12:30AM

Adam Button

https://ift.tt/3iYcyXT

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home