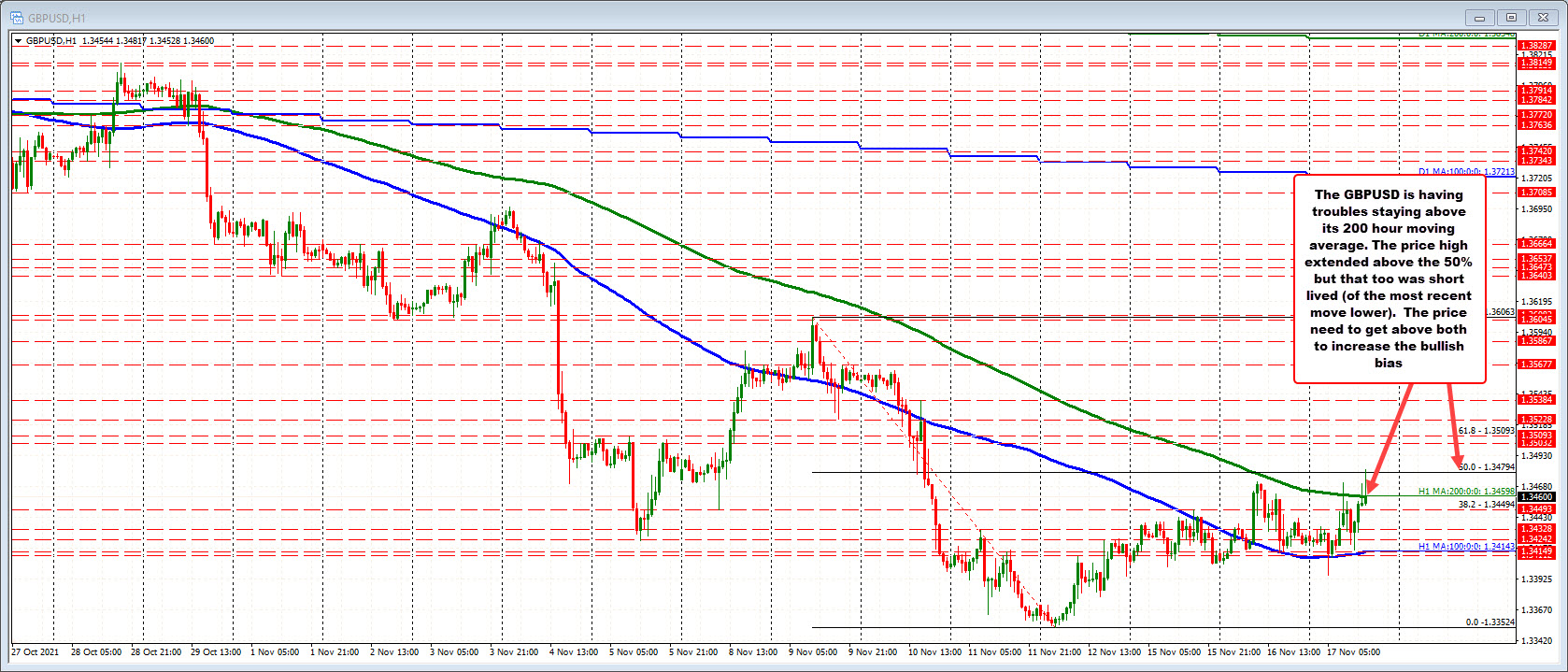

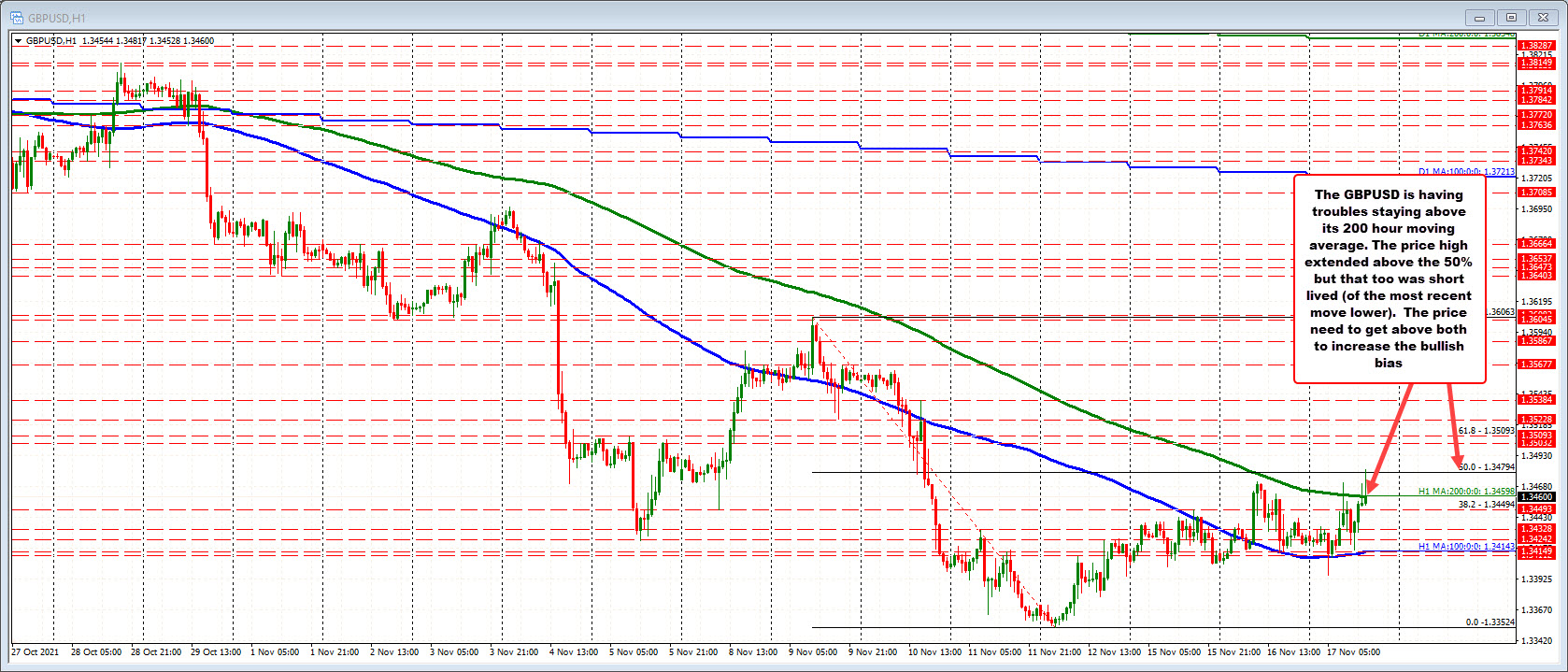

GBPUSD tries to crack above its 200 hour moving average

GBPUSD traders having trouble pushing the pair higher

The GBPUSD got a boost from the higher-than-expected inflation data, but traders have been having trouble extending higher above its 200 hour MA (green line in the chart below).

The GBPUSD price has extended above its 200 hour moving average on three separate hourly bars (including the current bar), but the price has not been able to sustain momentum and has dipped back below the key line. The pair had not been above its 200 hour moving average since October 29 until today.

The high price came in at 1.34817. That also took the price briefly above its 50% of the last move lower (from last week's high). That is just a minimum if the GBPUSD is to tilt more to the upside.

Admittedly the failures are disappointment especially given the data. It may also be indicative of the dollar buying tilt that has taken the DXY price to the highest level since July 2020.

Buyers are making a play today, but not being too convincing. So far there shots

have all missed.

November 18, 2021 at 01:53AM

Greg Michalowski

https://ift.tt/3no79Mw

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home