GBPUSD extends the 2021 trading range with a new low

Price trades to a new low for the year of 1.3363.

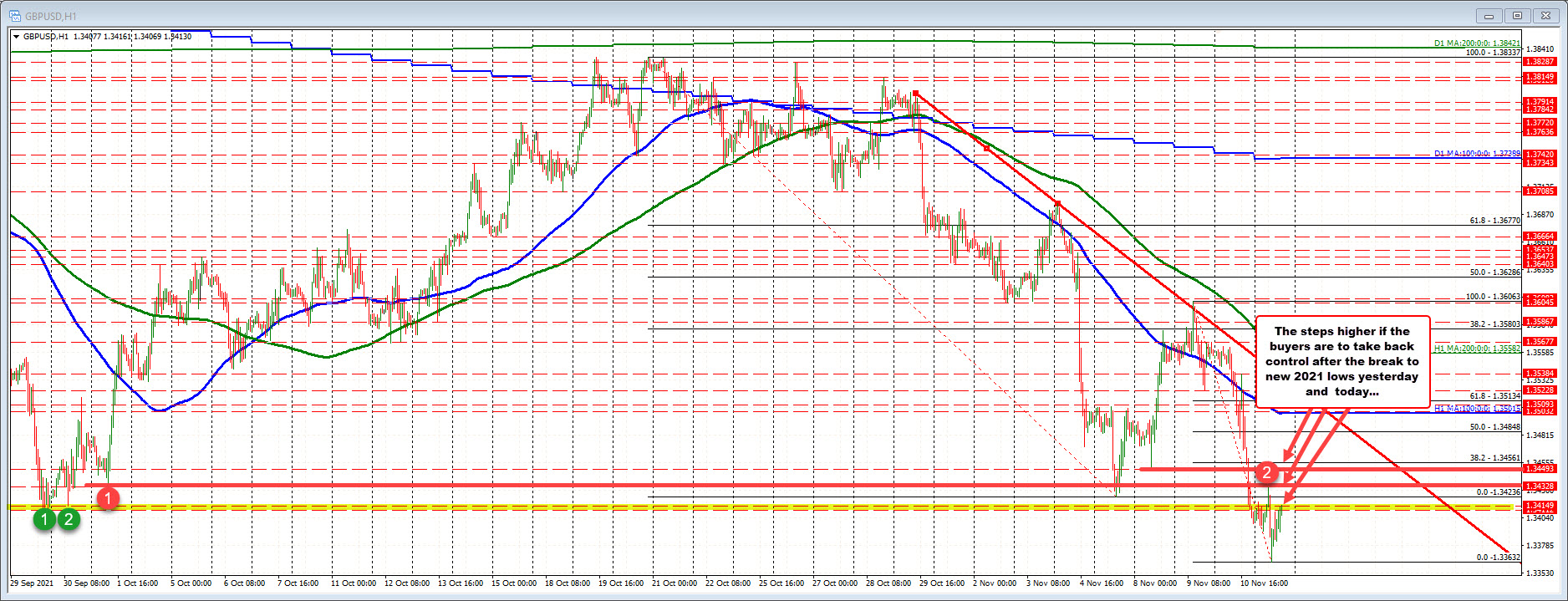

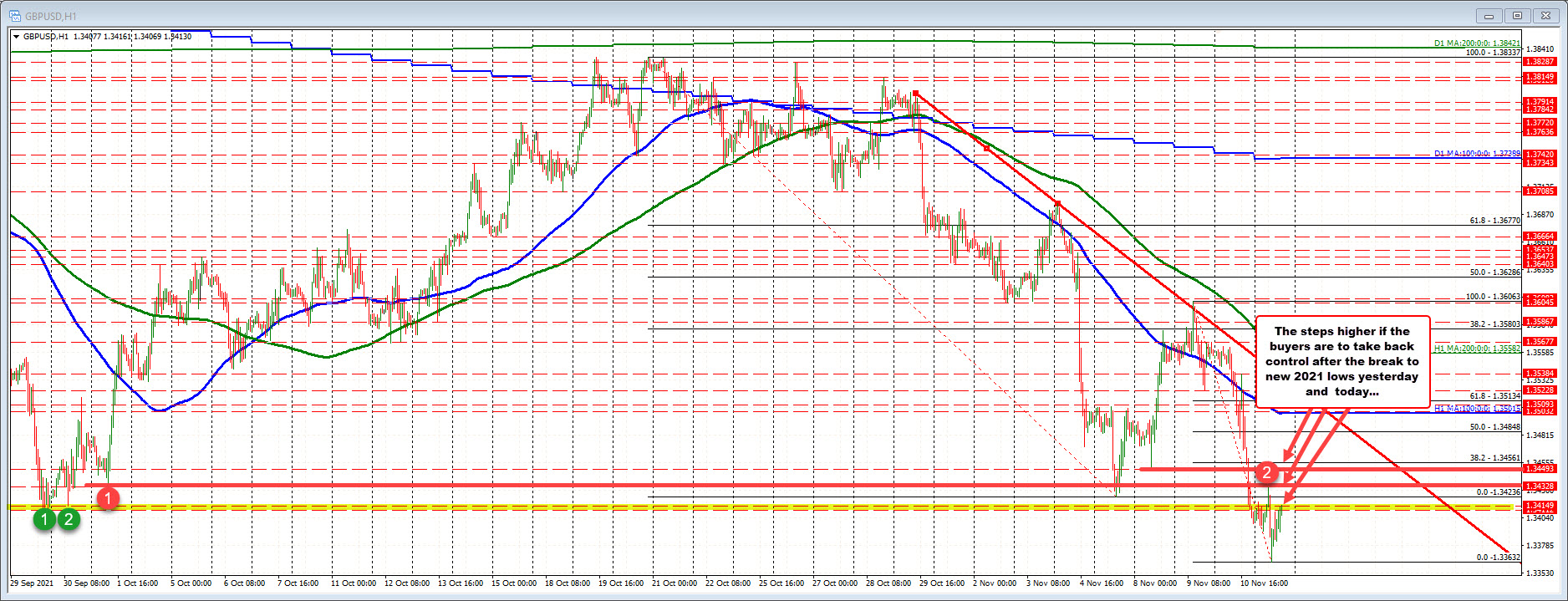

The GBPUSD extended the downside momentum from yesterday's post CPI trade with a move to a new low of 1.3363. That move came after the pair tested a swing low going back to October 1 at 1.34328 in the early European session. That move did take the price back above the November 4 low at 1.34236, but the move was short lived.

Since reaching the low, however, the pair has rebounded back toward the late September lows at 1.3411 to 1.34149. So far, that area is holding resistance. If sellers can keep a lid on the pair right here, that would be the best case scenario for a continuation of the move to the downside including the possibility of breaking the low for the day (at least going forward).

Conversely a move above would have traders targeting

- The low from last Friday at 1.34236.

- The high from today (and low from October 1) at 1.34328, and then

- The low from Monday's trade at 1.34493.

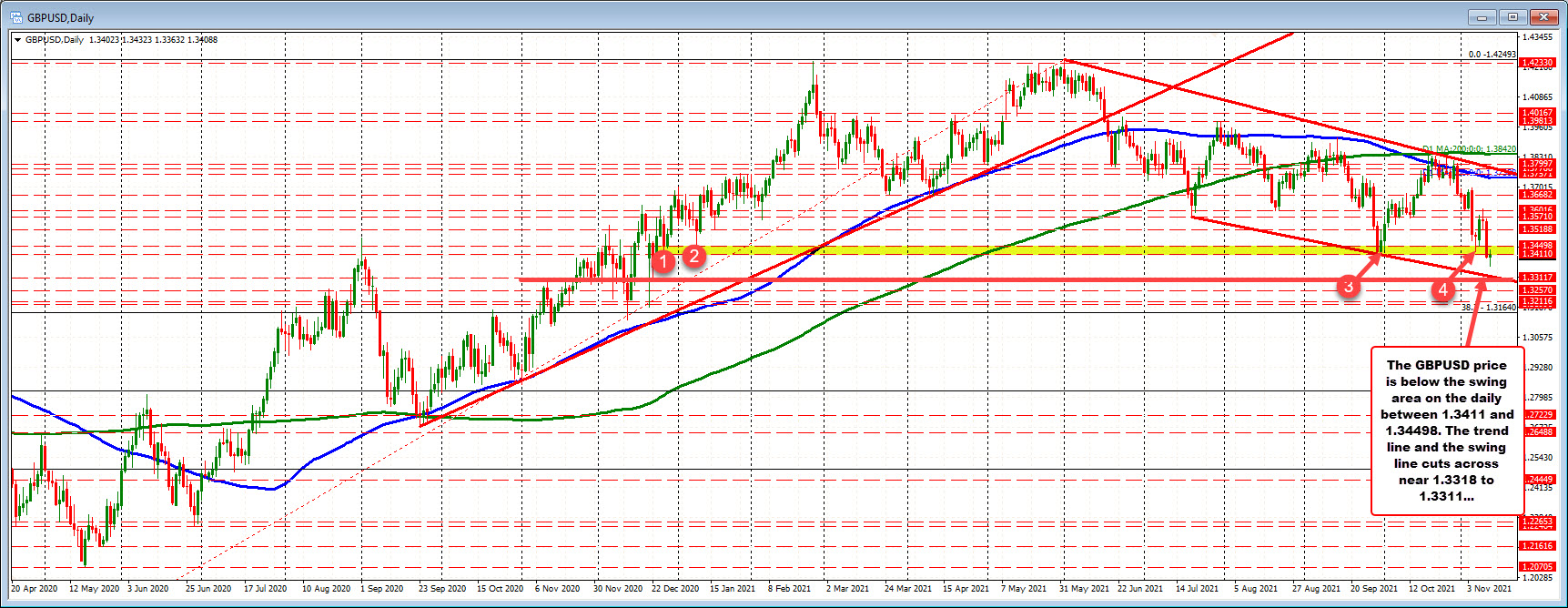

Taking a broader look at the daily chart below, the move lower yesterday has the pair trading to the lowest level since December 23, and moving away from the recent low swing from December 2020, January 2021 and September 2021 between 1.3411 and 1.34498 (see red numbered circles in yellow area in the chart below).

The high of that swing area on the daily chart is just below the 38.2% retracement from the hourly chart at 1.34561.

From the daily chart perspective... staying below that yellow area, keeps the sellers more control with the downward sloping lower trendline at 1.3318 and the swing level at 1.33117 as the next major downside targets.

November 12, 2021 at 02:19AM

Greg Michalowski

https://ift.tt/30ivHOh

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home