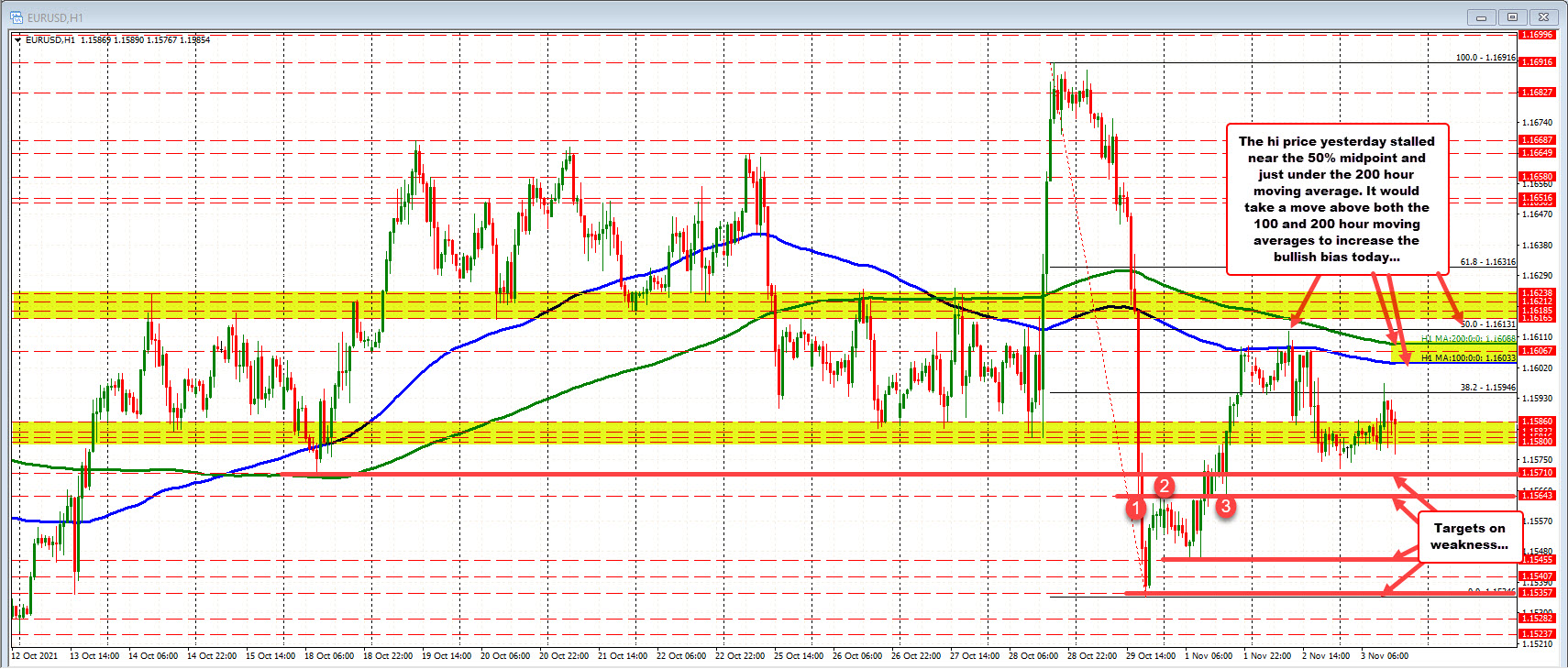

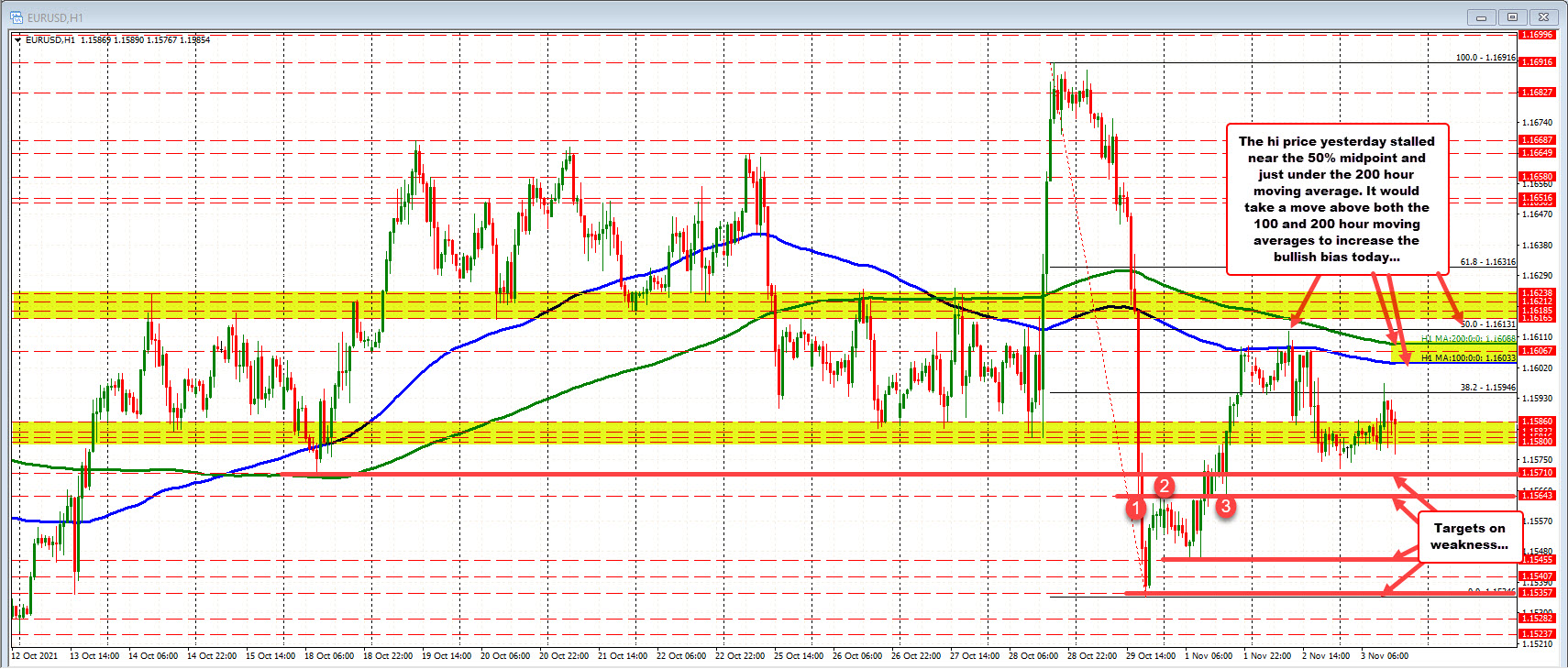

EURUSD higher on day but below hourly MA levels. Price action is choppy

Choppy price action ahead of the FOMC decision

The EURUSD is higher on the day but the price action is choppy ahead of the FOMC decision at 2 PM ET today (the chair will have a press conference at 2:30 PM).

Although higher, the price remains below its 100/200 hour moving averages which are edging lower with the 100 hour moving average at 1.16033 and the 200 hour moving average at 1.16088.

Traders will use those moving averages as a barometer to and through the rate decision. A move above (on presumably a less hawkish Fed - delay taper to December) would move the bias more in the favor of the buyers. Traders will look to get above the swing area between 1.1616 and 1.16238. Above that and the 61.8% retracement of the move down from last week's high comes in at 1.16316 and would be the next target.

Absent that (more hawkish or perhaps as expected Fed), staying below the moving averages would keep the USD better bid vs the EUR (lower EURUSD), and the bias to the downside. The swing low from October 18 at 1.1571, the 1.1564 level, and the swing low from Friday's trade at 1.15455 would be targeted ahead of the low from last week at 1.15346.

November 04, 2021 at 12:48AM

https://ift.tt/3k2hw6w

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home