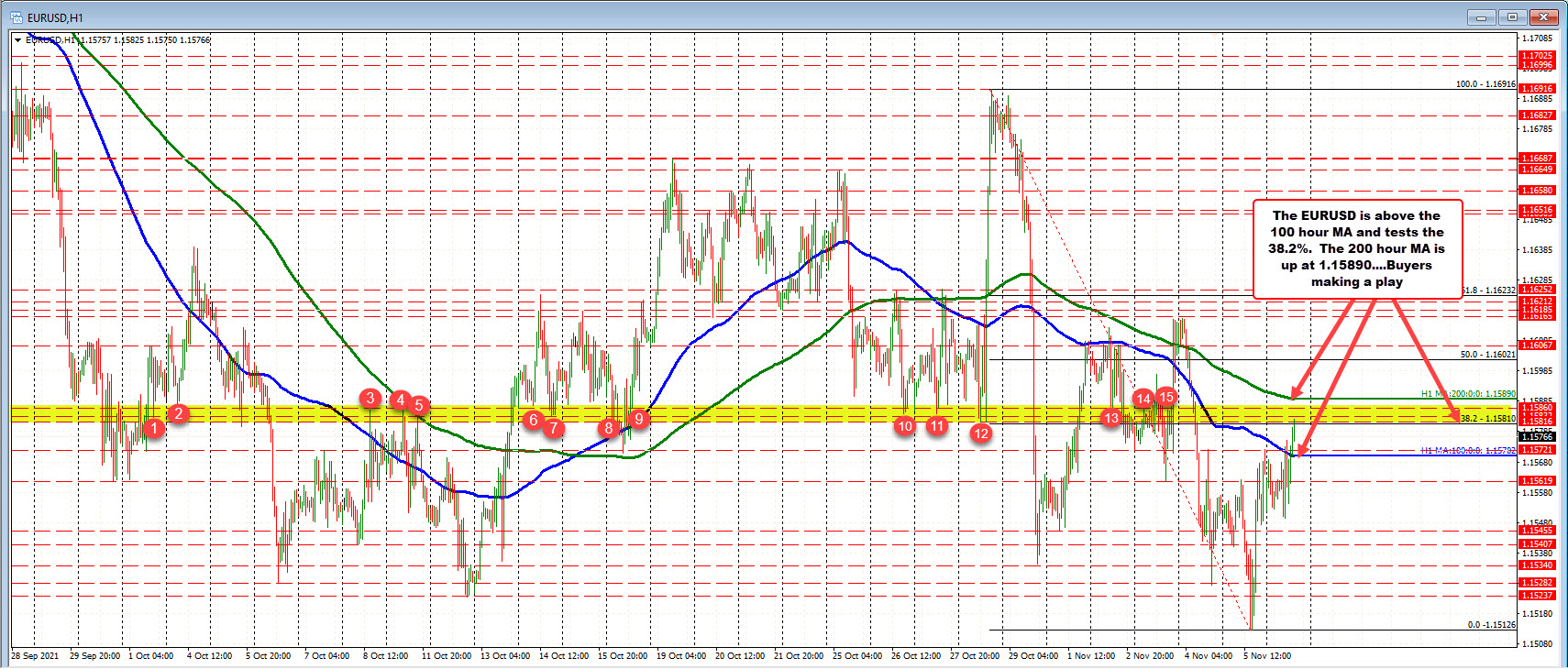

EURUSD is back above its 100 hour MA. Market is more neutral above that MA level

Test 38.2% of move down from October 28 high, and swing area ahead of the 200 hour MA.

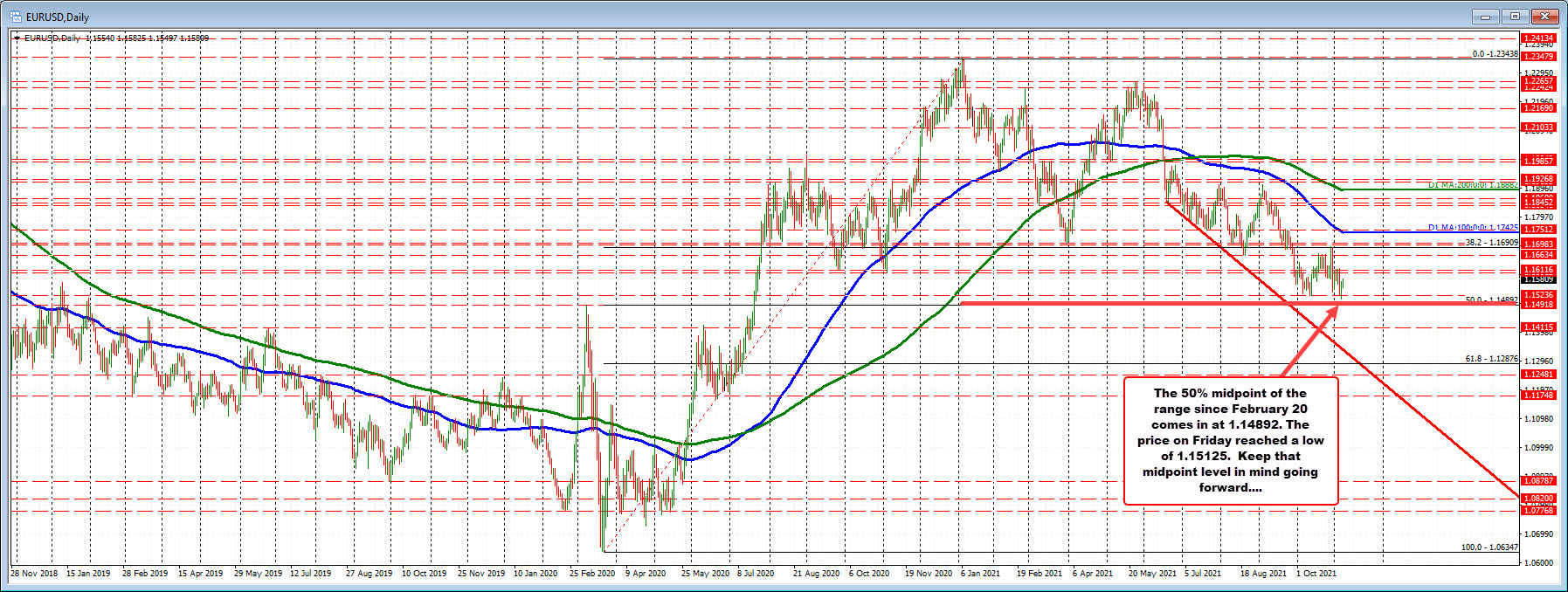

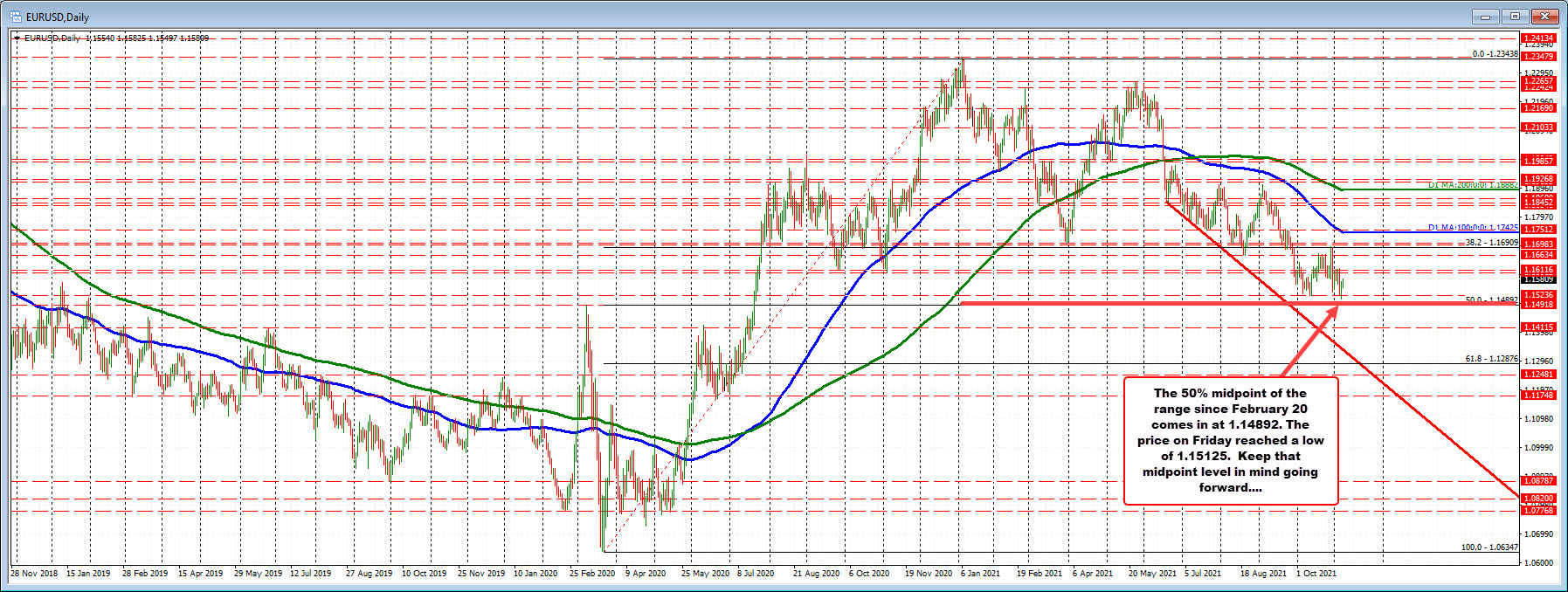

The EURUSD moved to the lowest level of the year and since July 2020 in the process on Friday. The low reached 1.15125. That was still above the 50% midpoint of the trading range since March 2020. That midpoint comes in at 1.14892. Going forward that is a key target for sellers to get to and through if the sellers are to take more control from a long term perspective.

Drilling to the hourly chart, the technical picture is a little different. The run to the downside on Friday, saw a snap back rally after the US jobs report. The price moved up toward the falling 100 hour MA (blue line currently at 1.15702), but stalled ahead of that moving average level (and near a swing high from Thursday's trading).

Today, the price chopped up and down, but is making a break higher above the 100 hour MA at 1.15702. The price is currently up testing the 38.2% retracement of the move down from the October 28 high at 1.1581. The pair is testing a swing area between 1.15816 and 1.15860 (see red numbered circles). The 200 hour moving average comes in at 1.1589. All those levels are potential resistance targets on the topside that would need to be broken to increase the bullish bias. They are also levels that willing sellers would lean against now to keep the sellers with more of the control.

Overall with the price back above the 100 hour MA, but below the 200 hour MA, the market bias is neutral. There is a battle between the MA levels with the swing area and the 38.2% between the high and low risk/bias MA levels.

The good news is the road map is in front of traders.

November 09, 2021 at 01:39AM

https://ift.tt/3qiHrLm

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home